The Central Know Your Customer (CKYC) is a centralized database of KYC data. It unifies KYC compliance across financial institutions in India. It is managed by CERSAI (Central Registry of Securitization Asset Reconstruction and Security Interest). With CKYC, individuals only need to complete their KYC process once.

Banks, Mutual Funds providers, and other financial institutions can access and verify the KYC details of customers details through the CKYC Number. It reduces the deduplication and enhances security. It removes the time-consuming repetitive KYC submissions. It saves time and effort. In this blog, you will learn about CKYC numbers and how to get them?

What is the CKYC Number?

The CKYC Number is a unique 14-digit identification number. Customers get this number when a financial institution updates KYC data on the CKYC Records Registry. This registry makes the KYC data centralized and accessible to financial institutions. It reduces the resubmission of documentation and KYC for different financial institutions.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

CKYC Number and Features

- 14-digit KYC Number: It’s a 14-digit number linked to your ID proof.

- Secure Data Storage: Your sensitive data is stored in electronic format.

- Document Verification: The documents you submit are verified during the document verification process.

- Instant Notifications: Institutions are notified whenever you change the KYC details.

- Uniform KYC Process: CKYCRR (Central KYC Records Registry) will maintain the KYC data same, across all institutions.

- Easy Access and Updates: You can search, download, upload, and update your KYC details easily.

- Secure Login: The system has advanced security to protect user access.

- Automatic File Exchange: It allows smooth file exchanges without manual work.

- Validity: This number is valid for a lifetime until and unless changes are made to KYC data.

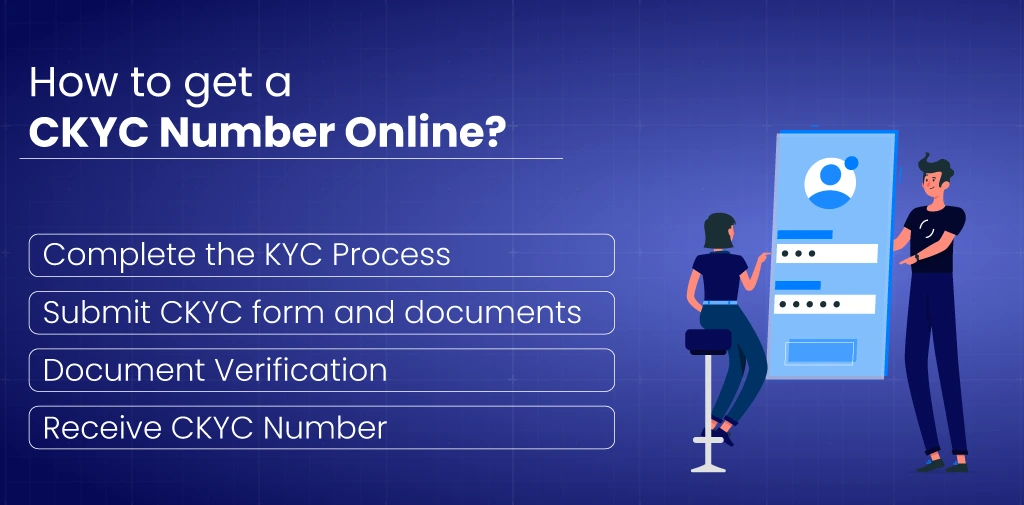

How to get a CKYC Number Online?

Follow these step-by-step processes to get your CKYC number.

Complete the KYC Process

To get your CKYC no., you must complete the KYC process with a financial institution, such as a bank, mutual fund, or other approved financial service provider.

Submit CKYC form and documents

Submit documents like a PAN Card, Proof of Identity, Proof of Address, and a recent Photograph.

Document Verification

After you submit the KYC form and document, the financial institution will verify and upload your details to the central KYC Registry.

Receive CKYC Number

After your details are registered, you will receive a CKYC no. You can use this number for future KYC verification without repetitive documentation.

(You can give missed calls on this number to get your CKYC no. 7799022129)

Check CKYC Number

These are the following platforms where you can check the CKYC no.

- Visit Karvy KRA or the CDSL website.

- Enter your PAN Number and CAPTCHA.

- CKYC Number and Details will be displayed.

