Being an employee in India, PF is essential. It is an essential component of financial planning. It serves as a long-term scheme where both the employee and employer contribute. It confirms financial security post-retirement. Whether you are starting a new job, changing companies, or just want to check your balance, finding your PF number is important. Here, in this blog, you will learn about the PF number and ways to find the PF account Number.

What is a PF Account Number?

The PF Account Number is a 22-digit unique identifier given to an employee’s PF account. This number is necessary to track contributions, interest earned, and overall balance within the EPF scheme. Its main purpose is to identify and manage an individual employee’s EPF account with a specific employer. When the employee switches jobs, they get a new PF number for their new EPF account.

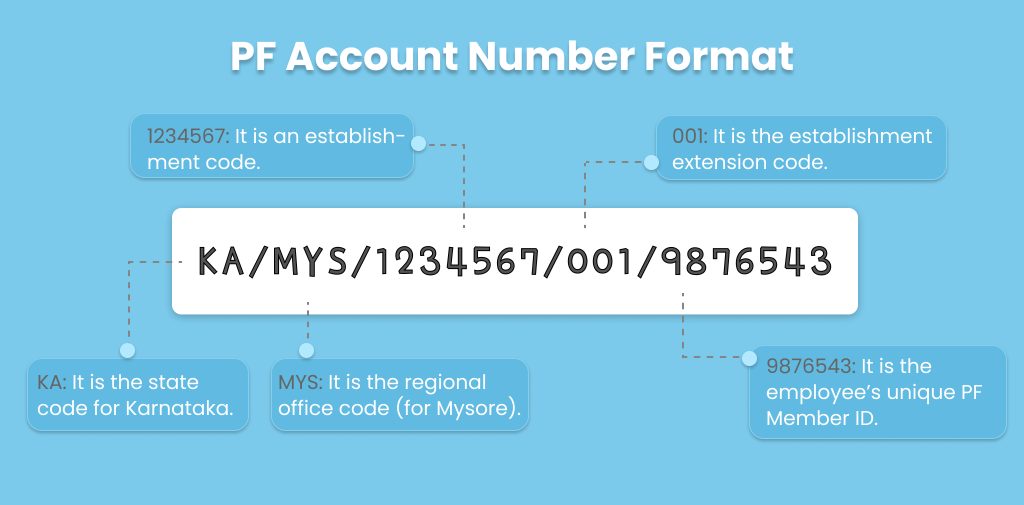

PF Account Number Format

- First Two Letters

The first two letters state the location of the PF Office.

- Next Three Letters

The next 3 letters represent the regional PF Office code within that state.

- Seven digits

It denotes the employer’s establishment code (a unique identifier for the company).

- Next three digits

Indicates the establishment extension code (used for larger organizations with multiple subdivisions).

- Last Seven Digits

It represents the employees under the PF account number within the establishment.

For example: KA/MYS/1234567/001/9876543,

- KA: It is the state code for Karnataka.

- MYS: It is the regional office code (e.g., for Mysore).

- 1234567: It is an establishment code.

- 001: It is the establishment extension code.

- 9876543: It is the employee’s PF member ID.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How to Find PF Account Number?

You can get the PF Account Number through the following ways:

From EPFO Portal

- Go to the EPFO Portal.

- Under the Services Tab, click for employees.

- Click on Member Passbook.

- Login.

- Get your PF number.

