Aadhaar is a widely used identity for verification in India. Whether it’s a fintech company, a bank, a recruitment firm, or any other organization, it relies on Aadhaar to verify individual legitimacy. Organizations that wish to conduct verification must access the UIDAI records for accurate verification. However, without proper authorization from UIDAI, no one can access the sensitive Aadhaar data of an Individual. As millions of verifications need to occur daily.

To support large-scale verification, UIDAI gives proper license and authorization to entities named as AUA and KUA. An organization that wants to verify Aadhaar can become a Sub-AUA/KUA to seamlessly verify Aadhaar without any legal issues. Here, in this blog, you will learn about the top benefits of becoming a UIDAI Sub-AUA/KUA.

Top Benefits of Becoming a UIDAI Sub-AUA/KUA

These are the benefits of becoming a UIDAI Sub-AUA/KUA:

- Reduces Infrastructure and Cost

When you register as an AUA/KUA is more affordable than becoming an AUA-KUA. Because the organization can use Aadhaar verification services without developing or maintaining IT infrastructure, network connectivity, and compliance teams.

- Simplify Know Your Customer (KYC) Compliance

License makes the KYC process simple, efficient, digital, and paperless. It helps them access demographic details and photographs directly from the UIDAI server.

- Fraud Prevention and Security

Aadhaar-based verification should be secured like OTP, Biometrics, and demographic matching. It helps in preventing identity theft, misrepresentation, and security breaches.

- Access to Multiple Authentication Methods

Sub-AUAs/KUAs can use multiple authentication services, including biometric (fingerprints/iris), demographic, and OTP based verification.

- Scalable Transaction Processing

The Sub-AUA/KUA can grow its operations without any worry of the authentication system capacity.

- Regulatory Compliance

Complying with UIDAI’s strict standards through a parent AUA/KUA. It confirms that a business remains compliant with UIDAI guidelines.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Become a Sub-AUA in 30 Days with Surepass

Becoming a Sub-AUA or KUA is a complex process. However, choosing the right partner, the process quicker and seamless. Surepass, a trusted Aadhaar-based identity and verification solution provider, helps you get authorized UIDAI Sub-AUAs within 30 days.

It provides support from documentation to compliance checks and technical integration. Surepass manages the entire process end-to-end.

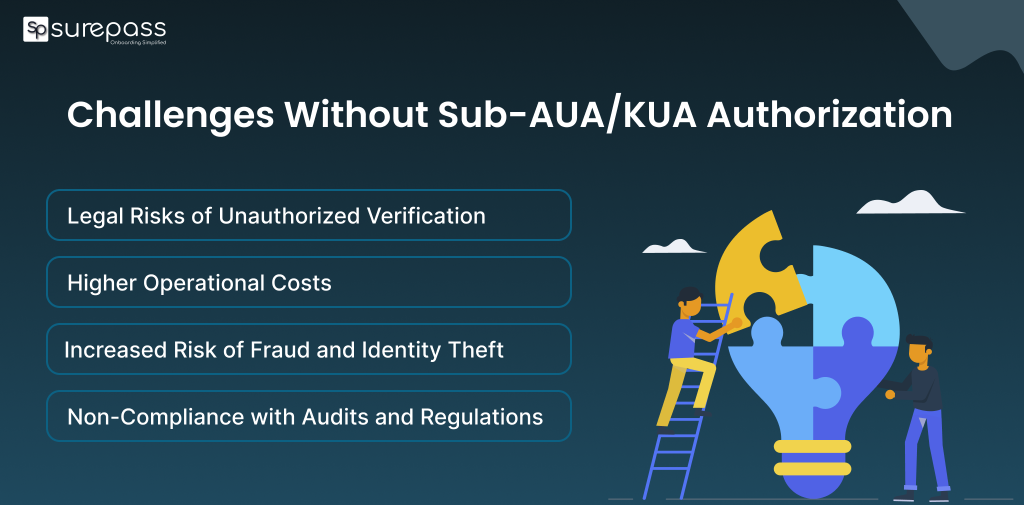

Challenges Without Sub-AUA/KUA Authorization

These are the challenges many organizations can face without having proper Sub-AUA authorization:

- Legal Risks of Unauthorized Verification

Accessing Aadhaar details or demographic information without proper UIDAI authorization. It can result in penalties and legal consequences.

- Higher Operational Costs

You need to spend a lot on alternative methods that can be slower, riskier, and highly expensive.

- Increased Risk of Fraud and Identity Theft

Unauthorized or unverified systems can create loopholes that fraudsters can exloit. It leads to data breaches, identity theft, and customer drop-offs.

- Non-Compliance with Audits and Regulations

All sectors, mainly finance and telecom, need strict KYC compliance. An organization without paper sub-AUA authorization may face rejection during audits and may face restrictions on operations.

Why Choose Surepass?

These are the reason why a business choose Surepass for getting AUA authorization.

- Quick Onboarding: Surepass helps you get registered as a Sub-AUA within 30 days.

- Comprehensive Compliance Support: It provides end-to-end assistance that helps you comply with UIDAI legal guidelines.

- Smooth Integration: It offers an API that allows you to integrate Aadhaar authentication and e-KYC service seamlessly into your existing systems.

- Cost-Efficient Solution: It eliminates the need for heavy infrastructure or in-house compliance teams. It saves both time and resources.

Industry Use Cases of UIDAI Sub-AUA/KUA

Apart from compliance being a legal Sub-AUA/KUA gives so many benefits, such as efficiency, security, and customer experience.

- Fintech and Banking: It helps banks and fintech conveniently process KYC for quick account opening, loan approvals, and digital wallet onboarding without lengthy paperwork.

- Telecom: The Sub-AUA/KUA license helps in the secure and quick customer verification. It helps activate new SIM cards within minutes.

- Recruitment and HR: It helps verify employee identity and background digitally and securely. It prevents fraud and ensures trustworthy hiring.

Conclusion

To conduct accurate verification without any legal issues, you must get proper authorization (Sub-AUA/KUA). This authorization brings you many benefits, such as reducing infrastructure cost, simplifying compliance, preventing fraud, multiple authentication methods. Getting a Sub-AUA/KUA license is complex and requires a lot of effort. Here, Surepass helps organizations get authorization easily with technical assistance.

FAQs

What are AUA and KUA in Aadhaar?

AUA refers Authentication User Agency, while KUA refers to the eKYC User Agency.

How to become a UIDAI agent?

Follow these steps to become (Sub-AUA or KUA):

- Partner with the UIDAI-licensed AUA/KUA

- Submit the necessary documents

- Complete UIDAI compliance checks

- Integrate Aadhaar Authentication Services

- Receive UIDAI approval.

What is the difference between AUA and Sub-AUA?

An AUA or Authentication User Agency has a license approved by UIDAI. A Sub-AUA operates under a parent AUA to perform Aadhaar verification without direct UIDAI authorization.

What is AUA/KUA Full Form?

AUA’s full form is Authentication User Agency.

KUA’s full form is a eKYC User Agency.

What are the risks of operating without Sub-AUA/KUA?

It can lead to legal penalties, higher operational costs, data breaches, identity theft, and non-compliance during audits.