Due to the availability of the internet millions of people are using various websites and services online. On most of the websites, a user has to share their sensitive information for multiple purposes. But do you know that the personal data users share on the internet, is under the threat of hacking and data breaches? A fraudster can use personal data for identity theft.

Currently, the cases of identity theft are rising. According to estimates millions of people fall victim to identity theft due to unauthorized access. Not only individuals but businesses are unprotected from such crime, facing reputational damage and financial loss.

What is Identity Theft?

In simple words, identity theft means stealing personal and financial information without permission. The fraud can use name, address, driver’s license, passport, social security network, credit card, health insurance account numbers, etc.

This vulnerable information is prone to theft due to the internet. One mistake and you can lose anything.

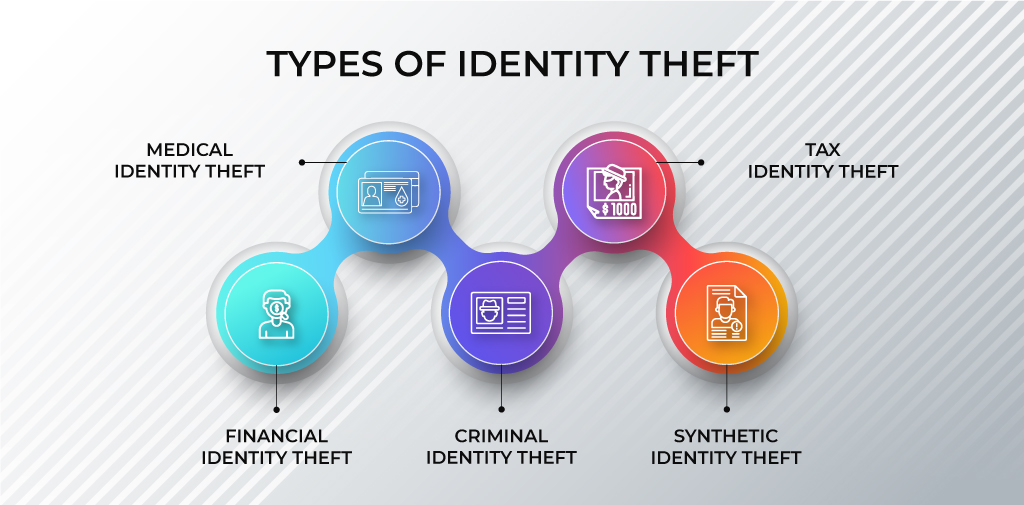

Types of Identity Theft

Here is the list of the most common types,

-

Medical

In this kind of theft, someone uses personal information to get medical services. This type of theft can have serious issues for example fraudsters can use health insurance to get treatments. This can result in incorrect medical records and the real owner can’t obtain the real benefit. Victims find this theft when they receive bills and claims.

-

Financial

Financial identity theft is another common form, in this theft financial information is used for illegal financial gain. Fraudulent people can use credit cards and take out loans. For example, a fraudster can steal credit card information, make unauthorized purchases, and can apply for a loan, leaving you with debt.

-

Synthetic

Criminals combine both real and fake information. Usually, this kind of fraud is not easy to detect. Fraudulent take help of this fraud for opening fraudulent accounts and buying things.

-

Criminal

In this theft, someone uses the personal information of others to commit a crime. In most of the cases, the victim has no idea about this. They get informed during background checks when they apply for jobs.

These are some of the common identity thefts that occur regularly. Frauds like Child identity theft, Tax, and Criminal identity theft are also seen.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Signs You’re a Victim of Identity Theft

These are the signs or activities you can find.

- Unauthorized login: You may receive a message of login or login attempts.

- Unfamiliar charges on your bank account: you will receive credit card bills for purchases.

- Unexpected Collection Notice: You may receive letters from debt collectors taken under your name.

- Rejection in Credit Application: Your loan application got rejected even though you maintain a good financial record. It happens because someone is damaging your credit score.

- Medical bills for services you didn’t use: Getting medical bills for the services you didn’t use because someone is using your identity to receive medical treatment.

