Checking ITR Refund Status is essential for businesses and individuals. It ensures that the refund is processed without delay. You can find errors or processing issues if you check the ITR Refund Status. This will help in taking the right action to resolve such issues. Here in this blog, you will learn the various methods to check the refund status.

What is an ITR Refund?

ITR Refund (Income Tax Return Refund) refers to the amount that the Income Tax Return Department refunds to the taxpayer. When taxpayers have paid more than their actual tax liability for a financial year. It includes due to TDS, advance tax payments, self-assessment tax, or excess tax deposit.

When an individual or business files their ITR claim a refund. The IT Department verified the details and processed the refund.

Documents Required for ITR Status Check

These are the things you should have:

- User ID and Password.

- PAN is linked with your Aadhaar Card.

- ITR filed a claim for a Refund.

Methods to Check the ITR Refund Status

Follow these methods to check the ITR Refund Status:

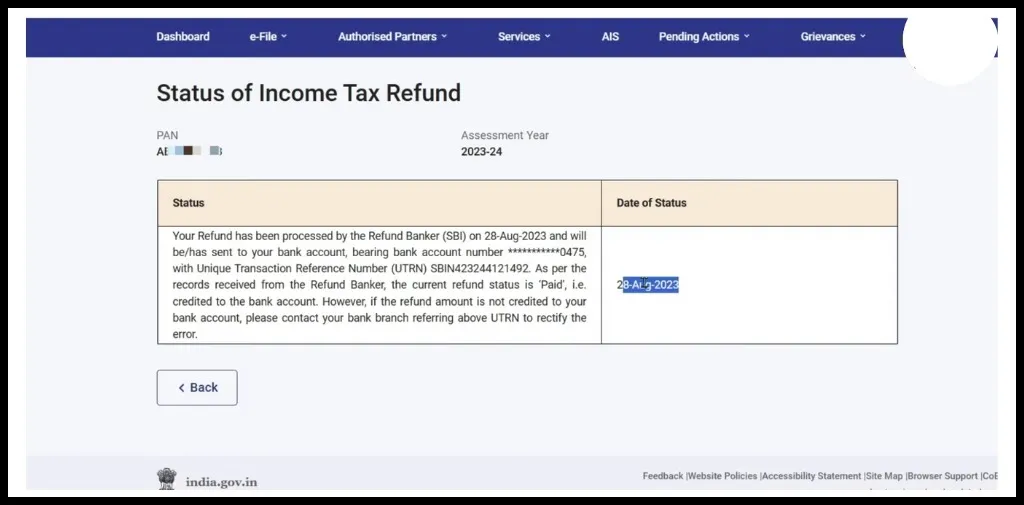

Through the Income Tax e-Filing Portal

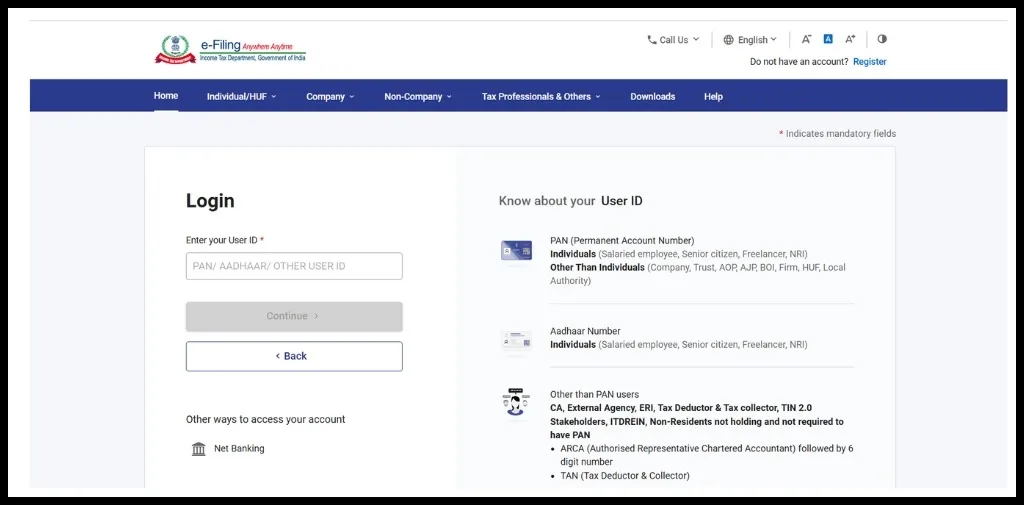

- Visit the e-Filing Portal.

- Login with PAN and Password.

