ITR verification is an important step in completing the income tax filing process. Without verification, the return remains invalid. The income tax department does not process refunds or evaluate the return. Traditionally, taxpayers had to send a physical ITR-V form to the CPC office. However, the e-verification feature offers a quick, secure, and paperless alternative. With Aadhaar OTP, net banking, a Digital Signature Certificate (DSC), or an electronic verification code (EVC), taxpayers can verify ITR within 30 days of filing.

Failure to verify an ITR within 30 days of filing results in the return being considered invalid. This can lead to the loss of tax refunds and potential penalties. E-verification simplifies tax compliance, making it easier for individuals to complete the process without paperwork.

What is ITR Verification?

ITR Verification is the process of confirming the legitimacy of an Income Tax Return (ITR) after it has been filed. The Income Tax Department requires verification within 30 days of submission to consider the return valid. Verification confirms that the return was filed by the taxpayer and not by someone else fraudulently.

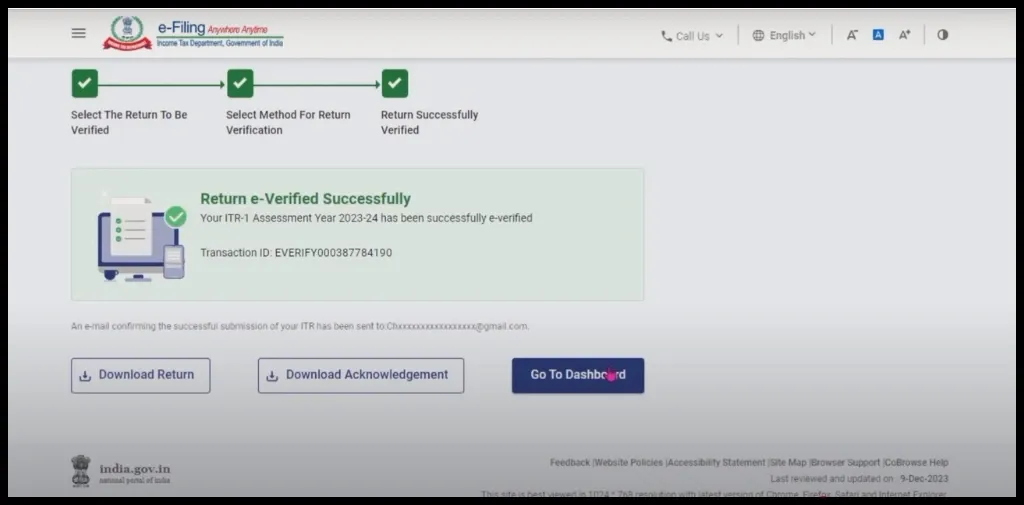

How to e-verify ITR through Aadhaar OTP?

To do this, ensure that the Aadhaar number is linked to the PAN and with a valid mobile number. Then follow these steps:

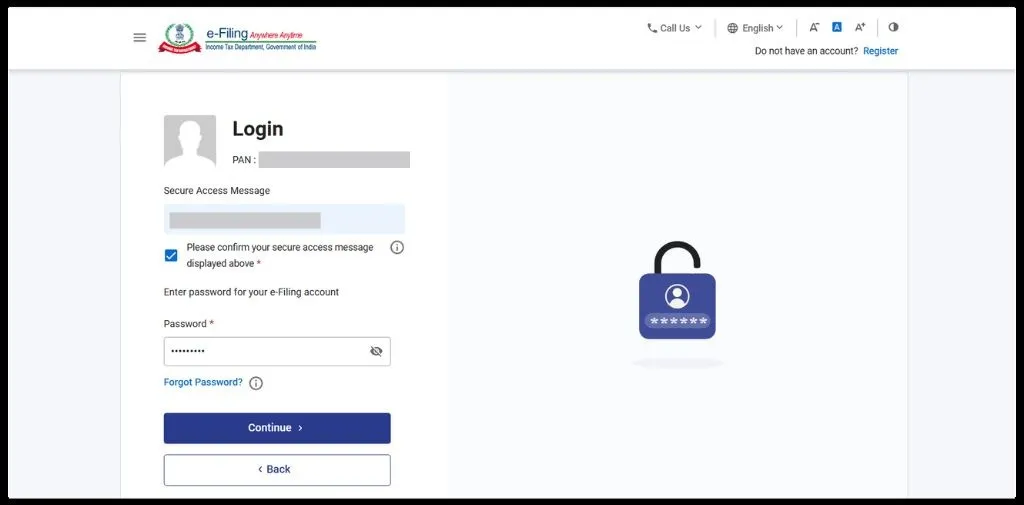

- Visit the Income Tax e-Filing Portal and login.

