Introduction

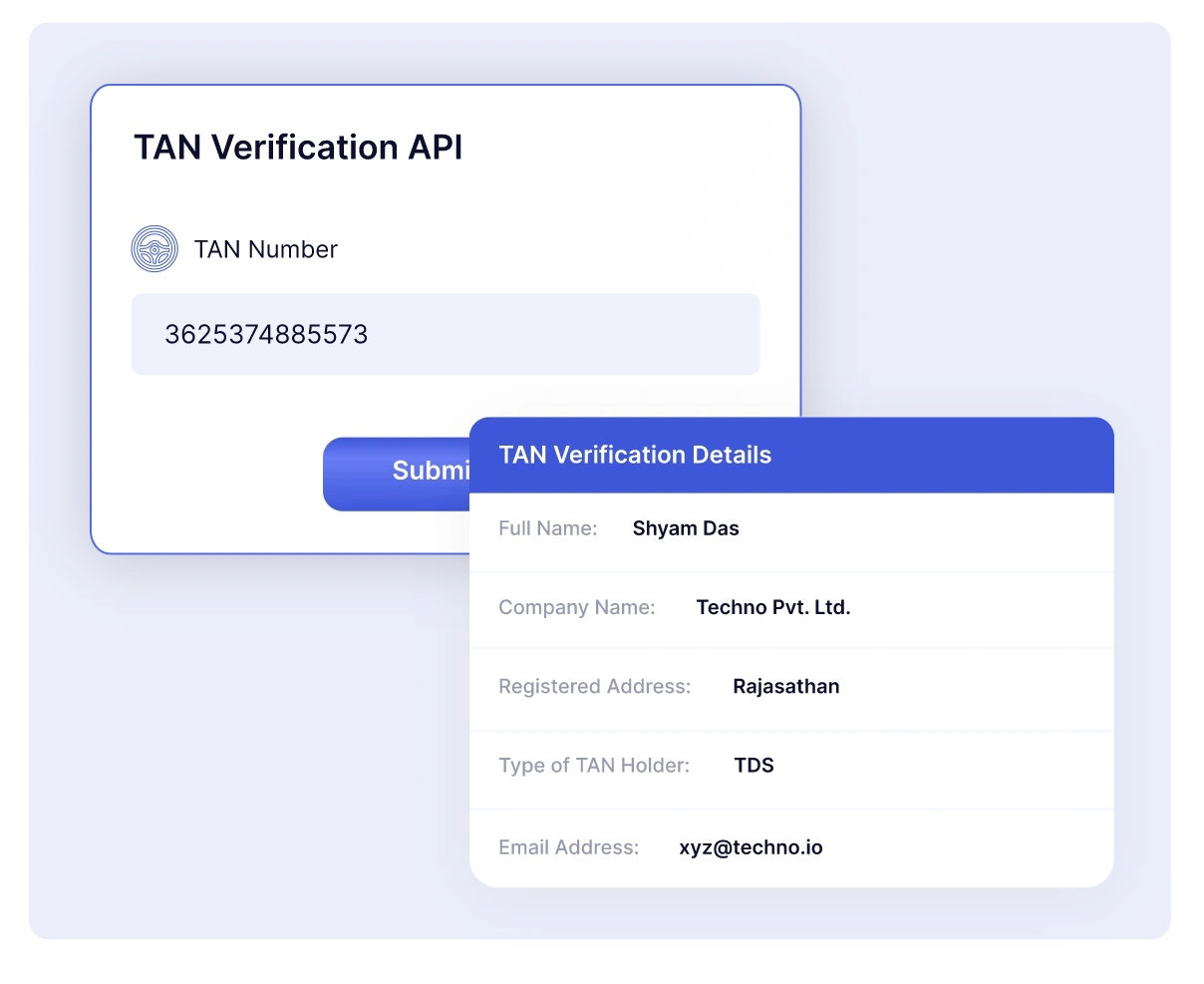

The TAN Verification API enables real-time validation of the 10-digit alphanumeric Tax Deduction and Collection Account Number (TAN), essential for tax compliance as mandated by the Income Tax Act.

The TAN API offers the TAN holder’s address and type information, aiding customer verification for organizations. It automates verification, reduces errors, and integrates easily with existing systems, offering customization for specific needs.

When you use our API, the process is simple and straightforward. All you need to do is enter the TAN, and the system will instantly return a result with the company’s name, address, full name and email ID. This can be done within milliseconds, saving you valuable time and effort.

Surepass’s TAN API has been well-tested and trusted by many of our service users. It is designed to be user-friendly and easy to integrate into your existing systems, so you can start using it right away. Our API is designed to save you time, energy, and money while also providing you with instant results, ensuring complete accuracy and reliability.

Benefits of Verifying with our API

Accuracy

Our rigorous TAN verification process thoroughly examines multiple data points to authenticate the TAN, ensuring the highest level of accuracy in the results.

Easy process

Simply enter your TAN and receive instant results without the need for any additional steps.

Only verified TAN holders

A valuable system when assessing the creditworthiness of an individual and determining loan eligibility.

case-study

How SurePass helped in verifying customers for a used two wheeler seller of India

What is a TAN verification API?

How does TAN number verification API works?

What are the attributes that we can verify using the TAN verification API?

What are the requirements for TAN API to work?

How many types of TAN card verification APIs are there?

How much time does it take to verify a TAN number?

Why is online TAN verification faster than offline TAN verification?

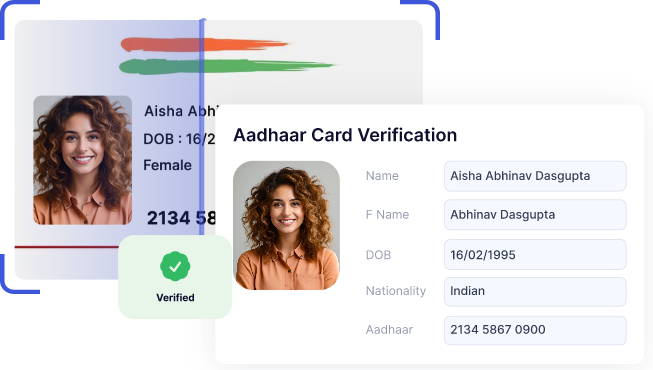

Aadhaar Verification API

Aadhaar verification API is an important process for every financial institution or the entities that need an API for Aadhaar card verification.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification.

Read More