PAN 2.0 is launched to simplify the taxpayer registration process with a unified, eco-friendly platform for managing tax services. This updated version of the PAN card has enhanced QR for easy PAN verification and fraud prevention. Here in this blog, you will learn how to apply for PAN 2.0 with simple steps.

What is PAN 2.0?

PAN 2.0 is a digitally upgraded version of the traditional PAN card system. It is designed and developed to make the process of registering taxpayers easy and efficient. This PAN 2.0 project will combine all the PAN services into a paperless platform that supports the government’s digital India mission. This new version of PAN has enhanced QR features in it, which makes it more secure.

Step-by-Step Guide to Apply for PAN 2.0 Online

Here are the simple steps you can follow to apply for PAN 2.0,

- Go to the NSDL or UTIITSL website.

- In the required services section, select “New PAN” to apply for a new PAN card, or “Update/Correction” to modify an existing PAN.

- Fill out the Application form carefully.

- You will receive the OTP on the registered mobile number or email ID.

- Upload necessary documents such as Aadhaar, and proof of address, if required.

- Get an e-PAN card on your registered email ID.

(Note: For Physical PAN Card)

If you want a physical PAN Card, you must request and pay the fee.

- Rs. 50 for domestic delivery

- Rs. 15 postal charge for international delivery.

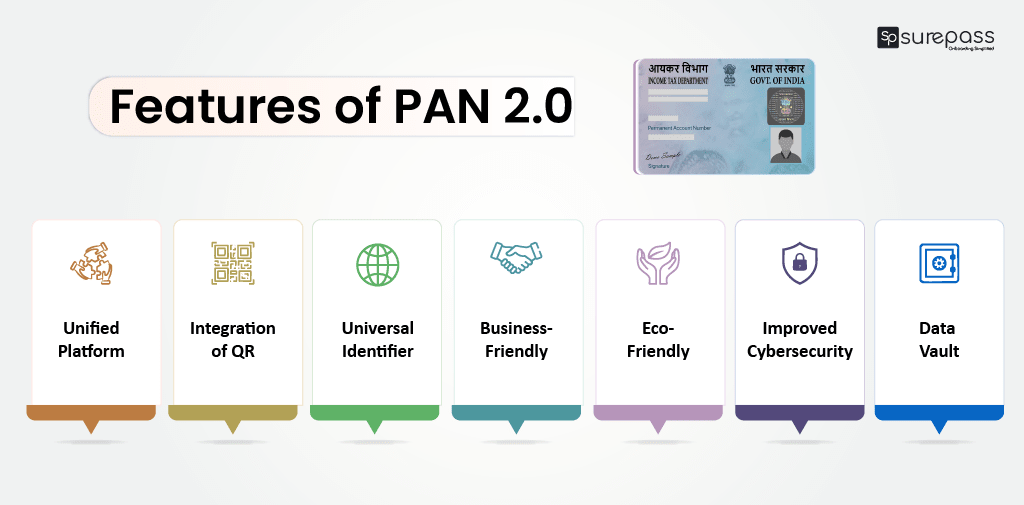

Features of PAN 2.0

PAN 2.0 offers key features designed to improve the efficiency and security of the PAN system

-

- Unified Platform: All PAN and TAN services will be available on a single platform.

- Integration of QR: The QR feature will improve security, prevent fraud and misuse of PAN details.

- Universal Identifier: It will be used as a universal ID across various government systems, reducing the need of multiple documentation.

- Business-Friendly: It will simplify the management of PAN-related tasks.

- Eco-Friendly: The paperless approach will reduce the environmental impact and lower operational costs.

- Data Vault: The secure storage system will keep PAN details safe.

- Improved Cybersecurity: The security measures will protect the taxpayer’s sensitive information from unauthorized access.

What Documents are Required to Apply for PAN 2.0?

The applicant needs the following documents for the new PAN card 2.0 application process.

- Proof of Identity

-

-

- Aadhaar Card

- Voter ID

- Passport

- DL

-

- Proof of Address

-

-

- Utility Bills

- Bank Statement

-

- Passport Size Photo

Common Mistakes to Avoid During the PAN 2.0 Application Process

Try to avoid these mistakes while applying for the PAN 2.0 application process:

- Filling Incorrect Details

Before submitting the application form, carefully review the name, DOB, and other details. Even a minor mistake can cause issues and delays in processing.

- Uploading Clear and Invalid Documents

Make sure that the documents you are uploading are clear and valid without any mistakes or errors.

What is the difference between PAN 2.0 and Traditional PAN Card?

Here is the list of differences that differentiate PAN 2.0 from traditional PAN cards,

Unified Platform

- Traditional PAN: Individuals need to use different websites for tax filing taxes, updating their PAN cards, and accessing other services.

- PAN 2.0: PAN 2.0 combines these services into one unified platform.

Master ID for Business

- Traditional PAN Card: Businesses need to use multiple IDs, such as PAN for income Tax, TAN for Tax deduction, GSTIN for GST, and CIN for company registration.

- PAN 2.0: The PAN 2.0 will transform your PAN into a single Master ID. This ID will replace the need of all these IDs.

Validity and Updates

- Traditional PAN: It only works as an ID for tax purposes.

- PAN 2.0: Your PAN card will remain valid. This project offers free updates, allotments, and corrections through new portal.

e-PAN and Physical Card

- Traditional PAN: Provides a Physical PAN Card.

- PAN 2.0: It sends ePAN to your registered email and phone number. It also offers the option of a physical PAN Card. You can get a physical PAN card by paying 50 rupees.

Verify PAN 2.0 with Surepass PAN 2.0 Verification API

After the launch of PAN 2.0, fraudsters will try to use fake PAN 2.0 cards for illicit activities. That’s why Surepass offers the PAN 2.0 verification API for fake PAN card detection and fraud prevention. Businesses can use this for the PAN 2.0 Verification process. The use of API in verification will improve efficiency and prevent fraud.

Conclusion

You can simply complete the PAN 2.0 application process to get the new PAN 2.0 card. It is embedded with a QR code for verification and fraud prevention. The PAN Card 2.0 provides a more secure system for individuals and businesses. By following the simple steps for application, and avoiding common mistakes, you can obtain the PAN 2.0.

FAQs

How to apply for PAN 2.0 online?

Visit the NSDL and apply for a new PAN 2.0 card, fill in the details, and get the new PAN card.

How to update your PAN Card online?

Visit the NSDL website select changes or corrections in PAN, and follow the instructions to submit your updated details.

Can I apply for 2nd PAN Card Online?

Yes, you can apply for a duplicate PAN card against your original card. However, obtaining a new PAN number is not allowed if you already have one.

How to get the new PAN Card with a QR Code?

You can get a PAN 2.0 card with an enhanced QR code by applying online on the official portal.