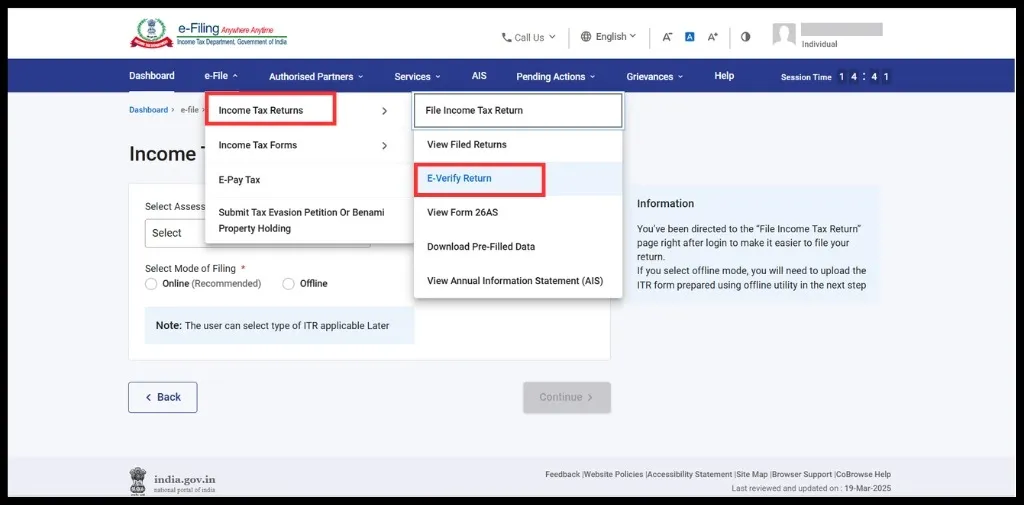

- Click on e-File and Income Tax Return

- Now, click on e-Verify Return

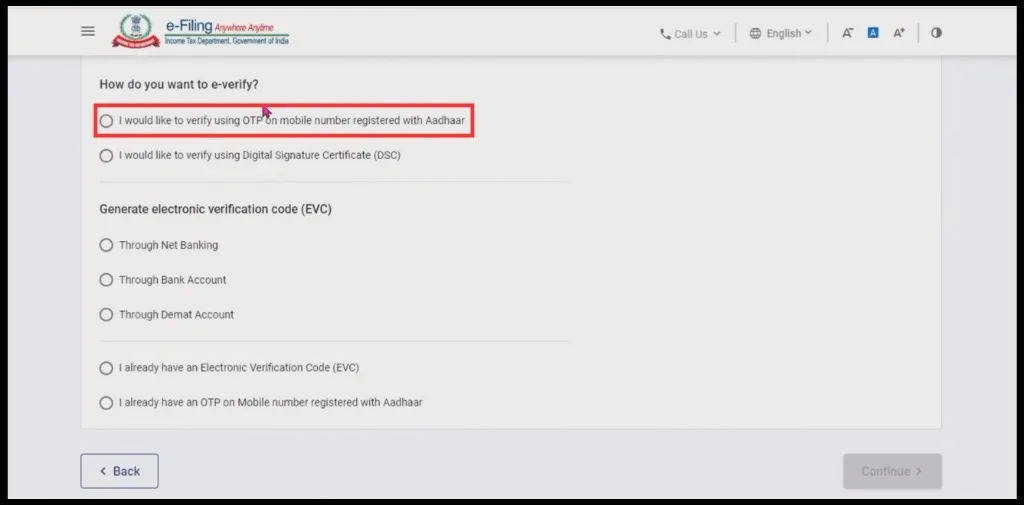

- Choose Aadhaar OTP as the verification method.

