Aadhaar is the most common and reliable identity that many organizations use to verify an individual. The verification required details matching the UIDAI records. However, not every business has the right to access the records. Sensitive data can lead to many issues, such as identity theft and other crimes. Organizations that want to conduct verification must acquire an AUA or KUA license. Some people often get confused between the terms AUA and KUA.

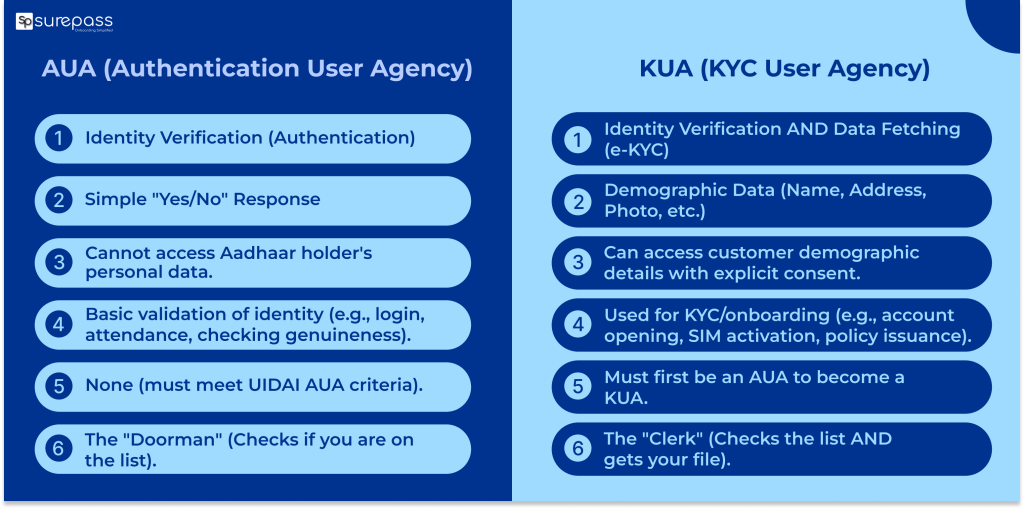

What is the AUA (Authentication User Agency)?

It refers to the Authentication User Agency (AUA), an organization authorized by UIDAI (Unique Identification Authority of India). It helps access the Aadhaar Database for authentication purposes. AUA mainly helps in identity verification and ensures secure and reliable identity verification.

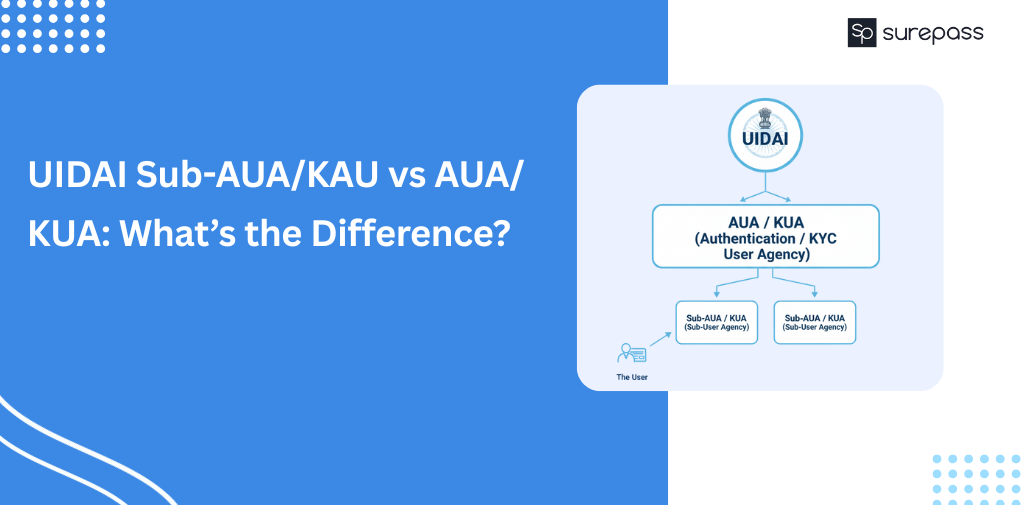

What is Sub-AUA UIDAI’s Meaning?

Sub-AUA (Sub-Authentication User Agency) is an entity authorized by an AUA (Authentication User Agency) that can perform Aadhaar-based authentication services. These organizations use AUA’s infrastructure and permission. These organizations must follow UIDAI regulations and use strong security measures.

