As a taxpayers, it’s our duty to file the ITR on time. It helps you comply with the tax regulations of India and avoid penalties for missing the deadline. Filing ITR on time also provides several benefits to the individual and business. You can use ITR records as proof of income for applying for credit cards and loans. It shows your financial stability and discipline and enhances your creditworthiness. On the other hand, missing the deadlines can lead to penalties and charges. Here, in this blog, you will learn about all the important deadlines for filing ITR for individuals and businesses. What you should do if you miss the deadlines. So, read the blog until the end.

Last Date to File ITR 2025 – Important Deadline for Financial Year (2024 – 25) and Assessment Year (2025 -26)

The Last Day to file ITR is 31st July 2025. Here is the list of all the important deadlines you must know.

- Businesses that require an audit: 15th October 2025

- Individuals, HUFs, BOIs (not requiring an audit): 31st July 2025

- A business requiring transfer pricing reports (international/specified domestic transactions): 30th November 2025

- Revised Return: 31st December 2025

- Belated/Late Return: 31st December 2025

- Updated Return: 31st March 2030 (4 years from the relevant Assessment Year)

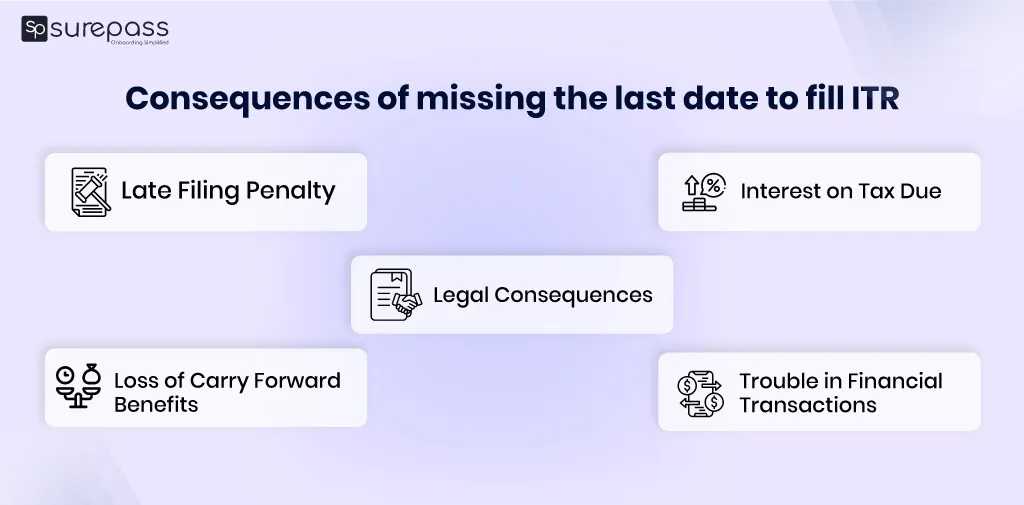

What are the consequences of missing the last date to file ITR 2025?

- Interest Charges: If you miss the deadlines due to some reason. You will have to pay the interest at 1% per month or unpaid tax as per 234A.

- Late Fee: According to 234F, a penalty is charged for late filing:

- ₹5,000, (Income above 5 lakh)

- ₹1,000, (less than 5 lakh)

- Loss Adjustment: If you have losses from stocks, properties, mutual funds, or businesses. You can carry them forward to reduce your tax in the upcoming year or future. However, if you miss the deadline, you will lose this benefit and can not adjust these losses in the next financial year.

- Revised Returns: If there was any error after filing the belated return, you have the option to file a revised return. It will help in eliminating errors and avoiding associated issues.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Options if you Miss the ITR Deadline

Belated Return

In some cases, if you miss the deadline, you have the option to submit a belated return. But with some conditions:

- A late fee and interest charges will apply.

- You will not be able to carry forward any losses for future tax adjustments.

Updated Return

If you miss the 31st July Deadline, you can still file an updated return (ITR-U), subject to certain conditions specified by the tax authorities.

How To File ITR Online (2025)?

After knowing ITR Filing date, follow these steps and file ITR immediately:

- Go to e-Filing Portal.

- Login.

- Click on e-file tab, then click on File Income Tax Return.

- Select the assessment year as 2024 to 2025 and select the online mode.

- Click on Start New Filing.

- Select the suitable status.

- Select ITR form (ITR-1).

- Click on “Let’s Get Started”.

- Select the appropriate reason and click on continue.

- 5 sections fill shown on screen, you need to fill all of these.

- E-verify ITR.

Benefits of Filing ITR on Time

Filing income tax returns on time is essential due to these benefits:

- Eliminates the chance of penalties: Filing ITR on time prevents penalties that are charged for late submission.

- Tax Refunds: If excess tax has been paid, filing on the due date helps with fast processing and faster refunds from the income tax refunds.

- Improves Creditworthiness: Banks and financial institutions check ITR compliance during the loan and credit card approval process. Filing ITR on time shows financial discipline and increases creditworthiness.

- Helps avoid last-minute submission: Filing ITR on time reduces the last-minute submission stress and errors.

- Carrying Forward Losses: Taxpayers who fill ITR on time get the benefits of carrying forward losses from business or capital gains to future income. It will reduce the tax liabilities in subsequent years.

- Sufficient Time for Verification: The ITR should be completed within 30 days of filing. A timely submission provides enough time for ITR Verification and eliminates errors if necessary.

Conclusion

Filing ITR on time is crucial for all businesses and individuals who have to file ITR. It helps you comply with tax regulations. Submission of ITR on time will reduce the risk of late fees. The last date to file ITR 31 July 2025. However, due to some reason, you fail to file ITR on the mentioned deadline. You have the option of a belated return but a late fee will be charged and you will lose the benefit of carrying losses. Apart from this, filing ITR on time gives you immense benefits like improved creditworthiness, give chance of carrying forward losses, and smoothing tax claims. You should also learn how to file ITR and the right ITR Form.

FAQs

What is the last day to file ITR?

The last day to file ITR is 31st July 2025.

What is the last date for the tax audit for FY 24/25?

The last date for submission of the tax audit is 31th October 2025.

What is the last date for filing an income tax return in India?

The last date for filing ITR 2025 is 31st July.

What is last date to fill it 2025 for salaried employees?

31st July 2025 is the last date for filing ITR for salaried employees.