Mutual Fund KYC is a regulatory process for investor verification. It ensures that the investor is authentic and not involved in illegal activity. KYC helps prevent fraud, maintain compliance, and build trust between investors and mutual fund companies. Completing KYC allows investors to proceed to smooth transactions without the necessity of resubmitting documents

What is KYC in Mutual Fund?

KYC is a mandatory process for investor verification in mutual funds. This verification is important for confirming the authenticity of the investor and ensuring compliance with AML regulations. The KYC process involves the collection of investor information that is then stored on a centralized database of KRA (KYC registration agencies). By completing the KYC process investors can invest in various mutual funds without repeated document submission with centralized access.

How to Check Mutual Fund KYC Status?

These are the simple steps any investor can follow to check mutual fund KYC status.

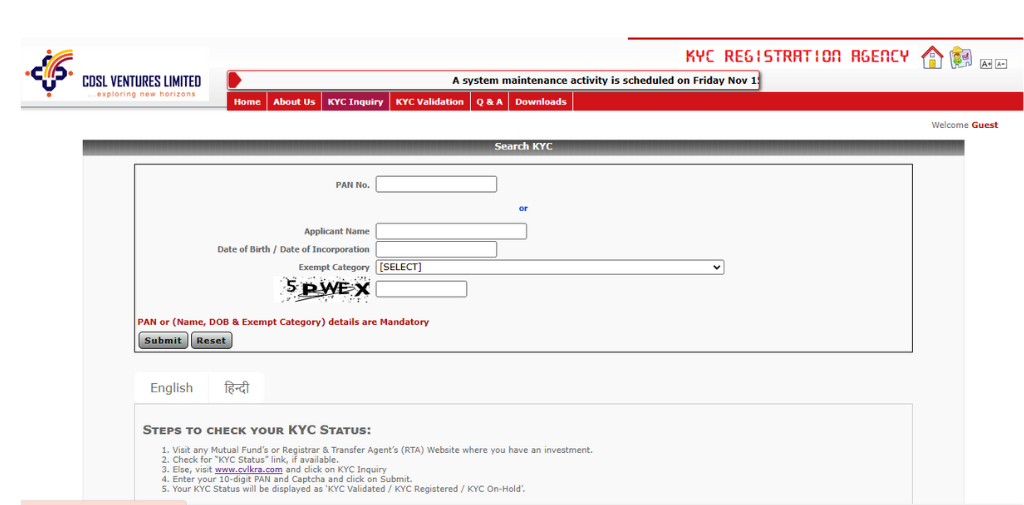

- Visit the www.cvlkra.com

- Click on the “KYC Inquiry.”

- Enter PAN Card Number.

- OR You can Fill applicant’s name, date of birth, and date of incorporation. (Optional)

- Select Exempt category (Optional)

- Complete the captcha and click submit.

