Know and Prevent UPI Fraud

UPI transaction is the most convenient method of online transactions. Almost all people in every household use UPI payment for buying daily necessities. But do you know that the rising use of UPI is associated with the potential risks of illicit money transactions? Now frauds are using many means to access other money with the help of UPI.

What is UPI Fraud?

The full form of UPI is the Uniform Payment Interface, it is considered as the most convenient way of payment. UPI Fraud means any tricks that use UPI Pin’s, OTPs, bank account details and sensitive information to carry out unauthorized transactions. UPI fraud can cause enormous financial losses. Do you know around 12 billion transactions occurred in the year 2023? Assume that one 1% undergoes UPI fraud. The sensitivity associated with UPI fraud cases is too much to consider.

Types of UPI frauds

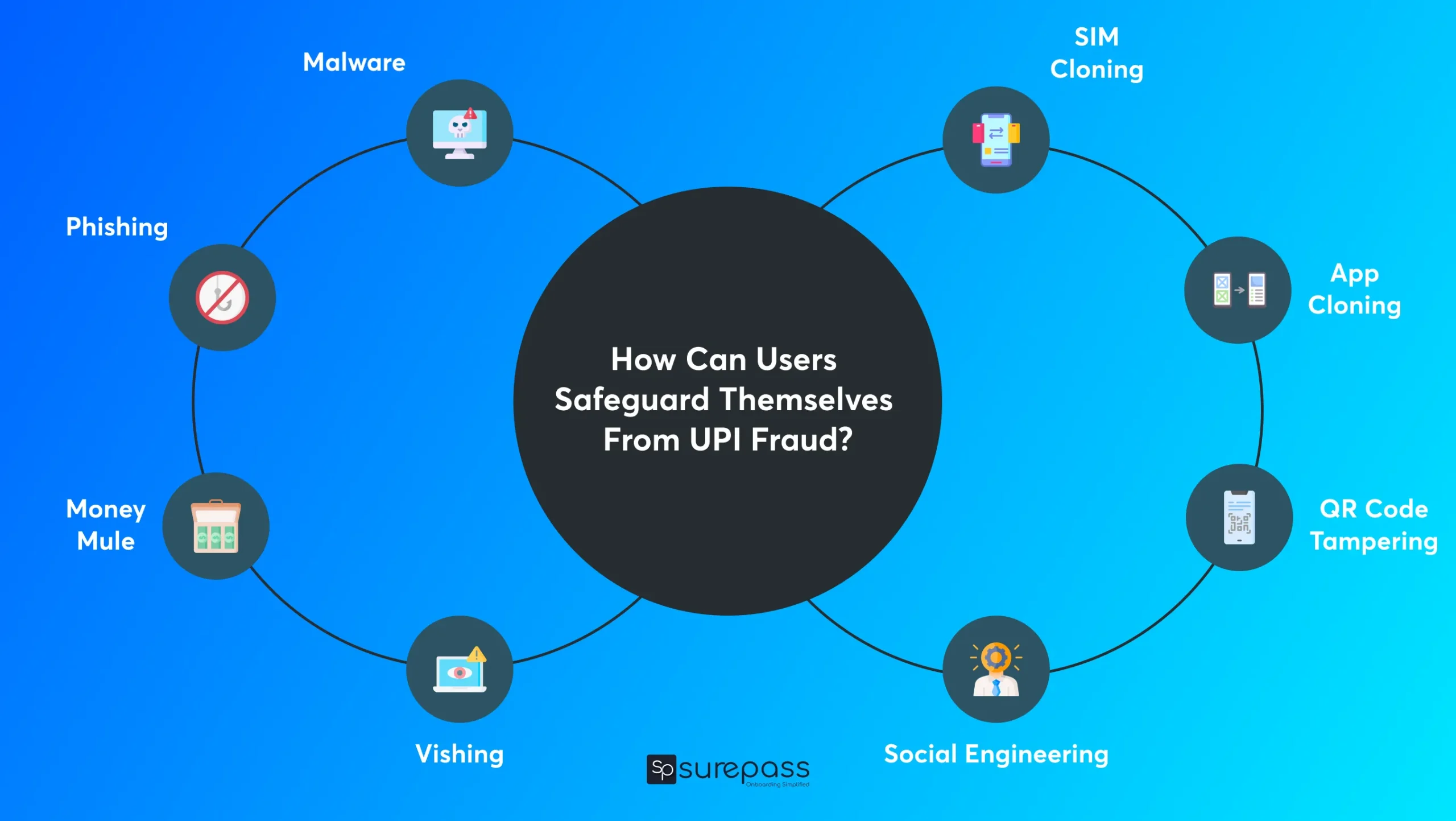

Here, we have gathered the most common types of UPI fraud cases

Malware

It’s software that is used by frauds to steal user credentials, payment information and other sensitive data.

