Introduction

With GST Analysis, companies can identify reliable partners, detect potential risks, and enhance financial and operational decisions. Whether you want to do vendor onboarding, loan approvals, or internal audits, GST analysis is essential to stay away from fraud.

Key Features

- Instant Compliance Check: Instantly check whether a business is GST compliant or not before partnering.

- Better Credit Evaluation: It helps in understanding the financial stability of the borrowers and partners.

- Fraud Prevention: GST Analysis helps detect suspicious activities and reduce the risk of fraud. It allows you to avoid working with non-compliant or shell entities.

- Time Saving: API eliminates the need for time-consuming manual verification. It streamlines the onboarding process.

Use Cases

Vendor Risk Assessment: It is important to check the financial and tax behaviour of vendors before partnering with any business. The GST Analysis API helps in checking whether a vendor files returns regularly. It minimizes the fraud risk by dealing with non-compliant entities.

Lending and Credit Decisioning: For financial institutions and lenders, GST Analysis is essential for credit risk evaluation. Quick review of the borrower’s GST filing history and turnovers, lenders can easily check repayment capacity and financial discipline. It will improve the loan approvals.

B2B Onboarding Platforms: e-Commerce Platforms, Aggregators, and B2B service providers usually deal with a volume of sellers and partners. Integrate the GST Analysis API into the onboarding process and streamline operations.

Benefits of Verifying with our API

Plug and Play

GST Analysis API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Prevent fraud and financial loss by identifying non-compliant or high-risk businesses through GST filing behaviour.

Accurate and Reliable

Our system checks the information. Therefore, the results are always correct and legit.

Blog

GST Number Check: Easy Steps and Methods for Accurate GSTIN Verification

What is GST Analysis?

Is there any solution for GST Analysis?

Why is GST Analysis important?

Who can benefit from GST Analysis?

Can GST Analysis help detect non-compliance?

Does it offer bulk verification?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.

Read More

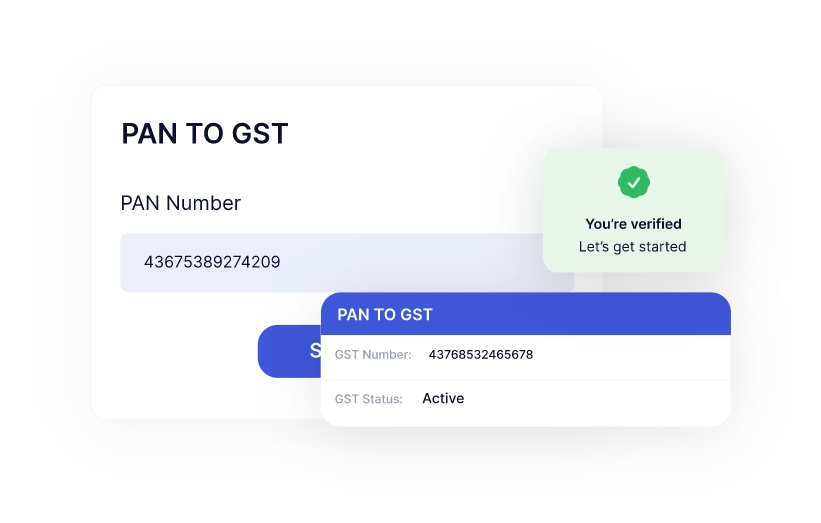

PAN TO GST

PAN to GST API is a process of obtaining a GST number for your business. By inputting your PAN number, the API returns the corresponding GST number, along with its active and inactive status.

Read More