Checking the legitimacy of the person is a crucial process for employee onboarding, background verification, and customer onboarding. Previously, businesses relied on in-person verification. It is a time-consuming process and prone to errors. However, the online identity verification process is simple and efficient. Here in this blog, you will learn about identity verification and services.

What is Identity Verification?

Identity Verification is a process of checking the authenticity of a person. It can be done through document verification, biometric data, KBA, Two-factor authentication, device intelligence, behavioural biometrics, liveness detection, etc. It prevents identity theft, reduces fraud, and ensures compliance.

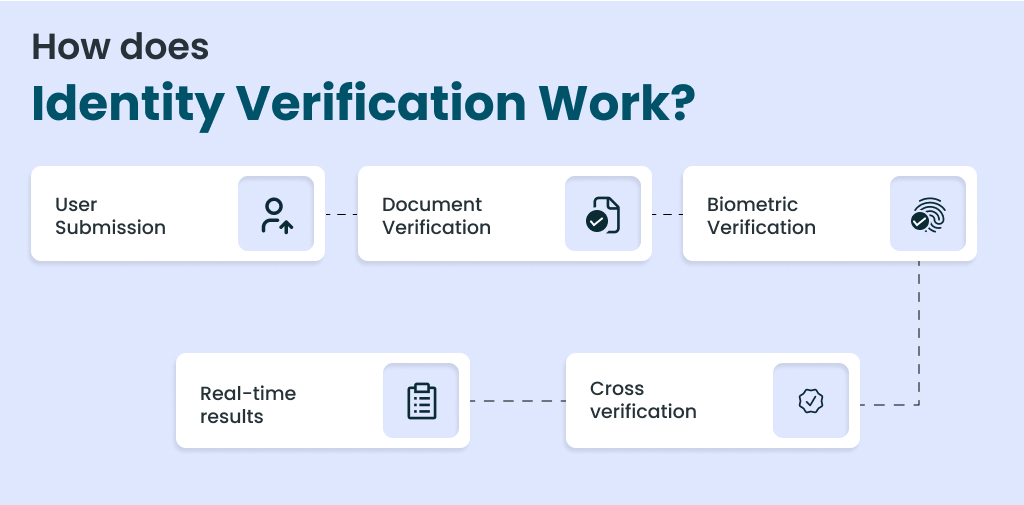

How does Identity Verification Work?

The online identity verification works in the following way:

- User Submission: User uploads an image of the identity document.

- Document Verification: Documents are scanned and undergo forgery detection and template matching.

- Biometric Verification: Facial recognition technology is used to verify the ID photo and liveness.

- Cross verification: Identity documents are verified against the reliable records.

- Real-time results: The User will get the result in a valid or invalid status.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Types of Online Identity Verification Methods

Here is the list of online identity verification methods that are commonly used in verification methods:

OTP Based Verification (One-Time Password)

In this method, a unique code is sent to the registered mobile number or email ID.

- Biometric Verification: In biometric verification, fingerprints, Iris scan, or facial recognition are used to match a user’s physical traits with records.

- Video KYC: In Video KYC, a live video call is conducted with the user. Here agent asks the user to share their identity documents and asks basic questions.

- Facial Recognition: In this method, the user’s face is captured via a camera. After that, the captured image is used to cross-verify against the submitted ID.

- Liveness Detection

In this method, a person’s photograph is used in the video KYC process to confirm that the person is physically present.

Benefits of Online Identity Verification

There are enormous benefits of identity verification:

- Reducing Identity Theft: It helps in confirming that the person is genuine. It reduces the risk of identity theft and associated fraud.

- Confirms regulatory compliance: It helps businesses comply with KYC (Know Your Customer), AML, and other regulations.

- Enhance the Efficiency of Customer Onboarding: Automated online solutions speed up the verification processes, reduce manual checks.

- Support remote access: Digital Identity verification provides secure access to services. A perfect solution for online banking, insurance, and e-commerce platforms.

What is Identity Verification Service?

Identity verification service refers to a system or software. It usually verifies the information against the reliable sources and confirms accuracy. That the person is a genuine and not a fraud. It involves document verification, biometric data, 2FA, Liveness Detection, etc.

How to choose an Online ID Verification Service?

As there are many service providers available in the market. You should consider these factors before buying any service.

- Accuracy: Choose a service that offers high accuracy and minimal false positives and negatives.

- Speed and Authentication: Go for a service that provides real-time results and automation.

- Security and Data Privacy: Check that the provider is compliant with DPDP regulations and uses secure encryption.

- Smooth Integration: Look for a service provider that offers technical support for integration.

- Scalability: The service should be able to handle a large number of requests simultaneously.

- Good Customer Support: Good customer support and customer reviews should be checked. It ensures that you will get assistance whenever you face while integration.

Surepass: Best Identity Verification Service

Surepass is a reputed name in the verification industry. It provides various services that assist you in quick and accurate verification. It offers a comprehensive suite of Identity verification APIs and services:

- Aadhaar Verification

- Voter ID Verification

- Driving License Verification

- Passport Verification

- Photo ID OCR API

- Vehicle RC Verification API

- Video KYC

- Liveness Detection

Surepass APIs and services provide real-time results and 100% accurate data. The technical and customer support teams are highly supportive. As it offers a wide range of services organization can rely on Surepass for faster customer onboarding. Apart from the services, it offers affordable pricing that makes it suitable for small businesses as well as for large enterprises.

Conclusion

Identity verification is a crucial step in the KYC or customer verification process. It involves several checks, such as document verification, biometric, facial recognition, liveness detection, etc. Traditionally, people need to undergo in-person verification for all these things. But with the online identity verification services, everything has changed. Now, you can verify identity in real time.

As there are numerous service providers are there. Choosing the right one for yourself is difficult. However, you can consider Surepass for accurate and automated verification. It offers a comprehensive suite of services that ease the verification, and the real-time result enhances the verification process.

FAQs

How do you verify your identity?

You can verify your identity through OTP, by providing a Government-Issued ID, etc.

What is meant by identity verification?

It is the process of checking the authenticity of a person through documents against official records and biometric data.

What is the KYC process of identity verification?

KYC is a know your customer verification process. It is used by financial institutions to confirm the customer’s identity.