Introduction

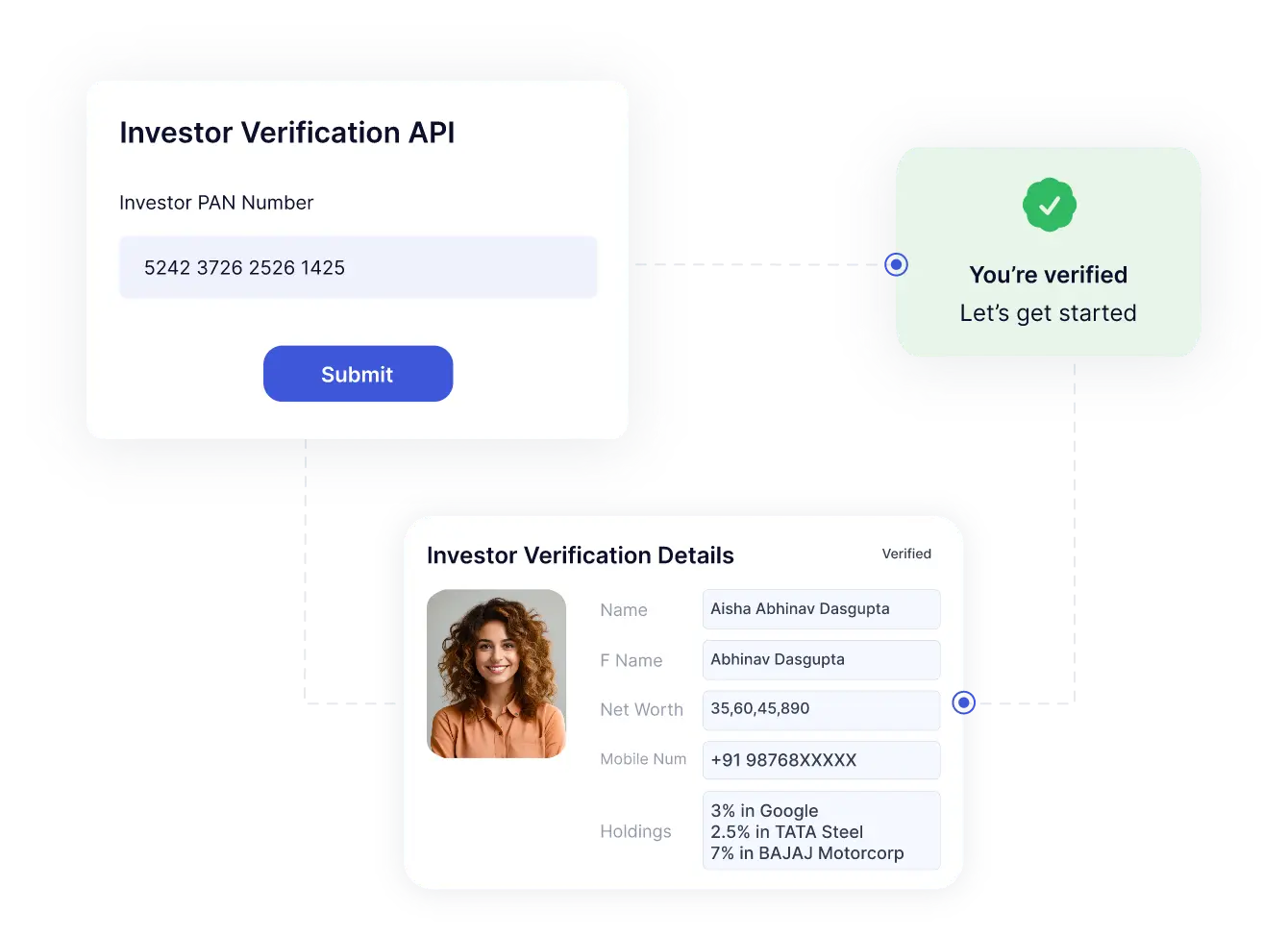

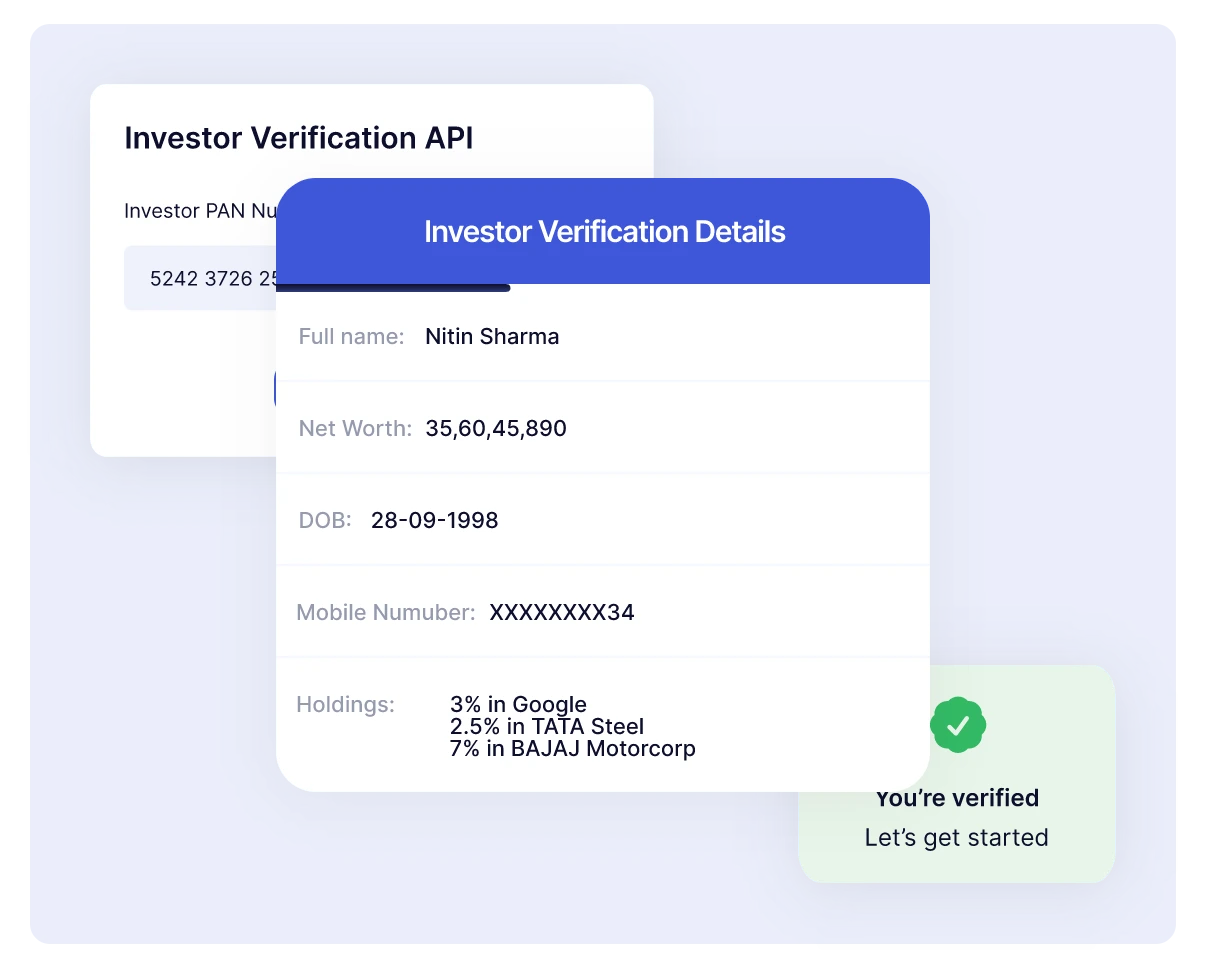

Qualified Clients and Accredited Investors are the two different investor types served by the Investor Verification API. Qualified Clients are defined by the Securities and Exchange Commission (SEC) under the advisors Act and are subject to certain requirements regarding their net worth, responsibilities within investment structures, and assets managed by advisors.

In order to verify compliance with regulatory requirements, qualifying clients are usually verified by a thorough review of financial records, including bank statements, W-2 forms, and tax filings. The SEC defines accredited investors as those who have established market credibility and are unrestricted by regulations when it comes to investing in a variety of financial instruments.

Businesses are not required to keep certificates on file, but they must take reasonable steps to confirm that Accredited Investors are eligible by gathering pertinent data and examining financial records.

To sum up, the launch of Surepass’s Investor Verification API gives companies a dependable and effective way to verify investors, which makes investment partnerships safe and legal. Businesses can confidently traverse the complex financial landscape by utilizing this cutting-edge API, which also protects against potential dangers and promotes long-term business opportunities.

