A GST registration is essential for accurate billing, eligibility to claim input tax credits, and compliance with tax laws. Verification of GSTIN confirms authenticity and reduces the risk of dealing with fraudulent companies. The official government portal makes it easy to register for GST. This blog will guide you on how to check the GST Registration status with the help of using ARN/SRN and FRN.

What is the ARN of GST?

ARN is the application reference number issued to the company after the submission of the registration application on the GST Portal. It helps track the GST status such as pending, approved, and rejected. Businesses can use ARN to track GST registration status.

What is the SRN/FRN Number?

The SRN (Service Request Number) or FRN (File Reference Number) are unique numbers assigned on the submission of applications on portals. When the business submits a registration application on the IFSCA portal, it gets the FRN number. When the business submits a registration application on the MCA portal, it gets an SRN number. These numbers are like IDs that help you check and track the status of your application and request.

How To Check GST Registration Status?

Here are the simple steps, you can follow to check the registration status by ARN/SRN and FRN.

Check GST Registration Status by ARN

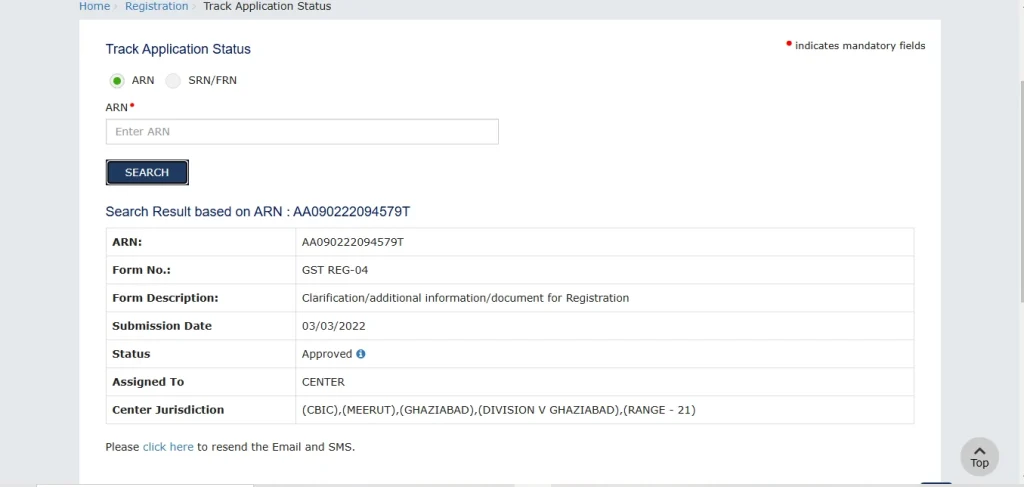

- Visit the official GST Portal

- On the Home page, click on the services tab

- Click on the track Application status, under the Registration.

- Enter the ARN Number and click on the search

The status will be displayed on your screen. It can be approved, rejected, or in the processing stages.

Check GST Registration Status by SRN/FRN

If you submit the registration application on the MCA portal, you will get SRN. On, the other hand, if you submit the registration on the IFSCA portal, you will get FRN.

- Go to the GST portal

- Click on services then click on track application status

- Click on SRN

- Enter SRN number

- Click on search

- Detailed status will be displayed on the screen.

The GST Registration Status Stages

- Pending for Processing: The registration application is submitted but is waiting to be processed by the Taxpayer.

- Site Verification Assigned – In this stage, the application of registration is marked for a Site visit and assigned to the Site Verification Officer.

- Site Verification Completed: The site verification officer submits reports to the tax officer.

- Pending Clarification: The tax officer sends a notice asking the applicant for more details.

- Clarification Filed (Pending for order) – You have responded to the tax officer’s request for clarification, and it’s now waiting for their approval or decision.

- Clarification Not Filed (Pending for Order) – When the applicant does not respond to the clarification request within the given time, but the decision is still pending.

- Approval: The registration has been approved, and the applicant will receive the ID and password via mail.

- Rejection: The tax officer has rejected your application due to incorrect or incomplete details.

- Application Withdrawn: The applicant has canceled or withdrawn their registration application.

These stages show the steps involved in the GST registration process and help the applicant understand the progress and action they need to take.

Common Issues

- Incorrect ARN Entered: If you enter the incorrect ARN number, tracking status can result in errors or no results. To avoid such mistakes, carefully enter the ARN number and recheck the typos before submission.

- Pending Clarification: If the tax officer requests additional documents for the application, this can result in delays. To solve this issue you can request the tax officer and reupload the documents.

- Site Verification Delays: Applications that are assigned for site verification may see delays in report submission, and slow down the registration process.

- Rejected Applications: The application can be rejected if there is incomplete or incorrect information occurs during document verification. To solve this review the rejection notice, make the necessary corrections, and reapply by submitting accurate documents.

- Technical Errors on the Portal: Server errors and glitches can disrupt the application status or tracking process. To resolve this issue, clear the browser cache, and use the GST portal in off-peak hours. You can also reach the GST helpline for support.

- Mismatch in Documents: Discrepancies between the submitted documents and details provided in the application can result in clarification and rejection.

Conclusion

Tracking and checking GST registration status is a simple process. By using ARN/SRN or FRN number you can easily check whether your application is approved, rejected, or in the pending stage. The different stages of the GST registration process help you understand the process and action you might take. It is better if you double-check the documents and information before submitting them to the portal to avoid errors and delays.

FAQs

How Long Does it take to get GST Registration Status?

The GST registration process may take 6 to 14 days.

How do I check my GST Registration Status?

Go to GST Portal > Click On Services > click on Track Application option > select registration in module list > Enter ARN Number and click on Search > status will be displayed on the screen.

Can we Check the Registration Status?

You can check the GST registration online on the GST portal.

How to Track GST Registration Status?

You can track GST registration Status by following these steps

- Go to the GST Portal

- Click on Services

- Select Track application status

- Choose the appropriate option between ARN/SRN and FRN

- Enter the number

- Click on search to view the status