Introduction

The Surepass CIBIL Report API offers a simplified way for individuals to retrieve their credit report and score, as well as other relevant credit-related details. To use this API, users need to provide specific information about themselves, including their full name, associated mobile number, date of birth, and PAN card number (a unique identification number issued by the Indian government).

The information retrieved through the CIBIL API provides individuals with a comprehensive overview of their credit history and financial activities, enabling them to better understand their creditworthiness and make informed decisions regarding credit applications and financial planning. The JSON format makes it easy for software applications to process and interpret the data returned by the API.

Benefits of Verifying with our API

Plug and Play

The Cibil Report API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Cibil Score Report API prevents fraud through identity verification, multi-factor authentication, secure communication, and user consent mechanisms.

Accurate and Reliable

It achieves accuracy and reliability by accessing current CIBIL credit data, employing rigorous data verification, and following secure industry standards.

Blog

What Is Aadhaar Verification API, Why Use It?

What is the CIBIL API?

How do I use the API?

Is my data secure when using the API?

How accurate is the information provided by the API?

Can I access someone else’s credit information through the API?

Can I trust the API’s credit score information?

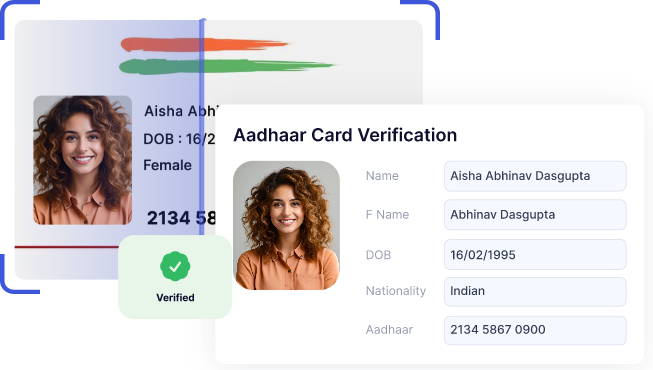

Aadhaar Verification API

The Aadhaar verification API is a digital tool used to verify the validity and accuracy of Aadhaar cardholder details, enabling streamlined authentication processes.

Read More

Equifax Credit Report API

The Equifax Credit Report API enables individuals to easily retrieve their credit report, providing lenders with essential information for assessing creditworthiness in financial applications.

Read More