Benefits of Verifying with our API

Plug and Play

The Investor Verification API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

The Investor Verification API prevents fraud by thoroughly assessing investors’ backgrounds, ensuring only legitimate stakeholders are involved in corporate investments.

Accurate and Reliable

Investor Verification API guarantees accuracy and reliability by thoroughly examining investors’ financial backgrounds and market reputations, ensuring the legitimacy of stakeholders in corporate investments.

case-study

How SurePass helped in verifying customers for a used two wheeler seller of India

What is the Investor Verification API?

How does the Investor Verification API work?

What types of investors does the API cater to?

How does the API ensure accuracy and reliability?

Can the API be integrated into existing systems?

Is the Investor Verification API compliant with relevant regulations?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.

Read More

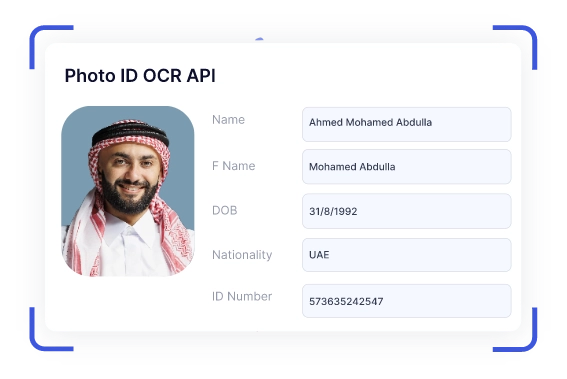

Photo ID OCR API

Photo ID OCR (Optical Character Recognition) API is the most efficient OCR out there.field’s like full name, address, mobile number, gender, date of issue and all details mentioned on the photo.

Read More