Introduction

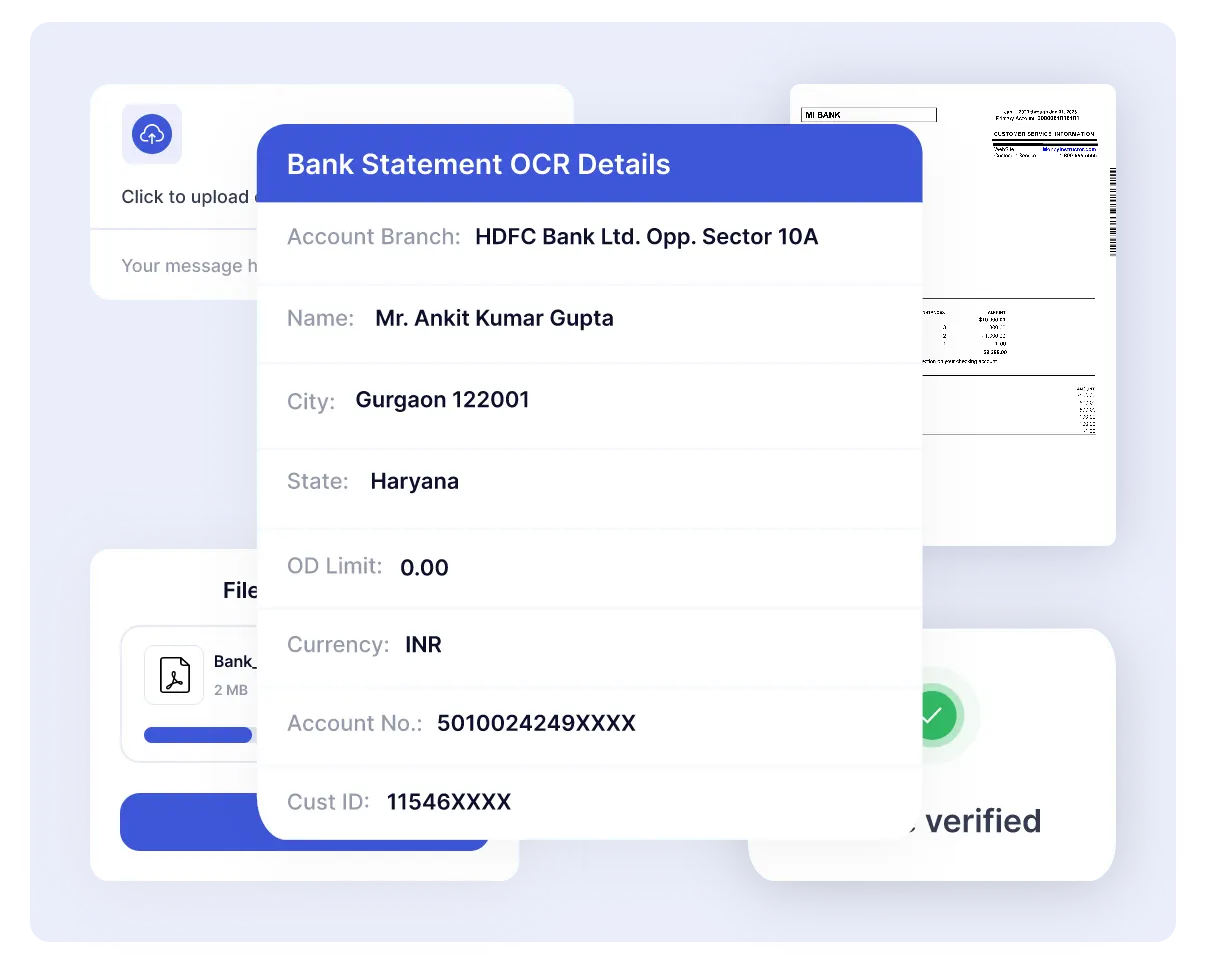

OCR in banking is a revolutionized tool that quickly extracts data from bank statements. OCR Bank statements extracted by Surepass Bank Statement OCR provide 100% accurate data with no error.

This OCR in the Banking tool scans documents, pre-processes them for quality enhancement, recognizes each character, group of letters, and words, verifies text, and finally exports the data into the digital format.

Benefits of Using OCR In Banking

- Increase the speed of data extraction from Bank statements.

- High Accuracy: OCR bank statement tool provides 100% accuracy with no spelling and typing errors that occur during manual bank statement verification.

- Cost Reduction: Our Bank statement automates the data extraction and documentation process and eliminates the requirement of manual verification hence decreasing Operational costs.

This tool is the best alternative to manual verification and data extraction in sectors like Finance, Accounting, Management, family law cases, and lending processes. This OCR in banking tool smoothly integrates with the existing system and helps streamline the verification and documentation process. Surepass is an essential tool for bank statement management in today’s digital landscape. It helps in analyzing bank statements and fraud detection.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Surepass Bank Statement OCR prevents manual data entry errors and reduces operational costs by automating text extraction from bank statement images.

Accurate and Reliable

Our system checks the information from the department. Therefore, the results are always correct and legitimate.

Blog

What Is Aadhaar Verification API, Why Use It?

What Is OCR In Banking?

How Is OCR Used in Banking?

What is an OCR clearance bank statement?

Can be edit bank statements through OCR?

How Does OCR For Bank Statements Work?

2) It Scans of Bank Statement images

3) OCR bank statement tool recognizes character

4) Extract characters into machine-readable format

5)Verifies text

6)Export it into editable data

Is Surepass Statement OCR Secure?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More