Introduction

Surepass’s Digilocker PAN Card Verification API Solution is an essential tool tailored to authenticate PAN Cards. Aligned with the recommendations of the Income Tax Department for online PAN verification systems, our solution serves as a robust defense against fraudulent activities, ensuring the credibility of your clientele.

Key Advantages of PAN Card Verification API:

- Forgery Prevention: Safeguard against counterfeit PAN cards or credentials with our API’s advanced detection capabilities.

- Real-time Verification: Attain instant verification of PAN Card details, accelerating your operational processes.

- Effortless Integration: Seamlessly integrate our API into your existing systems for a smooth user experience.

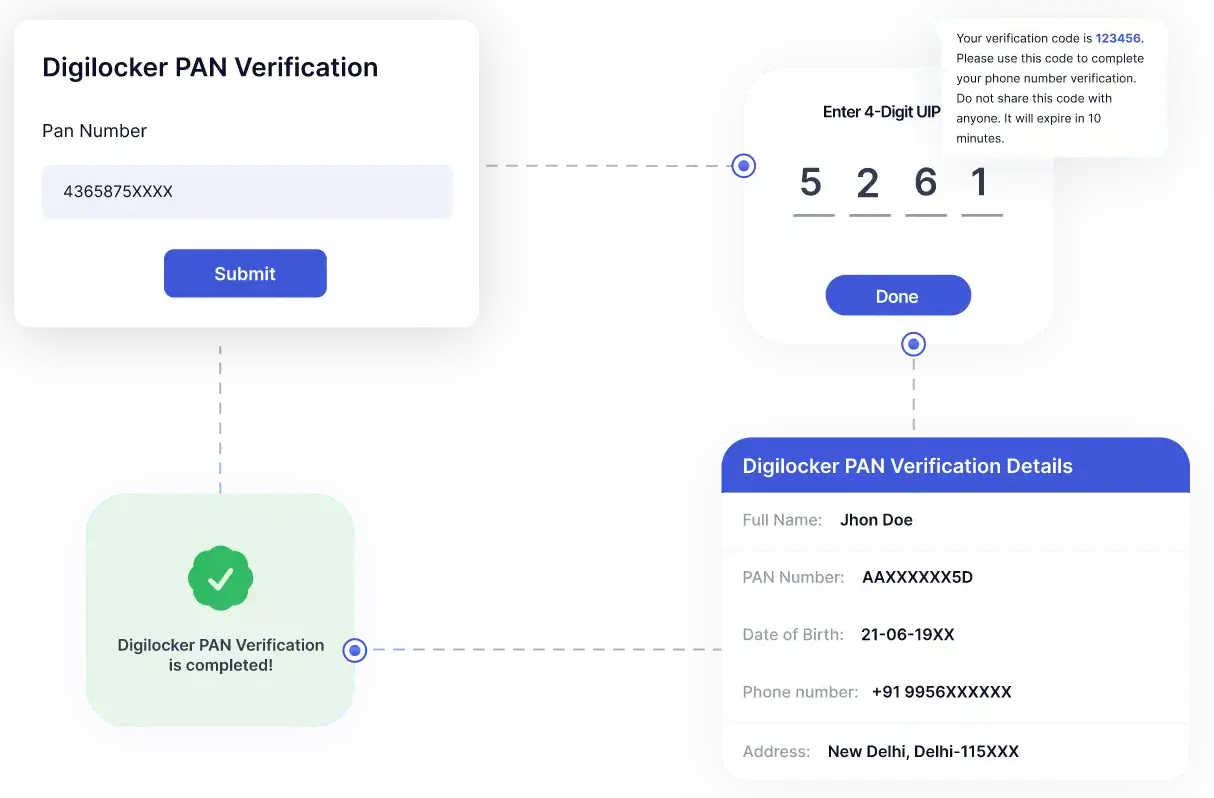

How to Confirm PAN Card Details:

Verifying PAN Card details has never been easier. Follow these steps:

- Contact Us: Click here to get in touch and sign up for the API.

- Integrate the API: Effortlessly incorporate the PAN verification API into your existing system.

- Provide the PAN Number: Include the PAN number (and other details) in your API request.

- Retrieve the Details: The Pan Card API promptly provides details associated with the entered PAN card, allowing you to extract and store this data for your records.

Applications:

- Identity Authentication: Ensure the genuine identity of your customers through robust PAN Card verification.

- Efficient Onboarding: Streamline the onboarding process by instantly authenticating customer PAN details.

- Building Investor Confidence: Foster trust with investors by using our Pan Verification API for swift and reliable PAN verification.

