Aadhaar-based KYC is an essential process a business conducts before offering services to individuals. It reduces fraud risk and confirms that only the genuine user accesses the service. The traditional identity verification involves paper-based and in-person verification. It is under the threat of document misuse. It also consumes so much time and is inefficient. However, the UIDAI is consistently launching new solutions to simplify the verification process for businesses and individuals while maintaining security. The UIDAI’s new Aadhaar App offers several features that make identity verification easy and secure for the cardholders. The new solution will change the future of Aadhaar-based KYC in India.

What is Aadhaar KYC?

It is a process of verifying customer identity through the Aadhaar card. This helps businesses check the legitimacy of the person and address. Types of Aadhaar-based KYC in India:

Aadhaar e-KYC

Aadhaar e-KYC is a digital Aadhaar verification process. It helps verify a person’s authenticity through OTP or biometric verification.

Common Methods

- OTP based eKYC

- Biometric-Based eKYC

Aadhaar Offline KYC

Aadhaar Offline KYC helps businesses in easy verification of customer identity via a digitally signed XML file. Identity can be verified without biometric or OTP verification.

Paper-Based OKYC

It is a traditional verification process where a photocopy of the Aadhaar card is submitted and manually verified.

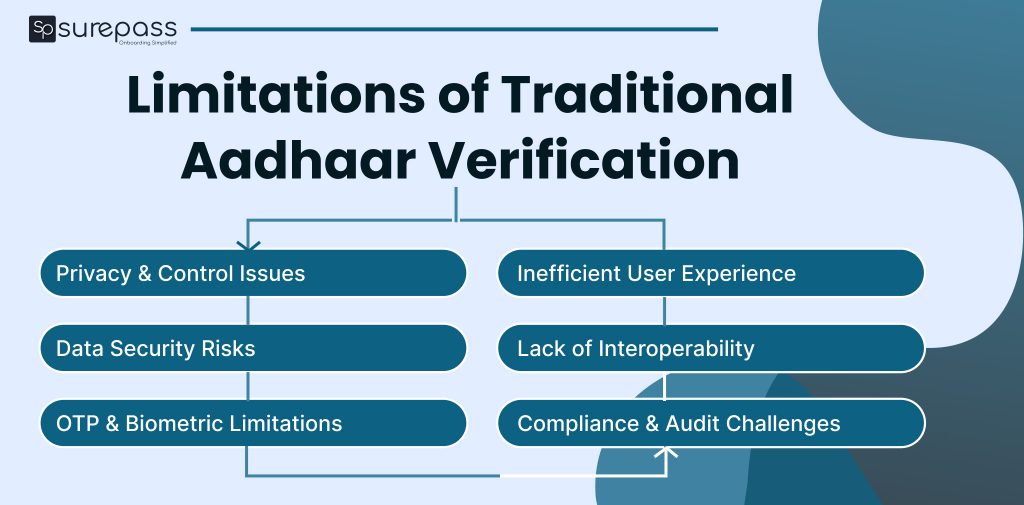

Limitations of Traditional Verification

The traditional Aadhaar identity verification process has several drawbacks:

- Privacy Concerns

In the traditional Aadhaar verification process, the user shares full Aadhaar details. The sensitive personal information is highly exposed. The ID holder has no control over how the information is being shared or stored.

- Data Misuse Risks

Sharing of Aadhaar information across multiple platforms is prone to unauthorized access, data breach, and misuse.

- Dependency on OTP verification

OTP verification is the widely used method. However, there are a few drawbacks to verification, including network issues, biometric failures, or outdated records.

- User Drop Offs

Lengthy verification steps, repeated KYC requests, and in-person visits delay onboarding and increase user drop-offs.

Automate your KYC Process & Reduce Fraud!

We have helped 3000+ companies in reducing Fraud by 95%

New Aadhaar App: A Turning Point in Aadhaar-Based KYC in India

The new App brings a big change in the Aadhaar identity verification:

- It replaces the need to carry a physical Aadhaar card or submit paper copies for KYC.

- The new Aadhaar apps make identity verification fully user-controlled. It means card details are shared only with the user’s permission.

- The App supports Face ID-based authentication. It allows quick and secure identity verification.

- The new Aadhaar App enables QR code verification, which makes the verification process instant.

- It offers a selective sharing feature that gives control to Aadhaar on how much Aadhaar data is going to be shared and used.

- Aadhaar holder can lock biometric, mask aadhaar, check authentication history, and more with just a tap under the Aadhaar App.

- New Aadhaar is updating new features to make verification simple, quick, and easy.

Future Trends in Aadhaar-Based KYC in India

The Aadhaar-based KYC and verification process is changing. In upcoming years, the KYC process will focus on:

- Privacy First Verification: Users will share only necessary information and protect sensitive data. Consent-based KYC will become standard.

- Offline Aadhaar Verification: QR code-based KYC without internet or Aadhaar number exposure. It is useful in remote or low-connectivity areas.

- Biometric and AI-Based Authentication: As digital fraud is increasing, facial recognition and liveness detection will be used for fraud prevention. The mobile modals will replace biometrics and replace OTPs for higher security.

- Digital Only Identity Management: Only digital ID will be used instead of physical cards. Integration with government and private services for seamless onboarding.

- Paperless KYC: It helps in real-time verification for banking, telecom, and fintech services. It reduces paperwork, time, and operational costs.

- Improved Security Measures: End-to-end encryption and secure storage of Aadhaar data. It will reduce identity theft and misuse of information.

Impact of Aadhaar KYC on Different Industries

Aadhaar KYC simplifies the identity verification process for various sectors:

- Banking and Financial Services

Online Aadhaar KYC simplifies the account creation and loan processing process. Now, Aadhaar holders no longer need to visit banks or submit documents physically. Services like OTP verification, biometric verification, and banks can quickly onboard customers. It reduces the risk of identity theft and manual work.

- Fintech and Digital Payments:

Aadhaar-based KYC confirms that only the legitimate person can register for the app. This prevents the creation of fake accounts, duplicate accounts and reduces fraud. The online process makes user onboarding faster and easier.

- Telecom and SIM Verification

Aadhaar KYC makes the identity verification process easy and instant. People don’t require physical verification, and it also reduces verification delays. The verification that takes days now can be done in seconds. It improves user experience.

Conclusion

The Aadhaar verification process is changing in India with new features and updates. The government is getting stricter with the KYC regulations. Traditional Aadhaar KYC verification requires paper-based physical verification. It is at high risk of document misuse and identity theft. But with digitalization, verification has evolved from paper-based to OTP and biometric verification. Now, with the new Aadhaar App, KYC has become even easier and consent-oriented.

FAQs

Ques: What is Aadhaar-Based KYC?

Ans: It is a process of verifying an individual’s identity through the Aadhaar card.

Ques: Can Aadhaar KYC be done without sharing the Aadhaar Number?

Ans: Yes, with offline KYC and QR-based verification, users can verify their identity without sharing their Aadhaar number.

Ques: How does Aadhaar-based KYC help prevent fraud?

Ans: Aadhaar KYC helps in checking the legitimacy of the individual and reduces the risk of identity theft.

Ques: What documents are required for Aadhaar KYC?

Ans: You need an Aadhaar card as an identity document and a bank passport or a ration card as proof of address for KYC.

Ques: Is KYC possible without an Aadhaar card?

Ans: Yes, other accepted identity proof documents can be used for KYC.