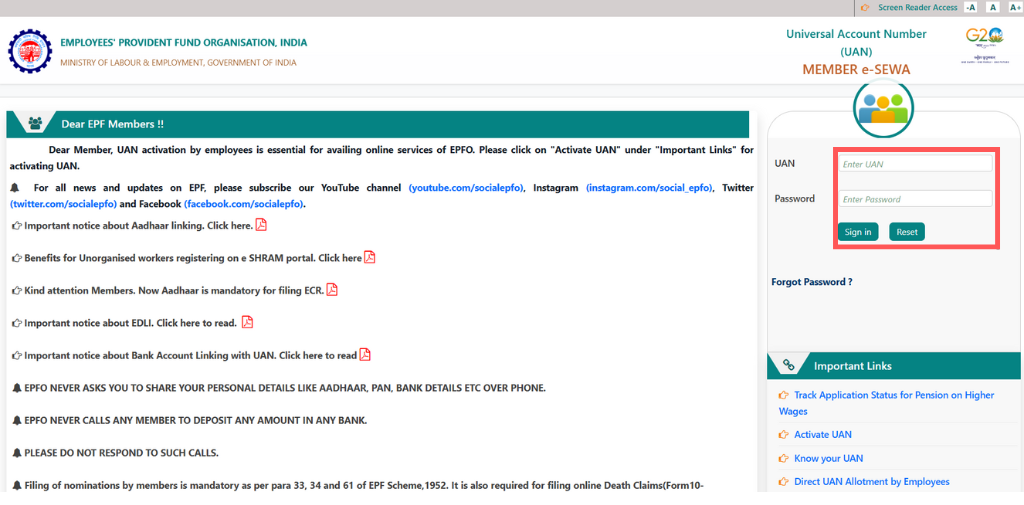

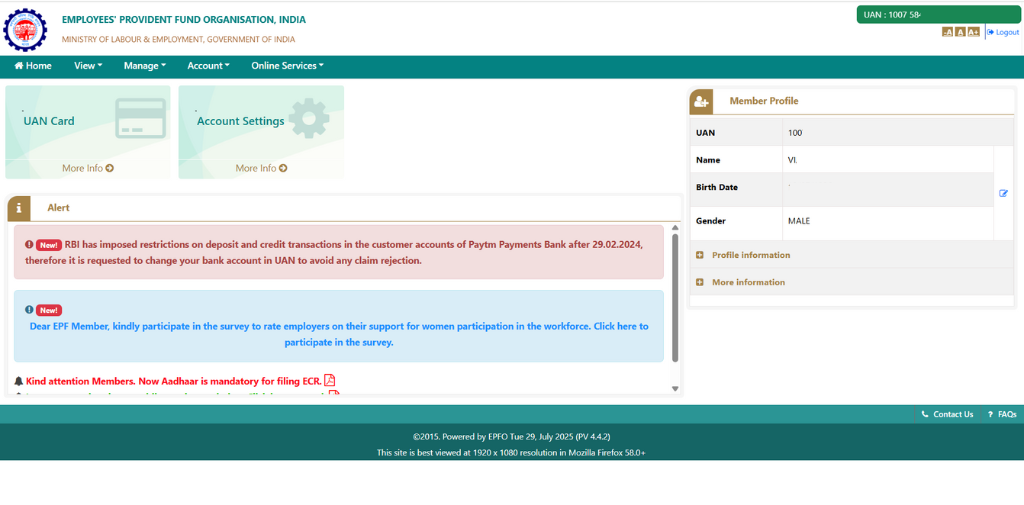

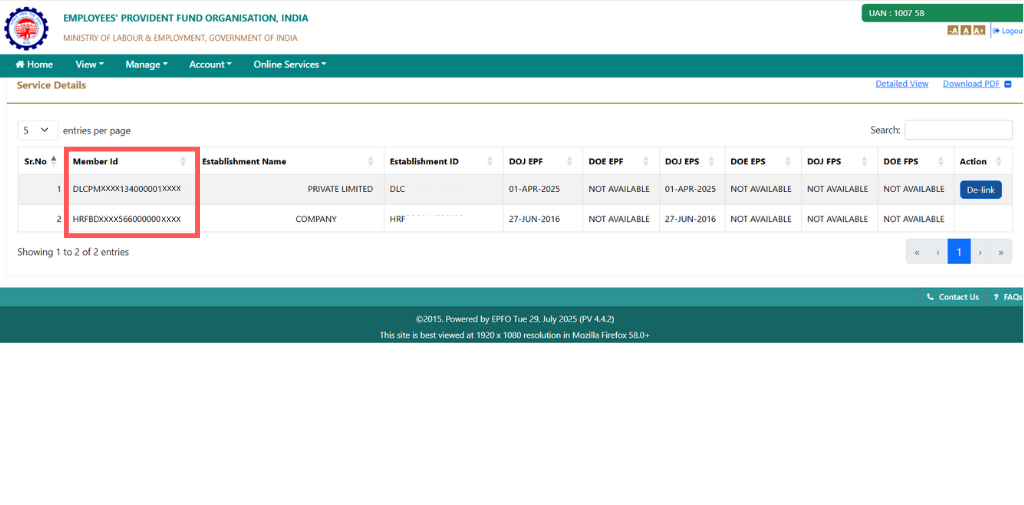

UAN Portal (EPFO Member Portal)

If you have a UAN number, use it to find your PF Number.

- Visit the EPFO Portal.

- Login with your UAN and Password.

- Go to View > Service History.