- Enhanced KYC Procedures: Improve Know Your Customer (KYC) procedures with our efficient PAN Card Verification API.

Benefits of Verifying with our API

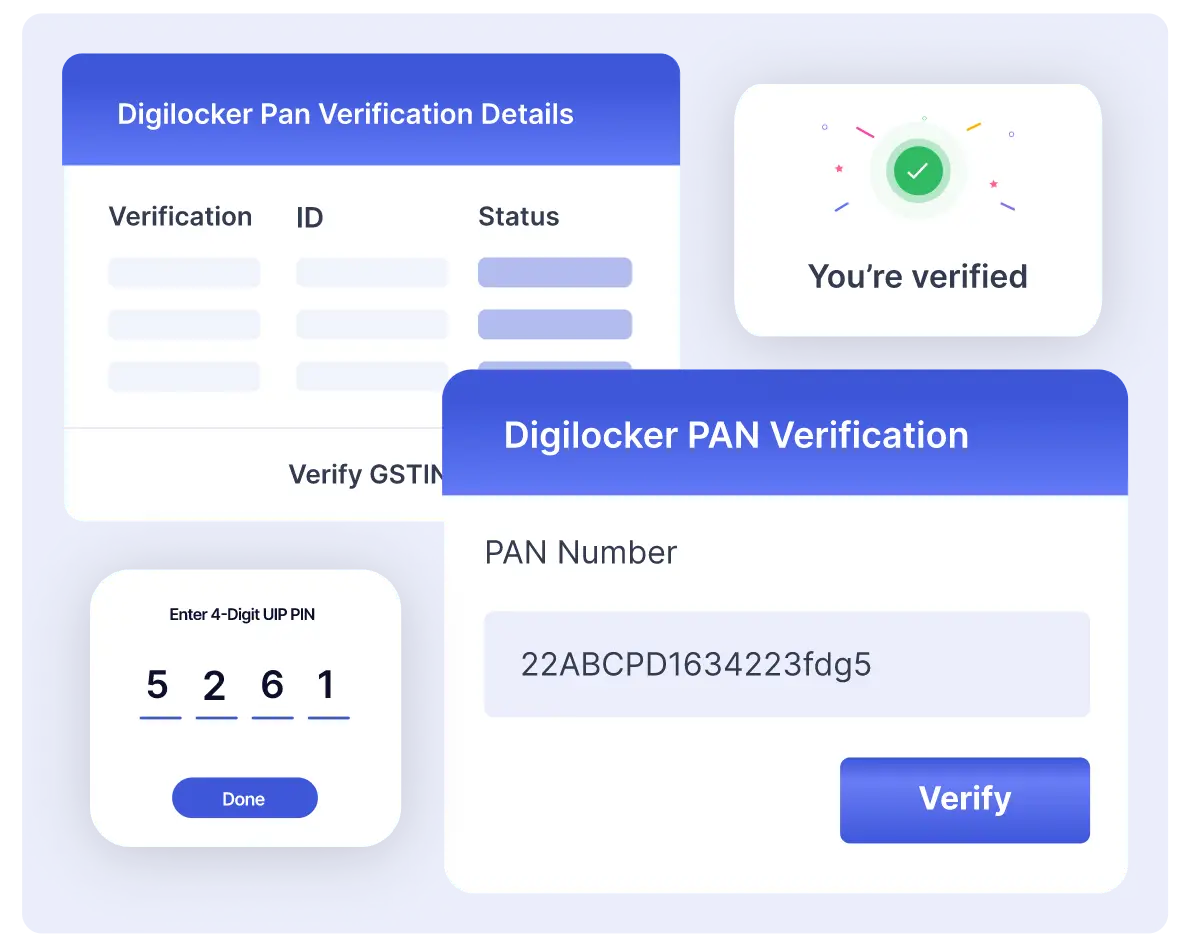

Plug and Play

The Digilocker PAN Verification API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

The process will save any institution that has been and can be a victim of fake cardholders. PAN API will easily detect such frauds.

Accurate and Reliable

Our system checks the information from the Aadhaar department. Therefore, the results are always correct and legit.

Blog

6 Main Factors That Affects Your Cibil Score

What is Surepass’s Digilocker PAN Card Verification API?

How does the API contribute to fraud prevention?

What are the key advantages of using Surepass’s Digilocker PAN Card Verification API?

Can the API be easily integrated into existing systems?

What information is required to verify PAN card details using the API?

How does the API enhance Know Your Customer (KYC) procedures?

Can the API be used for bulk verification of PAN cards?

Is the API compliant with data security standards?

How can businesses benefit from using the Digilocker PAN Card Verification API?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More