Customer verification is a crucial process for all banks and financial institutions. It is a mandatory process that should not be treated as a mere formality. OVDs are the documents used to verify customer identity and address in KYC. These proofs are the backbone of the verification process; any failure in verification can lead to legal troubles. These documents help Indian citizens access services like bank account opening, financial transactions, credit, and loans. Here, in this guide, you will learn about the OVDs in detail.

What is an OVD in Banking?

OVD full form in banking is an officially valid document. This document is a valid proof of identity and address. These documents are used to verify the identity and address of an individual during KYC.

Importance of OVDs in KYC and AML Compliance

OVD in banking is important for the following reasons:

Helps in Customer Identification

These documents assist banks and financial institutions in verifying customers and addresses. They are required for opening a bank account, loans, and credit card approvals, and processing financial transactions.

Reduce Financial Crimes Risk

OVDs are essential for reducing financial crimes, such as: OVDs in banking helps in

- Money Laundering

- Terrorist Financing

- Identity Theft

Helps in complying with the RBI Guidelines

The Reserve Bank of India (RBI) and the Government of India mandate that all banks should follow KYC norms under the Prevention of Money Laundering Act (PMLA), 2002.

Improves Customer Due Diligence

The OVDs help banks and financial institutions in conducting accurate customer due diligence, which includes:

- Checking customer risk profiles

- Monitoring financial transactions

- Detecting suspicious activities

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

What is the difference between OVD and KYC?

OVD is an officially valid document, and KYC is the Know Your Customer verification process.

Full Form

- OVD: OVD stands for officially valid documents. It is used as proof of identity or address.

- KYC: KYC stands for Know Your Customer, which is used for the verification process for individuals.

Purpose

- OVD: It is primarily used as proof of identity and address.

- KYC: It helps banks and financial institutions in verifying customer identity.

Scope

- OVD is a specific document, such as Aadhaar and PAN.

- KYC is the overall customer verification process in which OVDs are used for verification.

Nature

- OVD: It is a physical or digital document.

- KYC: It is a formal verification process using documents and information.

How is OVD Verified during KYC?

Currently, fraudsters are using fake or tampered documents. This makes it essential to verify documents accurately. Verifying an identity document is essential. Banks and financial institutions use various services to check the legitimacy of the documents, such as identity verification solutions like Aadhaar verification API, PAN Verification API, and document verification API.

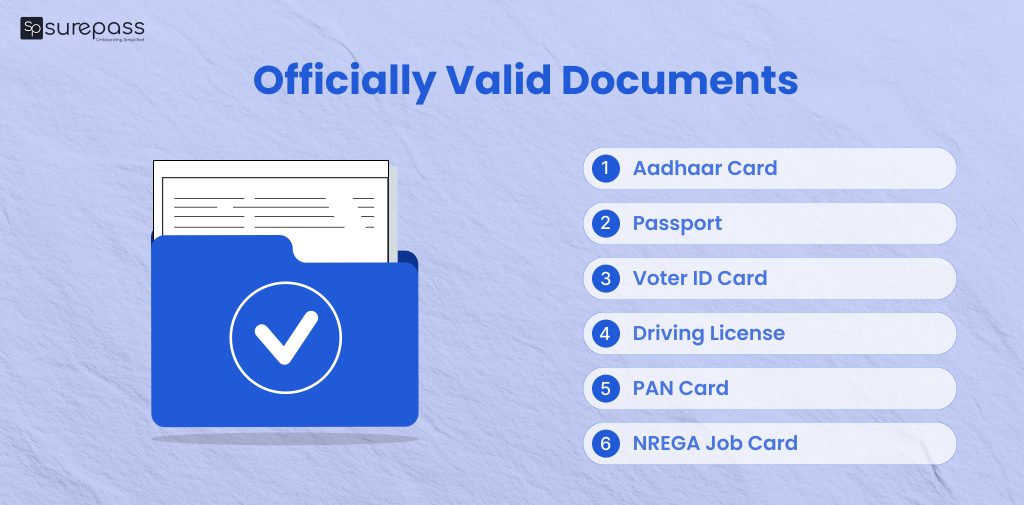

List of Officially Valid Documents

These are the list of OVDs:

- Aadhaar Card: It contains 12 digit unique identity number. It is used as both proof of identity and address for banking and government services.

- Passport: It is a government-issued document that serves as a travel document and proof of identity and citizenship.

- Voter ID Card: The Voter ID card (or EPIC card) serves as proof of both identity and address.

- Driving License: It can be used as proof of identity and address. The transport department issues this document to the drivers.

- PAN Card: This document contains a 10-digit unique number required for financial transactions. It is valid proof of identity, but it is not valid proof of address.

- NREGA Job Card: It comes under the proof of identity for individuals working under the Mahatma Gandhi National Rural Employment Guarantee Act (NREGA).

What is the OVD Expiry Date?

The expiry of an officially valid document depends on the document type. As many documents come under OVD, there is no specific date. For example,

- Passport: Valid for 10 Years for adults and 5 years for minors.

- Driving License: Valid for 20 Years.

- PAN Card: Does not expire.

- Voter ID: Valid until there is a change in address or personal details.

Indian citizens need to update or renew these documents before they expire to avoid legal issues.

Conclusion

The OVDs in banking refer to the Officially Valid Documents. They are government-issued documents used for verifying the identity and address of an Individual in the KYC process. The list of OVDs includes Passport, Aadhaar, PAN, Driving, and more. Banks and financial institutions verify these documents for accurate customer verification.

FAQs

Ques: Is the Aadhaar card an OVD?

Ans: Yes, Aadhaar is an officially valid identity document.

Ques: What is the OVD full form in Banking?

Ans: OVD full form in Banking is Officially Valid Documents.

Ques: What are the 6 OVD documents?

Ans: The 6 OVD documents are:

- Aadhaar

- PAN

- Voter ID

- Passport

- NREGA JOB Card

Ques: Is a Passport an OVD?

Ans: Yes, Passport is an OVD.

Ques: What does OVD in banking meaning?

Ans: In simple words, it is an officially valid document used for customer identity verification.