Proof of Income refers to documents that help verify an individual’s or company’s financial stability. These documents usually contain financial transactions or statements showing consistent income sources. Lenders and financial institutions ask for income proof to evaluate a person or business’s creditworthiness. It helps them check their financial credibility before approving loans, credit applications, and other services. Verification of documents reduces the risk of fraud and defaults.

What is Proof of Income?

Proof of Income is a document that a person or entity can use to show their source of income. It represents your regular stable income. Lenders and banks use these proofs to check the creditworthiness or financial stability of an applicant. It will help them make good decisions and reduce the risk of defaults and other compliance issues.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

List of Proof of Income Documents

- Salary Slip for Past 3 Months with Employer Stamp and Sign

- Trust Fund Income

- PF Statement

- Income Certificate

- Government Benefits Payments

- Employer’s Certificate

- Pension Statement

- Profit or Loss Statement

- Last Financial Year Form 16

- Latest Employment Contract Letter (Reputed Companies)

- Investment Statements

- Rental Income Document

- Letter of Financial Support

- Alimony or child support Documents

- Court Order Payments

This is a list of the documents you can use as income proof when you need to show your monthly or annual income.

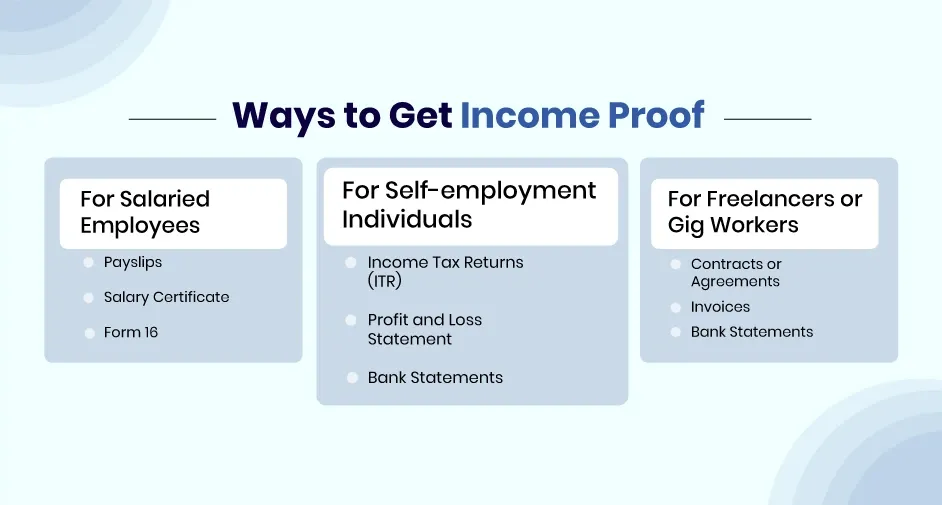

How to Get Income Proof?

Here is how you can obtain income proof:

For Salaried Employees:

- Payslips: Request payslips from the HR or payroll department.

- Salary Certificate: You can ask your employer to provide a salary certificate or employment letter containing information like salary, position, etc.

- Form 16: Request form 16 from your employer which has your salary details and tax deductions.

For Self-Employment Individuals

- Income Tax Returns (ITR): You can use ITR as Income proof.

- Profit and Loss Statement: Get a profit or loss statement with the help of CA.

- Bank Statements: You can show your bank statement.

For Freelancers or Gig Workers

- Contracts or Agreements: You can provide copies of contracts with clients.

- Invoices: You can submit invoices issued to clients.

- Bank Statements: You can show the bank statements that can represent payments received from clients.

For Rental Income

- Rental Agreements: Prepare rental agreement with the tenant to use it as Income proof.

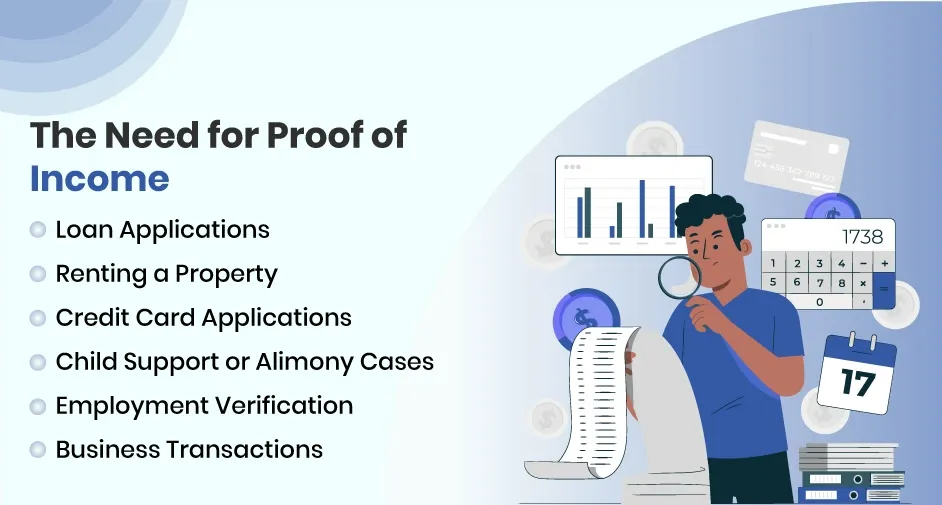

What is the Need of Proof of Income?

Proof of income has several applications such as:

- Loan Applications: Lenders require income proof to check a borrower’s creditworthiness. This confirms whether the person or entity can repay on time.

- Renting a Property: Landlords often ask for income proof to confirm that tenants can afford the rent.

- Credit Card Applications: Banks and financial institutions require income proof to assess a person’s or business’s financial stability.

- Child Support or Alimony Cases: In some court cases income proof is required to calculate fair child or alimony payments.

- Employment Verification: Employers and recruitment agencies ask for income proof of a previous job to verify your salary history and negotiate offers.

- Business Transactions: It is required for the filing of tax returns and ensuring compliance.

- AML Compliance: Financial institutions and banks can use the documents to detect suspicious transactions, and comply with AML regulations.

Income Verification Solutions for Business

Surepass offers various APIs that help businesses quickly verify the legitimacy of documents. From identity verification to payslips, credit scores, and OCR, you can verify authenticity in just a few clicks. Surepass offers a comprehensive suite of APIs that verifies all kinds of income documents such as bank statements, PF statements, Income certificates, etc.

To use the API you just need to follow these steps:

- Input: PAN Details or Upload the document.

- API Processing: The API will verify the data

- Output: Get the verified status or verified income details.

These APIs help in finding tampered and fake documents instantly. Businesses can integrate these APIs to detect and prevent the risk of financial loss, fraud and legal issues. They also reduce the document work and enhance the efficiency of the verification process.

Conclusion

Income proof is a valid document that shows your creditworthiness. Bank statements, ITR, Pension statements, investment statements, payslips, rental agreements, etc. We have given the list of documents you can check for more details. Having income proof is essential for businesses and individuals for loan applications, renting property, applying for credit cards, employment and other financial statements. You can obtain these documents through various ways, as mentioned above.

Businesses that want to verify income-proof documents accurately can use Surepass income verification APIs. It will help them detect fake documents in real-time. It will help in reduce the risk of defaults and fraud.

FAQs

What is the best document for proof of Income?

Payslips, bank statements and tax returns are the best income proof documents.

What is a valid income proof?

Bank statements, recent payslips, tax returns, and employment verification letters, are considered valid income proof.

How do you prove income?

Multiple documents can be used to prove income including bank statements, payslips, pension statements, income certificate, etc.

How to show income proof without pay stubs?

You can use bank statements, employer verification letters, W-3 Forms, etc.