The Government has announced the launch of the New Aadhaar app, which is currently in a beta testing phase. The app features advanced technology, including facial recognition, QR-based authentication, and privacy control. It will solve the security and misuse of Aadhaar card details.

This App will replace the need of carrying physical copies of Aadhaar. As 15+ crore monthly face authentication-based transactions are already in use. This app will allow instant verification and give the user control to share only the necessary data.

UIDAI Showcases New Aadhaar Innovations at Third Aadhaar Samvaad in Delhi

The UIDAI has recently organized the third Aadhaar Samvaad in Delhi with 750 officials, experts and stakeholders to discuss Aadhaar innovations. The Union Minister Shri Ashwini Vaishnaw highlighted the importance of Aadhaar and the need for AI Integration to DPI (Digital Public Infrastructure). The event focused on how Aadhaar can be used to improve government service, which includes more people in digital systems, and making the digital identity verification process safer. UIDAI has shared the launch of the new Aadhaar mobile app with features like face recognition, QR code verification, and privacy control. To know more about the new Aadhaar App, stay until the end.

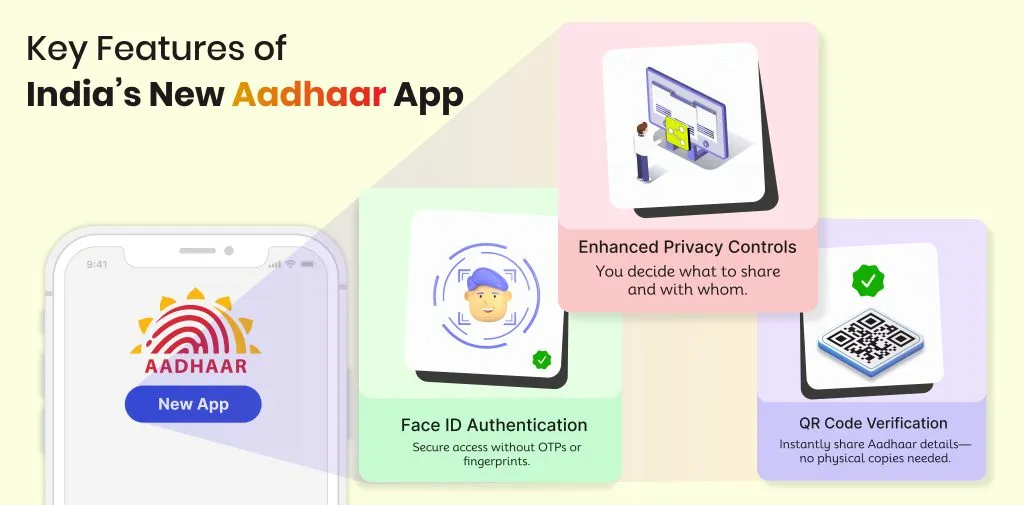

Key Features of India’s New Aadhaar App

The new Aadhaar App will make the identity verification process simple and secure with advanced features such as:

- QR Code-Based Data Sharing

The app offers a dynamic QR code generation feature. It will allow Aadhaar holders to participate in Aadhaar verification process by sharing a scannable code. This will improve the identity verification process and eliminate the need for physical documentation. Now, the people don’t have to submit the physical copy of Aadhaar at the hotel counters and offices.

- Face Authentication

The face authentication feature will ease out the verification process and eliminate the need for OTPs or fingerprint scans. You just need to look at the camera for authentication. This will reduce the risk of identity theft with liveness detection. This feature is helpful for elderly people who often face issues in fingerprint verification.

- User Data Control and Privacy

The new Aadhaar App gives data control to Aadhaar users. Now, the Aadhaar holder can choose to share only the necessary information instead of sharing full Aadhaar details. With facial recognition and QR codes, it will become tough for fraudsters to access the data. This will improve the security and reduce data misuse.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How the New Aadhaar App Transforms Digital Identity in India?

- Simplify the Identity Verification Process

The new Aadhaar App will use the facial recognition and QR code feature to make identity verification faster. With this new feature, users do not have to carry a physical Aadhaar card and rely on biometric authentication devices for verification. Whether you want to apply for loans, book tickets, or verify your bank account, this feature will make the process quicker.

- Easy to use and accessible to everyone

The new Aadhaar App Features offer a simple user interface. This will help people with non-technical knowledge or background use it easily, especially in rural and remote areas. It is designed to work with low-end smartphones and increase accessibility to a wide population.

- Supports Digital India Mission

Launch of new Aadhaar app marks a significant milestone towards the Digital India Initiative. It will enable a faster, safer and more reliable Identity verification online. It will reduce data misuse and unauthorized access.

Conclusion

The new Aadhaar App with its advanced features is going to launch soon. It will be a game-changer for the online identity verification process. With face recognition, data privacy control and QR-based authentication, it will offer a secure and user-friendly solution for individuals and institutions. The new Aadhaar App will eliminate the need to carry physical documents and reduce the risk of data manipulation and misuse.