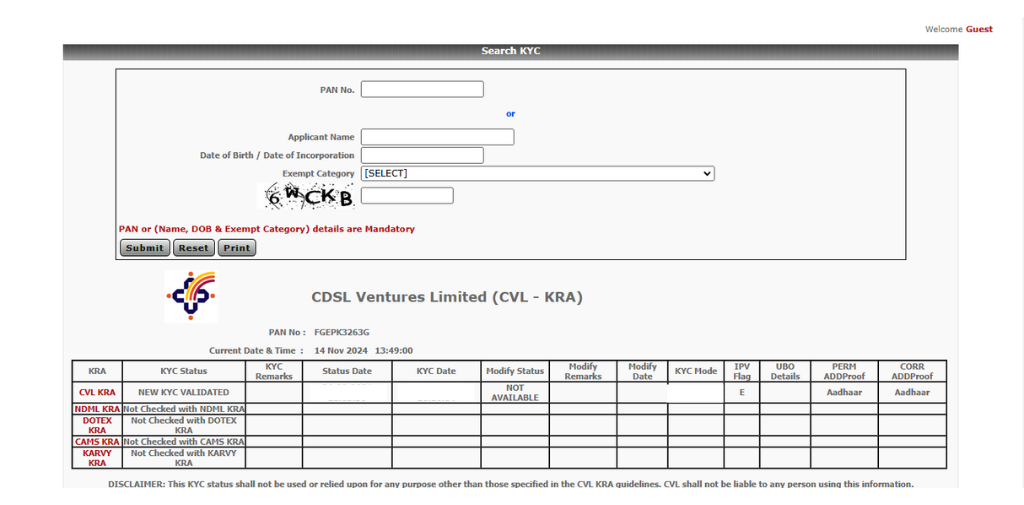

- You will get the KYC details along with the KYC Status.

Your KYC status will be displayed on the screen, showing options like KYC Validated, KYC Registered, or KYC on Hold

What is the Meaning of KYC Status in Mutual Fund?

Here’s what each KYC status means for your mutual fund investments

- Validated

It means your KYC is completed and you can do mutual fund transactions anytime.

- Registered

Registered KYC status indicates that investors can continue purchases, switches, and SIPs in existing mutual fund investments. But To invest in new mutual funds, they need to complete the KYC process again.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

An investor can update their status through the modification process by using PAN and Aadhaar XML, M-Aadhaar, or Digi-Locker.

- On Hold / Rejected

If your KYC status shows “On Hold” or Rejected, it means that either Mobile or Email is not validated / PAN is not linked with your Aadhaar / Deficiency in the KYC documents, etc.

You can resolve this issue by following the updation steps available on the website. After updation, you will receive the registered/validated status. Investors will become eligible for investing by receiving validates or registered status.

Steps to Complete Your Mutual Fund KYC

An investor can complete the KYC process both online and Offline. Follow these steps to complete the KYC.

Offline Method

Step 1: Collect The Necessary Documents

You need to collect these documents for Mutual Fund KYC,

- Identity Proof: PAN Card, Aadhaar Card, Passport, Driving License, or Voter ID card.

- Address Proof: Bank statement, Utility bills, Ration card, etc.

- Passport Size Photograph: Photograph.

Step 2: Fill Out the Mutual Fund KYC Form

Download the form from the KRA website or get a hard copy from the branch and fill out the form.

Step 3: Submit the Form

After filing the form attach a copy of the documents with it. Submit the form and documents to the KRA website, a mutual fund company, or an advisor.

Step 4: (IPV) In-Person Verification

IPV is a mandatory part of the process that can be completed in two ways.

- In-Person Visit: Visit the KRA or mutual fund office for document and identity verification.

- Online IPV: Many KRAs and mutual fund companies now offer online services through video calls.

Step 5: Verification

KRA will verify the documents and will update your mutual fund KYC status. You can opt for the mutual fund KYC check online option, where you can check your KYC status with the help of your PAN card number.

Step 6: Start Investing Once Approved

After getting validated status by the KRA, you will become eligible to invest in mutual funds across many companies.

Online eKYC

An investor can follow these steps to complete their Online eKYC

- Visit any website of the SEBI Licensed KYC Registration Agency (KRA)

- Create an account

- Enter the Aadhaar number and registered mobile number

- Enter the OTP received on your phone

- Complete the online Mutual Fund eKYC

- Submit a copy of your Aadhaar card

Conclusion

KYC is a necessary process for investor verification. An investor cannot start investing without getting validation status from KRA (KYC Registration Agency). Investors can complete the KYC both online and offline. They can check their KYC status from any SEBI-Licensed KRA website.

Investors may find three kinds of status including validated, registered, and on hold/rejected. A Validated status allows investors to invest in various mutual funds without restrictions. If the status is Registered, investors can transact in existing mutual funds but will need to update their status to Validated to invest in new funds.

An On Hold / Rejected status means there is an issue, and the reason will be provided along with the status. By resolving the issue, investors can become eligible to proceed with their investment

FAQs

How to check mutual Fund KYC Status Online?

You can check your mutual fund KYC status online through the KRA website.

How long does it take to get KYC verified for Mutual Funds?

The Mutual Fund KYC process takes 10 to 15 days.