- All your PF account numbers (Members IDs) will be listed with employer details.

Check on Salary Slip

You will find the EPF account number on your salary slip. Apart from this number, you will find the month’s PF contribution details on the slip itself.

Ask Your Employer (HR Department)

If you are currently working somewhere, then

- Contact the HR/Payroll Department.

- Request your PF account number or UAN.

Check PF Passbook Online

If you have already registered for UAN, you can check your PF passbook, which contains the PF number.

- Go to the EPF Portal.

- Login with UAN and Password.

- You will find Member IDs (PF numbers) linked to the UAN.

Through the UMANG App

The UMANG app is a mobile app by the Government of India.

- Download the UMANG App from the Play Store/App Store.

- Register and go to the EPFO services.

- Use “View Passbook” or “Service History” options.

- You will see your PF number under the employer.

Giving a Missed Call

Give a missed call to 9966044425 from your registered mobile number.

Via Aadhaar, PAN, or Mobile Number

If you don’t know your UAN or PF number.

- Visit EPFO.

- Click Know your UAN.

- Enter Aadhaar/PAN/Mobile Number and OTP.

- You will receive UAN, then log in to see your PF number.

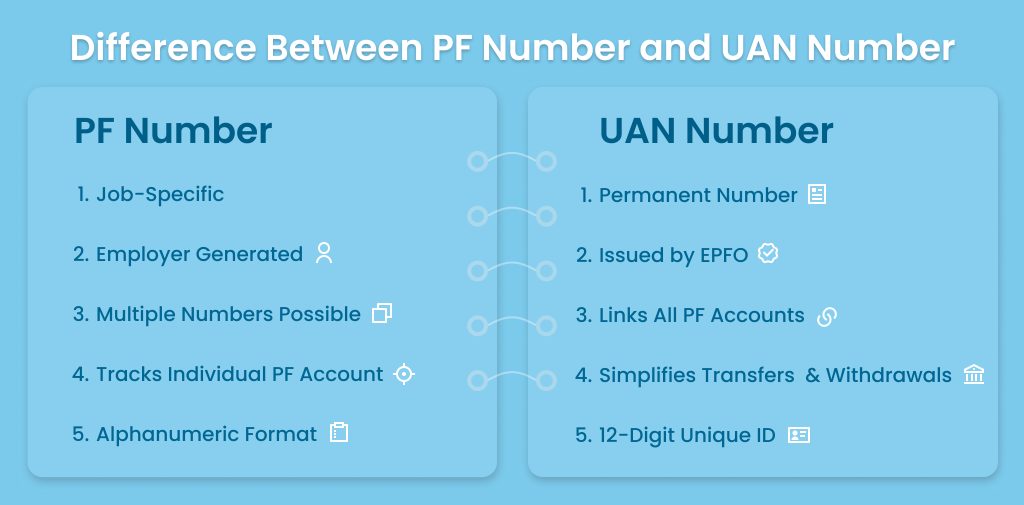

What is the Difference Between PF Number and UAN Number?

PF Number (Provident Fund Number) and UAN (Universal Account Number) are related to the Employees Provident Fund. However, both of them serve different purposes. Here is the key difference:

- PF Number

It is a 22-digit unique code; it changes whenever you switch jobs. It is used for PF account management under a specific employer.

- UAN (Universal Account Number)

It is a 12-digit number and acts as a single umbrella ID linking all your PF accounts from different employers. It is required for online EPF withdrawals, transfers, and KYC updates.

Conclusion

Finding your PF number is crucial to manage retirement savings. You can find out your PF account number using several methods, including the EPFO Portal, Salary Slips, UAN Portal or UMANG App. For a seamless process, it is essential to have your UAN, Aadhaar and PAN handy. You can check the balance of your PF account, monitor your savings and make sure that your employer pays on time. Download your PF Statement and keep it with you to record your details.

FAQs

Ques: How can I find my PF account number?

Ans: You can find the PF account number from the EPFO portal.

Ques: How can I know my PF account number by SMS?

Ans: You can send an SMS in the format EPFOHO UAN ENG to 7738299899 from your registered mobile number to get your PF account details.

Ques: What is a 12-digit PF account number?

Ans: UAN is a 12 digit number in the Universal Account Number for the Employee Provident Fund (EPF) in India.

Ques: Are the UAN and PF account numbers the same?

Ans: No, the UAN and PF account numbers are not the same.

Ques: Can I change my PF Number?

Ans: No, you can not change your PF number.