Introduction

Compliance of TDS-206 is quite tedious nowdays that’s why we came here for you take this burden from you and provide you a simple and reliable way to implement TDS-206. We provide you the ITR filing status of vendor and your vendor compliance about TDS-206.

Benefits of Verifying with our API

Vendor’s Compliance

Stay updated with vendor’s compliance with our reliable and user-friendly APIs.

ITR filing Status

You can track ITR filing status of your vendor’s whether or not your vendor fill ITR

Accurate and Reliable

Our system checks the information from the PAN department. Therefore, the results are always correct and legit.

case-study

How SurePass helped in verifying customers for a used two wheeler seller of India

What is a TDS 206 Compliance API?

How can such a TDS 206 Compliance API software help me?

How does TDS 206 Compliance API works?

How fast and accurate is a TDS 206 Compliance API?

What are the attributes that we can verify using the TDS 206 Compliance API?

What are the requirements for TDS 206 Compliance API to work?

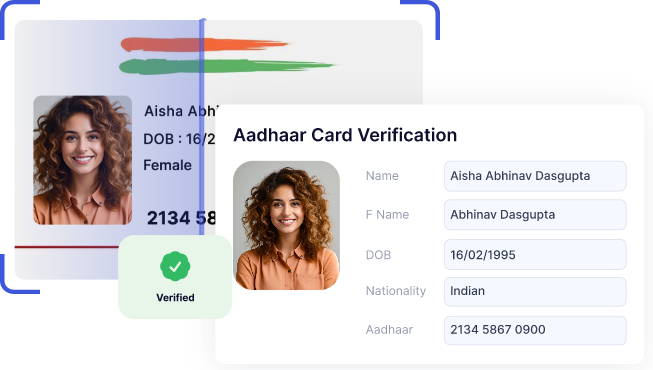

Aadhaar Verification API

Aadhaar verification API is an important process for every financial institution or the entities that need an API for Aadhaar card verification.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification.

Read More