Introduction

The Surepass Multi-Bureau Pull API provides instant access to comprehensive credit data, allowing lending firms to measure borrower creditworthiness efficiently. It also offers customized solutions, allowing businesses to get reports by selecting credit data from two or three bureaus, based on their specific needs and use cases. The comprehensive data will enhance decision-making, efficiency, and analysis, reducing the risk of fraud and financial losses.

How Does It Work?

Follow these steps to use Multi Bureau Pull API,

Input: Enter Full Name, Mobile Number, PAN Number, and Date of Birth as Input.

Output: Receive CIBIL Score, Experian Score, Equifax Score, CRIF Score, CIBIL Credit Report PDF, Experian Credit Report PDF, Equifax Credit Report PDF, CRIF credit report PDF, Credit Age, Credit Mix, On time payment % as output.

Use Case

Loan Approval

Lending platforms and financial institutions can use this API to access comprehensive credit information from all major bureaus (Equifax, Experian, CRIF, and TransUnion CIBIL), enabling accurate credit evaluation and informed decision-making during the loan approval process.

Credit Card Issuance

The Multi Bureau Pull API helps bank and credit card companies easily access the credit details of an applicant from multiple bureaus. This helps in a thorough evaluation and checking of the repayment capability of individuals, which reduces the risk of credit approval to high-risk individuals.

Tenant Screening for Real Estate

It enables real estate firms to verify tenants’ creditworthiness through detailed reports. This ensures they select reliable and financially responsible tenants for rental properties, it will minimize risk maintain steady rental income, and secure leasing agreements.

Benefits of Verifying with our API

Plug and Play

The Cibil Report API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Surepass Multi-Bureau Pull API helps lending institutions prevent fraud and financial losses by providing accurate credit reports.

Accurate and Reliable

It achieves accuracy and reliability by accessing current CIBIL credit data, employing rigorous data verification, and following secure industry standards.

Blog

What Is Aadhaar Verification API, Why Use It?

What is Multi-Bureau Pull API?

How to use Multi-Bureau Pull API?

How Quickly can API fetch credit reports?

Does this API handle high-volume requests?

How to integrate this API into the existing System?

Does this API provide accurate data?

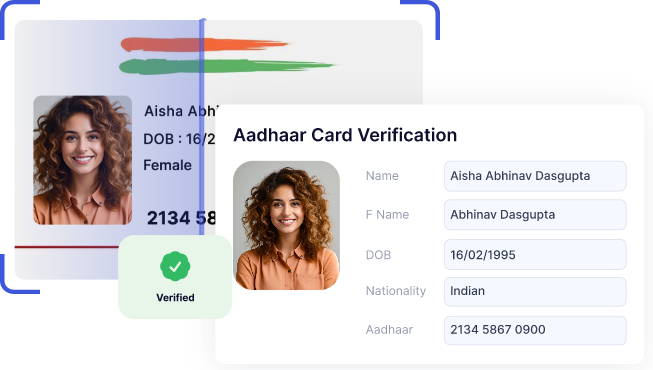

Aadhaar Verification API

The Aadhaar verification API is a digital tool used to verify the validity and accuracy of Aadhaar cardholder details, enabling streamlined authentication processes.

Read More

Equifax Credit Report API

The Equifax Credit Report API enables individuals to easily retrieve their credit report, providing lenders with essential information for assessing creditworthiness in financial applications.

Read More