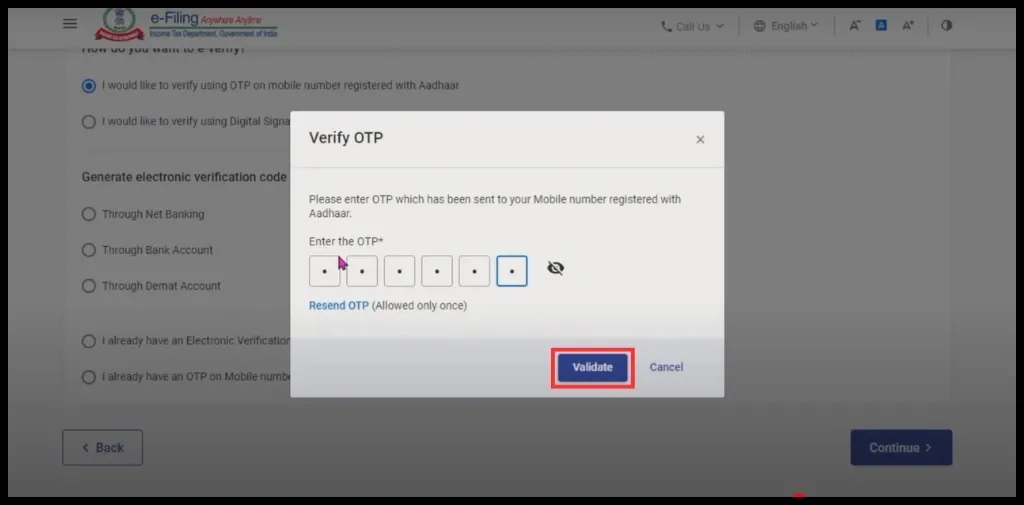

- OTP will be sent to the Aadhaar-linked mobile number.

- Enter the OTP and Click on validate to complete the verification process.

- Click on download Acknowledgement

How to e-verify ITR through DSC?

A Digital Signature Certificate is required for a taxpayer who wants to verify using a legally valid electronic signature.

- Install the DSC management utility and register the DSC on the e-Filing Portal

- Visit the Income Tax e-Filing Portal and login.

- Click on e-File and Income Tax Return

- Now, click on e-Verify Return

- Choose I would like to verify using DSC and click on continue

- Select provider certificate and enter password (USB Token)

- Click on Sign

- Click on Submit

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How to e-Verify ITR Through Electronic Verification Code (EVC)?

Follow these steps

- Go to e-Filing Portal

- Click on the services tab and select Generate EVC

- Choose anyone (Net Banking/Demat Account/ Pre-validated bank account)

- Let’s choose bank account and click on continue

- Enter the generated EVC on the e-Filing Portal to complete verification.

How to e-verify ITR through Net Banking?

- Log in to e-Tax Filing portal.

- Click on the e-File Tab.

- Now, click on e-Verify Return.

- Choose the option to generate an EVC via Net Banking.

- Visit Net Banking Portal.

- Find the e-Filing or Tax Services Section.

- Select Verify, it will redirect you to the e-filing portal.

- Enter the 10 digit EVC sent to your registered mobile number and email ID.

- Click Submit to verify your ITR.

How to E-Verify ITR Through Bank ATM?

- Visit the nearest ATM.

- Insert debit card and enter PIN.

- Here, select the option to generate an EVC for ITR Filing.

- EVC will be sent to your registered mobile number and email ID.

- Login to the Income Tax e-Filing portal

- Find the e-Verify Return Section

- Enter the 10 digit EVC received and click submit to verify your return.

