Open Banking Meaning

Open Banking is a transforming approach in the financial sector in terms of data sharing. It allows third-party providers to access the financial data of customers with customer consent. It is gaining popularity in India because financial institutions and fintech companies are accepting it due to its advantages. Our Indian Government and regulatory bodies have introduced guidelines that facilitate the adoption of open banking. With the rise of online banking and technological advancements, open banking is good to incorporate into the Indian financial ecosystem. Here, in this blog, we will discuss Open banking meaning and the Indian financial sector. We will get to know about the benefits, challenges and risks.

What Is Open Banking?

Open Banking meaning refers to the system where banks and financial institutions give access to consumer banking, transactions and other financial data using third-party service providers via Application Programming interfaces and APIs.

For consumers, open banking meaning is like having more control over their financial information and access to new services. For businesses, open banking helps make decisions based on data and provides customized services to customers. ‘

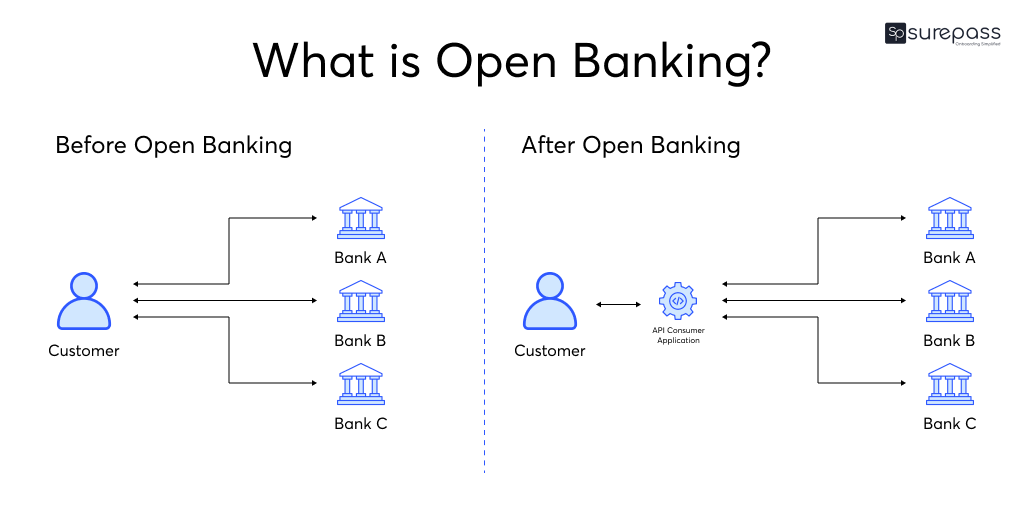

How Open Banking Differs From Traditional Banking Models?

Traditional Banking Model: In traditional banking, customer financial information is kept under the control of the bank system. Customers have limited visibility into how their data is used, banks control all aspects of data management and service offerings.

In this model, to provide new services banks either create new services themselves or work with a few chosen partners, which can be slow and limited.

Open Banking Model: Open Banking allows third-party developers to access customer data from the developers to access financial data from the banks through application programming interfaces (APIs). Open banking has transformed the financial data-sharing process.

How Does an Open Banking System Work?

Open banking uses API (Application Programming Interfaces) to allow third-party services access to financial information from banks and other financial institutions.

- APIs and Data Access: Banks use APIs to allow third parties to access financial data securely with customer permission.

- Customer Consent: The customer has control over what data can be shared with whom.

- Secure Data Transfer: Data is encrypted during transfer with strict security.

- Service Integration: Third-party services use the data to give enhanced features and personalized advice.

Open Banking Examples

After understanding the Open Banking meaning let’s see some examples of open banking.

- Account Aggregation

Financial Advisors and wealth management firms use open banking to gather financial data of customers from multiple accounts. It helps businesses check the financial health of clients.

- Instant Loan Credit Scoring

Businesses can automate the matching of invoices to transactions using open banking APIs. It reduces the manual work and increases accuracy.

- Personalized Marketing

Retailers can use open banking to analyze transaction data and find the targeted customer and loyalty rewards based on individual spending patterns.

- Real-Time Detection

Open banking allows businesses to analyze transaction data in real-time to detect and identify usual financial activity.

- Automated Invoice Reconciliation

Businesses can use open banking APIs, which help in automating the process of matching invoices to transactions. It reduces administrative work and improves accuracy.

Advantages of Open Banking

Open Banking offers a wide range of advantages that improve both customer and business experiences.

Increased Transparency: Open banking provides data-sharing control to customers. It depends on the customer how data they want to share and to whom.

Faster Payments: Open banking allows direct transactions from Bank accounts which reduces the dependence on traditional payment methods.

Cost Reduction: It simplifies the payment process by eliminating the intermediaries and reduces transaction fees and operational costs.

Helps build data-driven insights: It allows businesses to use the financial data for decision-making, and risk management.

Enhanced Security: It uses advanced security measures and encryption so the customer data can be protected and even shared with third parties.

Open Banking Risk

Things have their pros and cons, same in the case of Open banking. Here are some potential challenges of Open banking in India that we should understand.

- Data Leaks: Sharing with multiple channels increases the chance of unauthorized access to your financial information.

- Fraud: It is associated with the risk of fraud if the security is not strong.

- Privacy Issues: Open banking is prone to the risk of personal data misused by third-party services.

- Customer Awareness: Customers are not fully aware of data-sharing risks.

- Regulatory Compliance: Challenges in following all the data protection laws due to open banking and third-party involvement.

These are risks of open banking which can be prevented with security measures if businesses want its successful integration in the financial world.

What Is an Open Banking API?

Open banking is an application programming language that makes the financial data-sharing process secure and safe. It allows banks to share customer data with third-party providers. It helps customers access new services like budgeting tools, loan comparison etc.

Many open banking API providers available in the market but when it’s comes to security Surepass is the best choice over anyone.

Conclusion

Open banking meaning simply refers to the sharing of financial data of customers with third-party services with APIs. It is a transformative thing for a financial sector that enhances transparency, competition and innovation. Open banking in India is gaining popularity with supportive regulations and acceptance.

It offers several advantages including customer control over data sharing. Businesses are getting valuable financial information. But even with many advantages it is prone to risks such as data breaches and privacy concerns. Which makes it important to focus on security while using open banking.