Phishing

Phishing is another illegal means of fraud used to access user information such as UPI PINs, OTPs and passwords. The stealing includes UPI PINs, Passwords and OTP through illicit emails, messages and phone calls.

Money Mule

Money Mule is a complex type of fraud that involves stealing financial information and transferring money to an intermediary account. This intermediary account serves as the Money Mule, this account temporarily holds the collected funds from various unsuspecting victims.

This process hacks the UPI system.

SIM Cloning

SIM cloning is a new fraud that risks too much when banks make OTPs mandatory. If a fraudster clones a SIM Card, they can easily receive OTP on their device. They can even change your UPI PIN, and in a few minutes, you can become a victim of UPI fraud.

Vishing

Vishing is another illegal means that comes in UPI fraud cases. It comes when fraudsters pretend to be bank representatives to gather the personal information of individuals. They did it to get PINs and passwords.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

QR Code Tampering

In these UPI fraud cases, fraud manipulates and alters QR codes. This alteration redirects payments to the payments into fraud account instead of the merchant’s account. When unsuspecting users scan these QR codes, they unknowingly send money to the fraudster’s account.

Fraud Seller

After COVID-19, Indians are spending so much money on the e-commerce marketplace to buy everything. But many e-commerce websites are not authentic and fraud sellers are using money to collect payment without any deliveries.

App Cloning

In this type of UPI fraud in India fraudsters create fake UPI app that looks real, it tricks people into believing and downloading these apps. These fake apps collect user-sensitive information which helps frauds to transfer money into their accounts. To avoid be a victim of fake UPI payment be alert.

Social Engineering

In this kind of UPI fraud, fraudsters use tactics and trick users into revealing the UPI IDs or making transactions by pretending to offer rewards and money claims.

These are the most common UPI frauds that people should know to be careful of while transacting money through UPI ID.

How to prevent UPI Fraud?

The cases of scams and fraud are increasing day by day. But you avoid and protect yourself from fraud by taking some precautions.

Be Informed about the latest fraud and scams: Knowledge of scams helps in detecting fake UPI IDs and apps. Because you will be alert whenever you are transferring money.

Better stick to the official Apps only: Always download UPI apps from the Play Store or Apple App Store. Do not download from third-party sources otherwise, you will get a fake UPI app to remember to not click on links and emails.

Give importance to verification of sources: make your habit to check the source of emails and messages you receive. Check the source whether they are the official ID of banks or UPI service providers or not.

Enable two-factor authentication: two-factor authentication will add an extra layer of security.

Secure Your Device: Use strong passwords and biometric authentication to unlock your device and UPI apps. It is good practice to keep the device updated. Remember to use antivirus in your device.

Set Transaction Limits: Set daily transaction limits for your UPI transaction to minimize UPI payment frauds and financial losses during unauthorized transactions.

Verify QR Codes: Before proceeding to scan QR codes for payments, make it your habit to verify the authenticity of merchants. Look for any signs of alternation in the QR codes.

Make transaction monitoring your habit: it is good to check your bank statements and transaction history regularly. It will help you detect suspicious transactions without your notice. Immediately report your bank if you find any unauthorized transactions.

Do Not use public or Open Wi-Fi: open Wi-Fi benefits hackers to access all your data. So, do not use the UPI App or work related to banking using public Wi-Fi.

Easily Detect Fake UPI and QR Codes With Surepass QR Detection API

Surepass is a reputed API provider with 99% accuracy in fake UPI IDs and QR. Apart from this API, Surepass offers many other APIs for identity verification such as Aadhaar verification, Pan card verification, etc.

FAQs

1. Can I get my money back from UPI Fraud?

You can get your money back by requesting a bank or UPI app if you mistakenly transferred money or UPI fraud occurs.

2. Is UPI Fraud Possible?

A user’s UPI ID can be compromised through phishing or malware attacks.

3. Who is responsible and accountable for UPI fraud?

Payment service providers are responsible if responsible for the losses that occur during UPI frauds.

4. How do I Secure my UPI Fraud Account?

Do not share your UPI PIN with anyone or any online platform verify the fake UPI ID before proceeding to transactions.