Offline Verification via ITR-V Form

Follow these steps to do offline verification:

-

- Log in to the Income Tax e-Filing Portal

- Go to My Account

- Click on “View/Forms”

- Select Assesment Year

- Download the ITR-V (Acknowledgement Receipt)

- Take a clear printout of the ITR-V Form on an A4-sized white paper

- Use blue ink to sign the form

- Place the signed form in an envelope

- Send it via speed post or ordinary post (courier services are not accepted)

- Address the envelope to:

- Income Tax Department – CPC (Centralised Processing Centre)

- Post Box No. 1,

- Electronic City Post Office,

- Bengaluru – 560100, Karnataka, India.

Track the ITR-V Delivery Status

- After sending the form, track the delivery status using the India Post Tracking service.

- Once received, the Income Tax Department sends an acknowledgment via email and SMS.

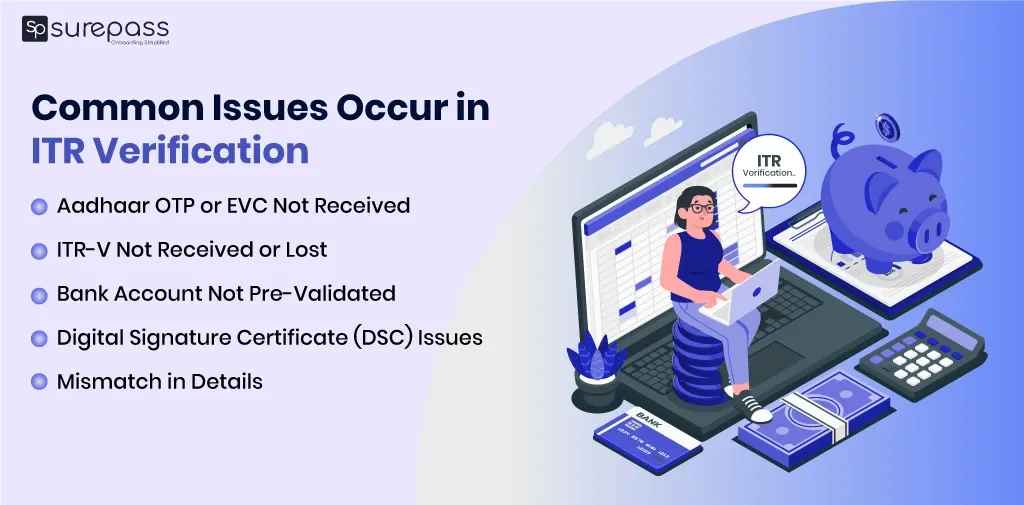

Common Issue Occur in ITR Verification

E-Verifying an Income Tax Return (ITR) is a simple process, but taxpayers may encounter some issues.

- OTP not received for Aadhaar Based Verification: Ensure that the Aadhaar is linked to PAN and to the registered mobile number. Check network issues and resend the OTP. If things didn’t short out without updating the Aadhaar details on the UIDAI website.

- Invalid Digital Signature Certificate (DSC) Error: The DSC is not recognized or shows an error during verification. Check if the DSC is registered on the e-Filing portal. Install or update the DSC management utility from the e-filing website. Use the correct USB token and ensure the signature is valid.

- Error in Electronic Verification Code Generation: If due to some reason, the Electronic verification code does not get generated. Ensure that the bank account/demat account is pre-validated on the e-Filing portal. You can also use an alternative method like Aadhaar OTP.

- Verification not completed in 30 days: If you missed the ITR deadline, the ITR will be considered invalid. File a belated return and confirm timely verification.

Conclusion

ITR Verification is an essential process. It confirms that the return is valid and has been processed by the Income Tax Department. e-Verification offers a quick and paperless way to complete the process through Aadhaar OTP, net banking, DSC, EVC, or a bank. Apart from online, you can send a signed ITR-V form to the CPC office. It is good to do verification within 30 days, which prevents issues like invalid returns, loss of refunds, and penalties.

FAQs

What is the timeline of ITR Verification?

The timeline for ITR Verification is 30 days from the date of Filing.

What will happen if a return is not verified within 30 days?

If the return is not filed within the time limit, it will be considered unfiled or invalid.

What are the consequences of not verifying an ITR?

It can lead to legal penalties and fines.

How do I verify my Tax Return?

You can verify your Tax Return easily from the e-Filing Portal with Aadhaar, Net Banking, DSC, etc.