The Cabinet Committee on Economic Affairs approved the PAN 2.0 project which is a major transformation for the digital India vision. It aims at introducing a fully paperless and online system for managing PAN-related services in the country. PAN 2.0 is designed to meet the needs of the business and also offer better cybersecurity.

In this blog, we will understand everything about the new project PAN 2.0 and its impact on Digital India’s vision.

What is PAN 2.0?

PAN 2.0 is an advanced version of the existing PAN Card. This is an e-governance project that is focused on providing a digital experience for taxpayers. It will bring all PAN and TAN services into one platform which is paperless and easy to use. It is supporting the government’s Digital India initiative. The new system will have one platform for all the PAN services. It will have stronger security to protect user data.

Do you need to reapply for a PAN Card?

Now the main question is, Do you need to apply for a new PAN Card?

No, you need not apply for a new PAN Card under the newly launched scheme. The cabinet approves the Rs 1,435 crore initiative, ensuring that your PAN remains valid even if the system is going to have a digital transformation. The individual can upgrade to a new PAN card free of cost but the existing PAN Card is equally valid.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Is there any change in the Format of the PAN Card?

The older version of the PAN Card has been in use since 1972 under Section 139 A of the Income Tax Act. Till now 78 crore PAN Cards have been issued and cover 98% of individuals in our country.

The new PAN 2.0 includes a QR code to make the verification process faster and more secure. This QR code can be scanned to quickly access and verify details of the PAN Card digitally, reducing the chances of misuse or fraud. It also provides a convenient way to verify the authenticity of the PAN without needing to manually check the information, ensuring a smoother experience for users.

The objective of PAN 2.0

PAN 2.0’s aim and objective is to make PAN-related services simple, fast, and secure. It will bring all PAN-related services into one digital platform, making processes quicker and more accurate. The system will also improve convenience for users, protect data with better security, and support the government’s goal of a paperless, eco-friendly future under the Digital India initiative.

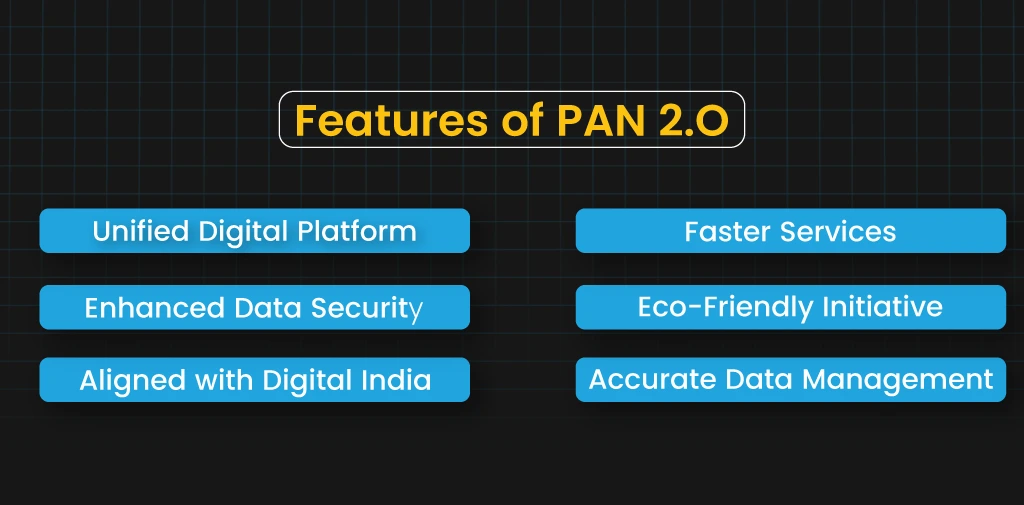

Features of PAN 2.0

- Unified Digital Platform: PAN 2.0 will bring all PAN and TAN-related services together in one online system. This means users can access everything they need, like registration or updates, in a single place without switching to multiple platforms, making the process easier and more convenient.

- Faster Services: PAN 2.0 simplifies procedures to save time and effort for users. It ensures quick processing for tasks like applying for or updating PAN details. This helps individuals and businesses complete their work efficiently. The focus is on reducing delays and making the experience smooth for everyone.

- Enhanced Data Security: PAN 2.0 uses strong cybersecurity protocols that help keep all the data safe. It makes sure that no one can misuse personal data and all personal information is protected. With the use of new advanced security systems, users can feel safe and secure about their personal data.

- Eco-Friendly Motive: PAN 2.0 promotes an eco-friendly environment which eventually will affect the environment in a positive manner. By shifting to digital processes, it minimizes the use of paper and supports sustainability for the future. This approach not only makes the system more efficient but also contributes to protecting nature.

- Accurate Data Management: PAN 2.0 ensures that taxpayer information is consistent and reliable. It improves data quality by reducing errors and discrepancies. This helps in better management and smooth processing of user details.

- Aligned with Digital India: PAN 2.0 supports the government’s Digital India initiative by creating a fully digital system. It aims to make taxpayer services more user-friendly, accessible online, and efficient. This alignment enhances the overall digital experience and streamlines processes for citizens across India.

Why is PAN 2.0 required?

The government is focused on improving the “grievance redressal system” in the country. This way it can address user concerns and needs more easily and effectively. This system will help resolve issues quickly. It ensures that taxpayers and users can get the support they need on time. The aim is to make the process more user-friendly, helping people with any problems they might face while using the services.

The existing PAN Card has been working for years but it lacks the technical advancements that are required for modern tax administration. Another main focus is to make PAN a “common business identifier” across digital systems.

The entire PAN insurance and verification system will be transformed. This will be an upgrade to the current PAN Card ecosystem covering all PAN/TAN activities as well as the PAN validation services.

Conclusion

In conclusion, PAN 2.0 is a major upgrade to the current system, offering a more efficient, secure, and eco-friendly solution for taxpayers. It simplifies the process by providing a unified, digital platform that makes services faster and more reliable. With better data security and support for the Digital India initiative, PAN 2.0 aims to meet modern needs and improve user experience. This transformation will make managing PAN-related tasks easier for everyone.