In India, the microfinance sector is the foundation of financial inclusion. Small-ticket loans are available to help borrowers meet essential needs and start small businesses. Recently, MFIN tightened its microloan standards to encourage responsible lending. MFINs introduced key updates including the reduction of the number of lenders per client from 4 to 3 and the cap on loan exposures at 2 lakhs rupees. Here is the overview of MFIN’s Norms updates and their impact on borrowers as well as lenders.

Importance of Responsible Lending in Microfinance

Responsible lending is important for a sustainable microfinance ecosystem as it,

Promotes Financial Stability

Providing loans according to the borrower’s repayment capacity helps them improve their financial condition rather than fall into a debt trap. It will build a good relationship between the borrower and the lender.

Prevents Borrowers From Indept Traps

Many borrowers take loans from multiple lenders, which traps them into repayment struggles and financial stress. Here responsible lending focuses that borrowers are not burdened with more than the debt they can’t handle.

Strengthens the Microfinance Ecosystem

Approving loans according to the borrower’s capacity will reduce the risk of defaults and maintain a healthier financial system for Microfinance institutions.

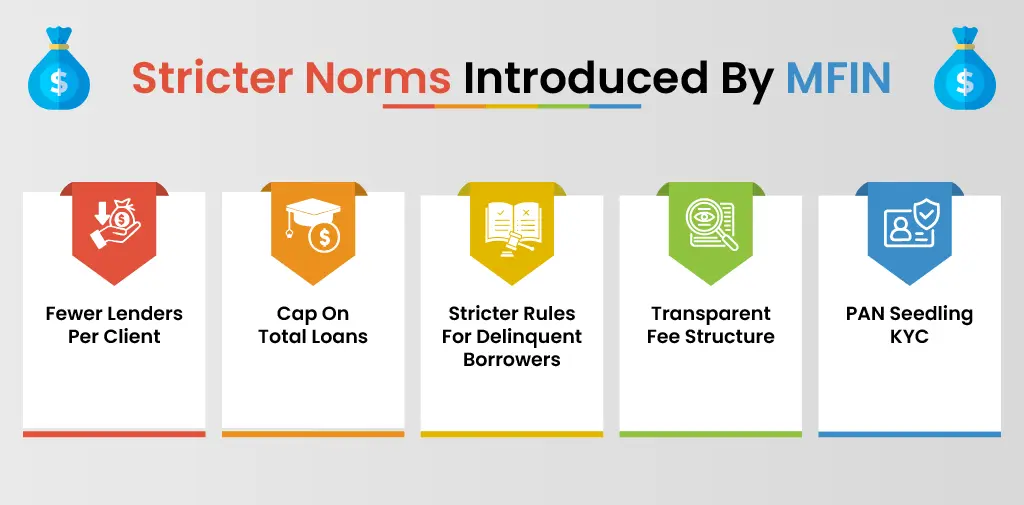

Stricter Norms Introduced By MFIN

Here is a quick overview of the MFIN Tighten norms,

- Fewer Lenders Per Client

To reduce the cases of overborrowing and loan defaults, MFIN reduced the number of lenders per client from 4 to 3. This update will be effective from Jan 1, 2025. It will ensure borrowers don’t overburden themselves from managing multiple loans. It will reduce the risk of default and financial stress.

- Cap On Total Loans

From now on, a borrower’s total loan amount including both microfinance loans and secured retail loans is capped at 2 lakh rupees. This will limit excessive borrowing and improve financial management while reducing the risk of defaults.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

- Stricter Rules For Delinquent Borrowers

Previously, a borrower with overdue payments of more than 90 days and amounts exceeding 3,000 rupees came under the red flag. Now, borrowers with overdue payments of more than 60 days and the same amount will be considered delinquent. This will help lenders identify the risky borrowers earlier.

- Transparent Fee Structure

This norm will improve fairness, by allowing only fees and credit life insurance can be deducted from the sanctioned loan amount. Apart from that, no other charges will be deducted.

To improve the KYC process, microfinance institutions aim to link PAN cards with 50% of the borrower accounts by March 2025. This will reduce the risk of identity theft and help lenders make informed decisions.

The main of these updates in the norms are protecting borrowers, promoting transparency, and creating a more sustainable microfinance ecosystem

Impacts of New Norms

The update in the norms is beneficial for both borrowers and lenders.

For Borrowers

The new norms will help borrowers by reducing financial stress, as they will have fewer loans to repay. Without any hidden fees, the loan term will be transparent. In addition, linking accounts to PAN cards will improve the accuracy of the credit profile of borrowers and promote fairer lending.

For Lenders

Responsible lending like checking the repayment capacity of borrowers will reduce the risk of defaults, The stricter rules on late payment help leaders identify high-risk borrowers early and prevent defaults.

Conclusion

Recently, MFIN further tightened norms for micro-loans to reduce the stress in the Microfinance sector. These updates include the reduction of lender number 4 to 3 per client, capping loan amount to 2 lakh rupees, and tightening rules of overdue payment. The new includes eliminating the hidden cost reduction from the sanctioned loan amount and liking PAN card. These changes are made to prevent borrowers from indebtedness and reduce the risk of defaults. It will enhance responsible lending and create a stable microfinance ecosystem.