Introduction

Whether you’re new to customer verification or an experienced customer onboarding professional, this page contains many resources to help you improve your KYC verification knowledge.

What exactly does KYC stand for?

Identifying and verifying customers is known as Know Your Customer (KYC). Identification entails gathering a customer’s personal information; verification entails ensuring that this information is correct.

Businesses typically require at least the following information to identify a customer:

- name;

- date of birth;

- address.

Businesses can use a document-based verification approach to validate this data. This entails verifying the authenticity and validity of the customer’s identity and proof of address documents (typically a utility bill).

Businesses must also ensure that their customers are trustworthy—that they are not fraudsters or subject to sanctions—as part of their Anti-Money Laundering (AML) obligations. By consulting global sanctions lists, watchlists, blocklists, or hostile media, you can accomplish this. Other articles on our blog that go into greater detail about these processes can be found here:

What is the difference between KYC and AML?

KYC is only one of many procedures that comprise Anti-Money Laundering (AML) compliance, which encompasses all of the measures used by financial institutions and governments to combat economic crime. As a result, AML covers a wide range of policies, controls, and procedures, such as AML training, detection of suspicious activity, reporting, etc.

Automate your KYC Process & reduce Frauds!

We have helped 200+ companies in reducing their user onboarding TAT by 95%

What is the significance of the KYC process?

The Know Your Customer process aids in detecting fraud and the prevention of financial crimes such as money laundering.

You can use stolen personal information to register on platforms ranging from payment apps to dating sites to conduct illegal transactions or defraud honest users. Because of these risks, businesses are required to complete customer verification in the form of KYC.

Who requires KYC?

Since KYC falls under AML requirements, any AML-compliant business must implement KYC procedures. These are typically financial institutions, cryptocurrency businesses, and gambling platforms that provide their services ongoing and limitless.

However, KYC can also benefit businesses that are not subject to AML regulations, such as marketplaces and car-sharing platforms. It can aid in the identification of suspicious individuals as well as risky suppliers and platforms.

PAN+DOB-PAN Verification API helps you do pan card verification using DOB with reliability for specific institutions and entities to verify their customer’ credibility.

Bank -The Bank Account Verification API is a system that uses a user’s bank account number and IFSC code to verify their legitimacy when onboarding them.

Income Verification (ITR, EPFO, Credit Report) -The Income Verification API is a sophisticated system that allows a company to authenticate a person’s bank account and transaction details with high accuracy in a short amount of time.

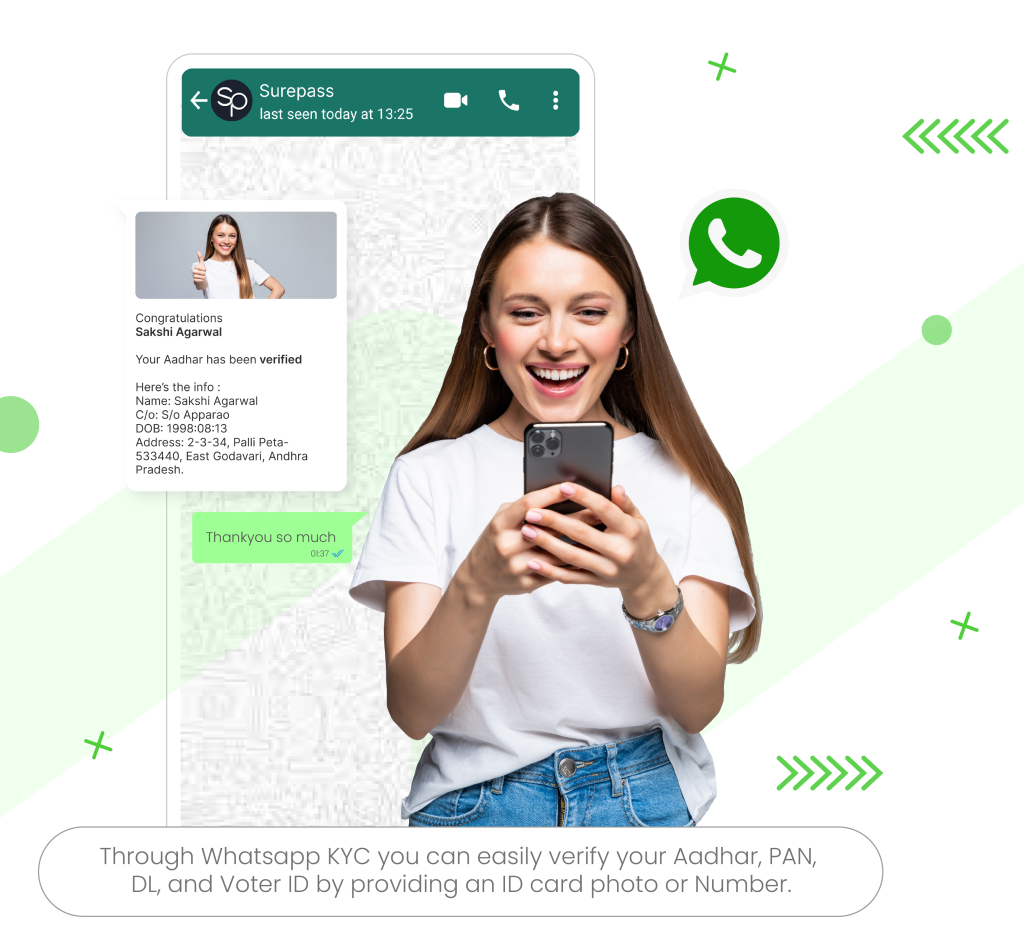

ID (Aadhaar, Passport, DL, Voter ID) -The Income Verification API is a sophisticated system that allows a company to authenticate a person’s bank account and transaction details with high accuracy in a short amount of time.

Video KYC -Video KYC API is a video-based digital KYC verification process that’s now used by banks & insurers across India.

Face Match -Face detection API allows you to detect faces in images, identify key facial features, and verify if the person applying for verification is the same in the IDs.

KYC requirements are required all over the world. While many jurisdictions have similar requirements for identifying and verifying customers, the exact list of required KYC checks may vary. Businesses in Germany, for example, must conduct video verification with customers in addition to document-based verification.

On the other hand, KYC checks do not end with the onboarding stage. AML regulations require businesses to continue monitoring a customer’s profile and transactions. This includes checking for expired documents and detecting suspicious transactions.

Why choose Surepass KYC API?

Surepass API provides modern enterprises with the assurance to seamlessly onboard and authenticate online customers. More conversions and fewer lost customers result from real-time, fully automated identity verifications powered by AI and machine learning. With Surepass, our users transition from a manual to a highly automated 100% online process, and it all comes back to leveraging innovation and technology for a great customer experience.

Shubhendu Kumar

Shubhendu is a seasoned API developer with years of experience. Get expert advice, best practices, and real-world examples on API development, testing, deployment, and more. Take your API development skills to the next level with Shubhendu's in-depth articles and tutorials.

More posts by Shubhendu Kumar