What is the KUA (KYC User Agency)?

It is an organization which are approved by UIDAI to verify Aadhaar details (like name, address, and photo) for verification purposes. These organizations can perform verification and access the Aadhaar demographic with user consent.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

UIDAI AUA vs Sub-AUA

| Aspect | AUA (Authentication User Agency) | Sub-AUA (Sub-Authentication User Agency) |

| Definition | It is an authorized entity that can perform Aadhaar Authentication. | An entity authorized by an AUA to perform authentication on its behalf. |

| Connection to UIDAI | Direct connection to UIDAI’s Central Identities Data Repository (CIDR). | Connects indirectly through the AUA. |

| Authorization | Directly by UIDAI | Through an existing AUA |

| Compliance Oversight | Responsible directly to UIDAI | Oversight under the AUA. |

| Example | Bank accessing UIDAI CIDR to verify customers. | A retail store authorized by the bank to verify customers. |

Difference Between AUA and KUA

| AUA (Authentication User Agency) | KUA (e-KYC Agency) |

| Authentication User Agency | Know Your Customer User Agency |

| It helps verify whether Aadhaar is authentic or not. | Gets Aadhaar holder’s details (like name, address, photo) after verification for e-KYC |

| It can only verify identity. Cannot access details for verification. | KUA can access customers’ details with Consent from UIDAI. |

| It is used for Aadhaar Authentication purposes only. | It can be used for Aadhaar e-KYC (to fetch demographic data) |

| Every KUA must first be an AUA (verify first) | KUA is basically an AUA with extra rights to get e-KYC data. |

| A bank checks if the Aadhaar number is genuine. | The same bank then fetches the customer’s name and address from Aadhaar to open an account. |

Benefits of Proper AUA and KUA Implementation

Implementation of AUA and KUA offers multiple advantages for businesses, government agencies, and customers. These are reasons why it matters:

- Efficient Customer Onboarding: Proper AUA and KUA integration helps in instant Aadhaar-based authentication. It reduces paperwork and the manual verification process. Customers can complete KYC in minutes rather than days. It improves user experience.

- Prevent Fraud: Secure data transmission between AUAs, KUAs, and UIDAI ensures protection against unauthorized access. It helps prevent identity fraud and account duplication. It reduces the risk of financial fraud and data-related crimes.

- Cost Efficiency: It adds automation and reduces the need for manual verification. It minimizes errors that could lead to additional costs in fraud rectification or compliance fines. It enables scalability for large customer bases without a proportional increase in resources.

- Simplifies Operations Across Multiple Platforms: AUAs and KUAs can integrate with multiple services. It supports digital onboarding, e-signatures, and other online services efficiently.

Become an Official Sub-AUA/KUA of UIDAI with Surepass

If you are a business that has to verify the number of individuals, becoming a Sub-AUA or KUA is better. For accurate verification, you need to verify the Aadhaar details in the Aadhaar database. Surepass helps in the organization of Sub-AUA/KUA within 30 days. Apart from this, it offers multiple solutions for verification, such as DigiLocker Integration, eSign, Offline XML File/QR Code, and others. These solutions add automation to the verification process and make onboarding easier as well as faster.

Conclusion

People often get confused between the terms AUA and KUA. Both of these agency helps in Aadhaar verification. However, both of them have some differences. The AUA is the Aadhaar Authentication Agency, and KUA is the KYC user agency. The AUA helps in checking the legitimacy of the Aadhaar. KUA helps access the Aadhaar demographic for verification. All the key difference between AUA and KUA is listed in the above table. A business that wants to verify Aadhaar should become an official Sub-AUA/KUA of UIDAI with Surepass.

FAQs

Ques: Are AUA and KUA the same?

Ans: No, AUA refers to Authentication User Agency, and KUA refers to KYC User Agency.

Ques: What is the full form of KUA?

Ans: The full form of KUA is eKYC User Agency.

Ques: What is the full form of AUA?

Ans: The full form of AUA is Aadhaar User Authentication.

Ques: What is the main difference between AUA and KUA?

Ans: The difference between AUA and KUA is that AUA only helps in verifying Aadhaar Number Authenticity, while KUA helps in accessing Aadhaar details for verification.

Ques: Who can become AUA or KUA?

Ans: Banks, telecom operators, fintech companies, government organizations, and other regulated entities can become AUA or KUA.