Easy Steps for CKYC number check online

Follow these steps to check the CKYC number:

- Visit the Karvyakra.com.

- Enter the PAN Number.

- Enter the Captcha/Security code displayed.

- Fill in the Captcha or security code.

- Receive CKYC No. and other details.

Carefully review the information and download your CKYC report.

Institutions Eligible to Register Customers for CKYC

Banks and financial institutions regulated by SEBI, RBI, IRDAI, and PFRDA can register your KYC details with CKYC. It is the responsibility of these banks to accurately update the KYC data of the customer to CKYC, whenever the customer opens:

- Open a bank account.

- Create a Demat account.

- Purchase an insurance policy.

- Make investments in mutual funds.

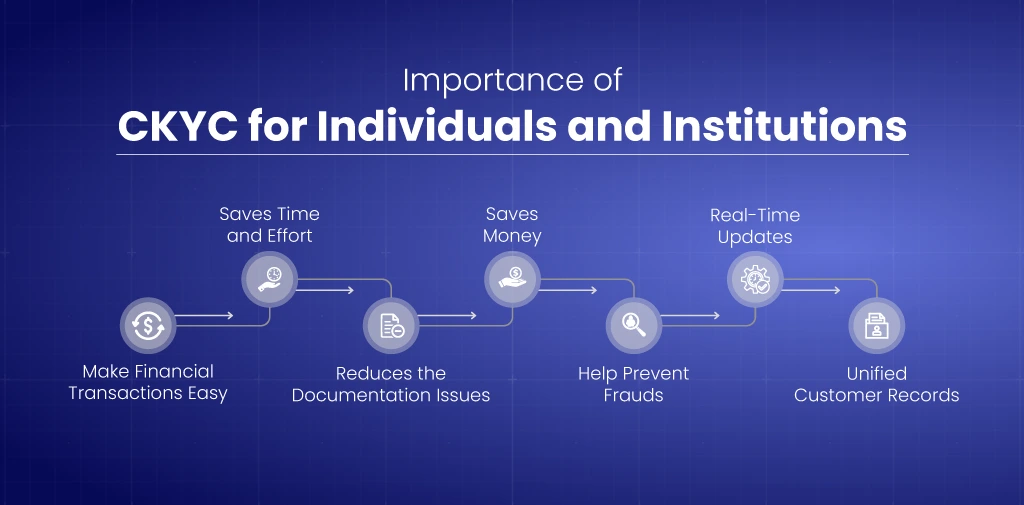

Importance of CKYC Number for Individuals and Institutions

These are why CKYC is important for both individuals and institutions:

- Make financial transactions easy: With CKYC, customers need to complete KYC only once. After that, they can use their CKYC no. to share their KYC information with banks, mutual funds, insurance, and more.

- Saves time and effort: The centralized records eliminate the repetitive KYC document submissions and speed up processes.

- Reduces the documentation issues: Centralized data storage minimizes duplication and inconsistencies.

- Saves Money: It saves time and resources required for manual or repetitive KYC documentation work.

- Help Prevent Frauds: It verifies customer details and minimizes identity fraud and financial crimes.

- Real-Time Updates: It notifies the institution, whenever customers update their KYC data. It reduces the risk of outdated or inaccurate records.

- Unified Customer Records: CKYC centralise customer details. It provides the financial institution with date information.

Conclusion

CKYC No. makes the KYC document accessible to financial institutions for identity verification. This eliminates the need for repetitive KYC documents and saves time. Individuals get this Number when their financial institution registers their KYC data in the registry. A simple overview of the CKYC process is described above. You can also give a missed call on this number 7799022129 to get the CKYC no.

FAQs

How do I Find my CKYC No.?

Visit any official portal that offers CKYC number check services like Karvy KRA, CVL KRA, CKYC India, etc.

How to get 14 digit CKYC Number online?

Complete the KYC process with a bank, when the bank uploads your KYC data, you will receive the 14-digit CKYC number online.

Is CKYC Mandatory for Everyone?

Yes, every regulated bank and financial institution must register customers under the CKYC.

What is the Central KYC Registry?

The Central KYC Registry (CKYC) is a centralized database of customer KYC records managed by CERSAI.

Can you do CKYC online?

Yes, you can complete the KYC process online at a registered financial institution portal.