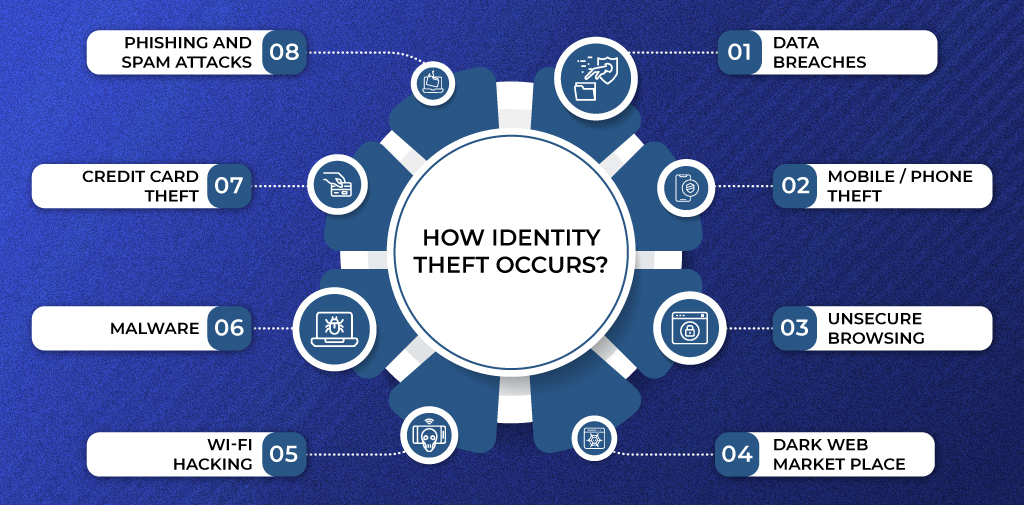

How Identity Theft Occurs?

Identity theft can occur in many ways,

- Data Breaches: Hackers steal personal data from databases of organizations illegally.

- Mobile Phone Theft: Stolen phones are used to access personal information and apps.

- Unsecure Browsing: Sharing personal and financial information on unsafe websites can lead to stealing.

- Malware: Malicious software can steal your data or spy on your computer without your knowledge.

- Dark Web Market Place: Stolen information about people often sold on the dark web.

- Wi-Fi Hacking: Hackers may intercept data when people use public wifi, they steal their password, account number, and other essential details.

- Phishing and Spam Attacks: Scammers send fake emails or messages to trick you into giving up sensitive information or installing malware.

- Credit Card Theft: Criminals use stolen credit card details from breaches, physical theft, or skimming devices to make unauthorized purchases.

Consequences of Identity Theft

Identity theft can cause severe consequences to victims. Individuals can face huge financial losses from activities like unauthorized transactions, leading to lengthy recovery processes. Their credit scores often suffer due to fraudulent account activities. This makes it difficult for individuals to secure a loan. Many victims suffer emotionally like experiencing anxiety and stress.

Apart from the emotional and financial damage, to proving the innocence is difficult, this process requires documentation, multiple visits, and communication with banks and businesses. Sometimes it creates frustration and challenges in restoring financial issues. In simple words, victims of identity theft face disruption and stress in life.

How to Prevent Identity Theft?

These are key prevention methods to protect yourself from identity theft.

-

Safeguard Personal Information

Be careful while sharing personal and financial information online and offline. Do not throw away the documents containing personal data, shred them.

-

Use Strong Passwords

Use unique and complex passwords while creating an account. Update and change passwords regularly.

-

Enable Two-Factor Authentication (2FA)

Use two-factor authentication for added security and accounts.

-

Monitor Financial Accounts

Regularly check bank and credit card statements for unauthorized transactions. Don’t miss to set up account alerts for unusual activity.

-

Monitor Your Credit Report

Check credit reports from the major credit bureaus. Regular monitoring helps in detecting fraud.

-

Use Secure Connections

Try to avoid public Wi-Fi for transactions, it is better to use a VPN.

-

Keep your device secure.

Use antivirus and anti-malware software and update your system.

-

Be Aware of Phishing Scams

Always check the sender of the mail before sharing information.

Steps to Take if You Are Victim of Identity Theft

Follow these steps if you are a victim,

-

Contact Financial Institutions

Inform your bank and credit card companies about unauthorized transactions.

-

Report to Authorities

File reports about the identity to police and special authorities dealing with identity theft and financial fraud.

-

Check Bank and Credit

Regularly check your credit reports for any unusual activity.

Conclusion

Identity theft in India can be considered as a major issue, it affects a victim (business and individual both) economically and socially. Millions of people are using internet with no worries about data leaks, which makes them a target for fraudulents.

That’s why it is important to be careful while sharing personal data over online sources. Being aware of the types of identity theft, signs, and prevention is crucial for safety.

FAQs

What is Identity Theft?

Identity theft refers to the use of personal information of a person without their knowledge for illegal activities.

What are the first signs of identity theft?

Here are some of the signs you can find

- Unexpected bills

- Unauthorized Transactions

- Debt Collection Notices

- Medical Bills for Unused Services

How is Identity Theft Caused?

It’s caused by illegal access or use of personal information through stolen devices, phishing scams, data breaches, etc.