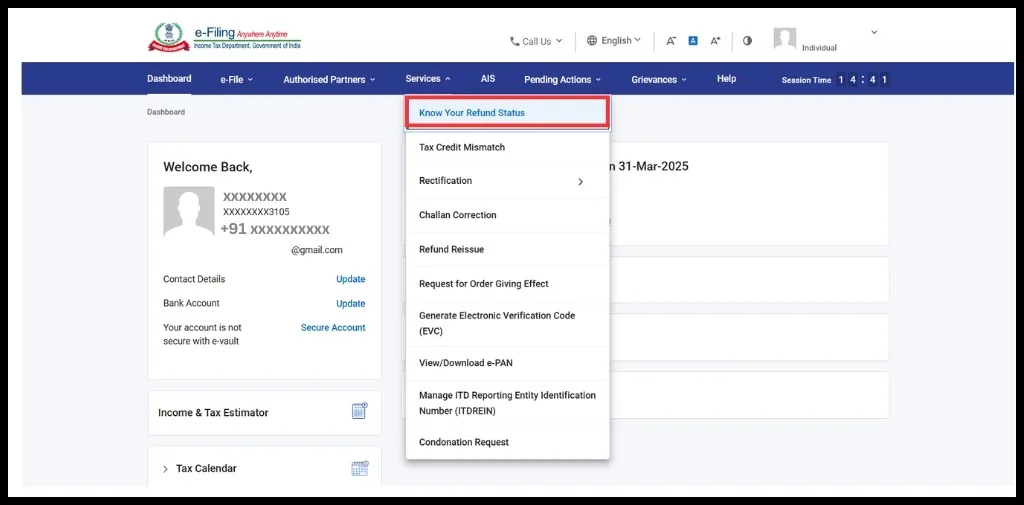

- Click on the Service Tab, then Know Your Refund Status

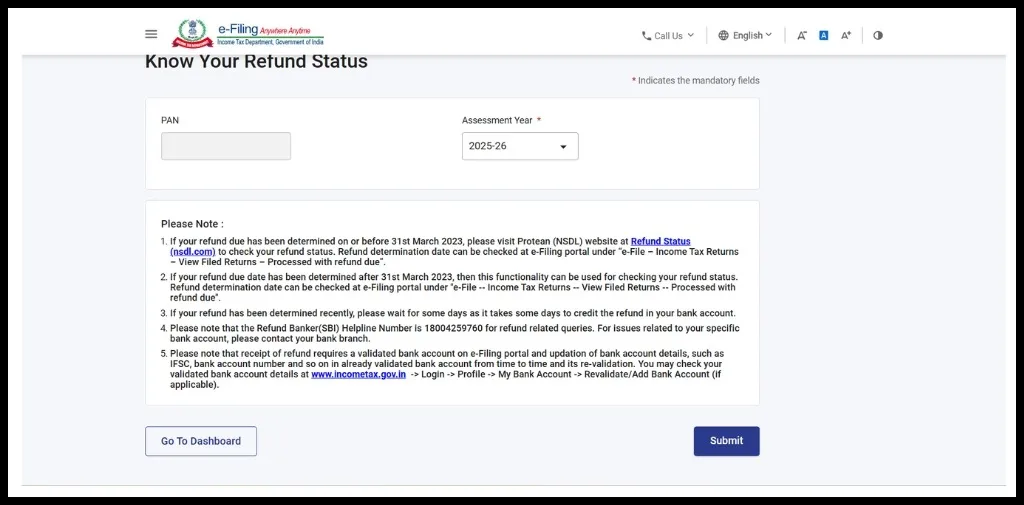

- Select the Assessment Year and click on the Submit button.

- ITR Refund Status will be displayed on the screen.

Through the NSDL Portal

- Click on this link NSDL.

- Enter the required details, PAN select Assessment year, and enter Captcha.

- Click on the Proceed Button under the Taxpayer Refund (PAN) Option.

- Get refund status.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Why is the ITR Refund Status Check Online important?

There are many reasons checking ITR Refund Status is important:

- Avoid Delays and Errors: ITR refund status checks online help you identify and resolve issues like incorrect bank details or verification issues.

- Helps in Timely Refunds: As refund status is processed in different stages. Checking the ITR status helps you know the time when you can receive the refund.

- Verify Successful Processing: If the Refund has been processed but not credited to you. In this case, you can complain to the IT Department or the bank to resolve the issue.

When Can You Claim or Get a Refund?

- Excess TDS Deducted: If the Tax deducted is more than the actual tax liability, the taxpayer is eligible for a refund.

- Deduction or Exemptions Reduce Taxable Income: If you claim deductions under sections like 80C (Investment in PFF, ELSS, etc) or exemptions (HRA, LTA) can lower taxable income.

- Double Taxation Relief: In some cases, if the taxpayer earns income in a foreign country and also in India, the taxpayer can claim relief under DTAA (Double Taxation Avoidance Agreement) and get a refund.

Common Reasons for ITR Refund Delays

- Incorrect or Incomplete Bank Details: If your bank account number, IFSC code, or MICR code entered in the ITR document is incorrect, the refund will not be processed.

- PAN and Aadhaar Not Linked: According to the income tax rules, PAN and Aadhaar must be linked to process refunds.

- ITR Not Verified: After filing ITR, it is important for you to e-verify ITR within 30 days through Aadhaar OTP, net banking or DSC. Because without ITR Verification, the ITR filing will be invalid. You should not miss the last date to file ITR.

What to Do If Your Refund is Delayed or Not Credited?

If you have seen delays in the refund, contact the IT department and provide the correct details like PAN, assessment year, refund amount, etc.

You can follow these steps to request for refund:

- Visit the e-Filing Portal and log in

- Find the My Account Section

- Select Refund Re-Issue

- Click on Create Refund Reissue Request

- Fill in the required details such as PAN, Assessment Year, and Refund Amount.

- e-Verify

- Submit a refund re-issue request.

Conclusion

The ITR Refund Status is important for timely processing and avoiding unnecessary delays. You can check it through the e-Filing Portal and the NSDL Tin website. You can follow the above step-by-step guide to check the refund status. It helps you take corrective actions in case of errors, incorrect details, or verification issues, and it will help taxpayers get their income tax refunds on time.

FAQs

How Can I Check My ITR Refund Status?

You can check your ITR Refund status on the e-Filing portal.

How to check ITR status without login?

You can check the ITR Status without login in through the mobile number and the valid ITR acknowledgement number.

What if the ITR refund is not received?

If a refund is not received, the taxpayer should look for the error.

How long will it take to get an ITR Refund?

It takes 4 to 5 weeks to get a refund.

What is the difference between an income tax return and a refund?

An income tax return refers to a form filed to report income, deductions, and tax liability. An Income Tax Return refers to the tax amount refunded, if the tax paid exceeds the liability.