With digital transformation, customer verification has changed so much. It has become an important part of the onboarding or recruitment process. Now, documents can be quickly verified through the Aadhaar Verification API.

Customer onboarding should not take days when it can happen in minutes, whether you are opening thousands of accounts daily or onboarding users. Verifying identity in real-time is no longer a time-consuming process. Here, this blog explains how Aadhaar Verification APIs simplify compliance and reduce fraud.

What is the Know Your Customer Process?

Know Your Customer (KYC) is a mandatory process used by banks, financial institutions, and other regulated entities. It is conducted to verify the customer’s identity. The primary objective of KYC is to confirm that customers are genuine. It prevents financial crimes such as money laundering and terrorist financing.

KYC helps financial institutions:

- It helps verify customer identity during the account opening process.

- Monitor transactions for suspicious activity.

- Evaluate risk levels and confirm compliance with Anti-Money Laundering (AML) regulations.

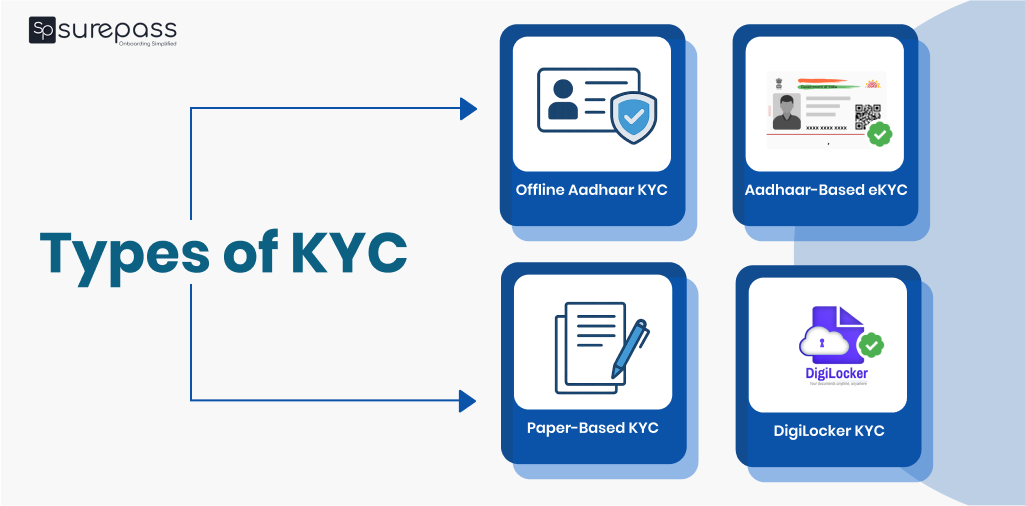

Types of KYC:

KYC can be conducted through various means.

Paper-Based KYC or Traditional KYC

In traditional or paper-based systems, customers submit physical copies of their identity and address. The customer should visit the bank, fund house, or KYC Registration Agency in person.

Aadhaar-Based eKYC

Verification is done online using UIDAI Aadhaar Data. In this process, the customer can be verified through:

- Biometric Verification (fingerprint/Iris Scan).

- OTP-Based Verification (One-time password sent to Aadhaar-linked mobile number).

Offline Aadhaar KYC

The customer provides their Aadhaar number and OTP to decrypt an Aadhaar XML file containing their KYC details. Alternatively, the QR code on the Aadhaar card can be scanned for verification.

DigiLocker KYC

Customers store their documents (Aadhaar, PAN, Passport, Voter ID, Driving License) in DigiLocker. Financial institutions can use this document via DigiLocker for instant and Paperless verification.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Importance of Aadhaar Verification in KYC

Here is why KYC is essential for banks and financial institutions:

- Compliance with Regulations

KYC is essential to comply with (such as RBI and SEBI) and to prevent crimes. Non-compliance can lead to penalties, legal consequences, and reputational damage.

- Prevents Financial Crimes

It helps detect and prevent money laundering, terrorist funding, fraud, and identity theft. It confirms that only legitimate customers access financial systems.

- Enhance Customer Trust

It shows that the company follows ethical and secure practices. It builds transparency and credibility between businesses and customers.

- Risk Assessment and Management

It allows financial institutions to evaluate the risk profile of a customer before onboarding. It helps identify high-risk individuals or businesses and enhances due diligence.

- Protection Against Fraud

It reduces fraud and breaches. It confirms the long-term sustainability and financial integrity of the organization.

- Supports Digital Transformation

Modern eKYC methods help in instant verification and improve customer experience. It eases paperless onboarding and reduces operational costs and errors.

How Aadhaar Verification API Works?

We offer a DigiLocker-based Aadhaar Verification API for Business. Here is how it works:

- Visit the Dashboard.

- Click on the given link.

- You will be redirected to DigiLocker.

- Enter the Aadhaar Number and security PIN.

- Provide Consent by clicking on Allow.

- Copy the client ID.

- Paste the client ID.

- Verify the Aadhaar details.

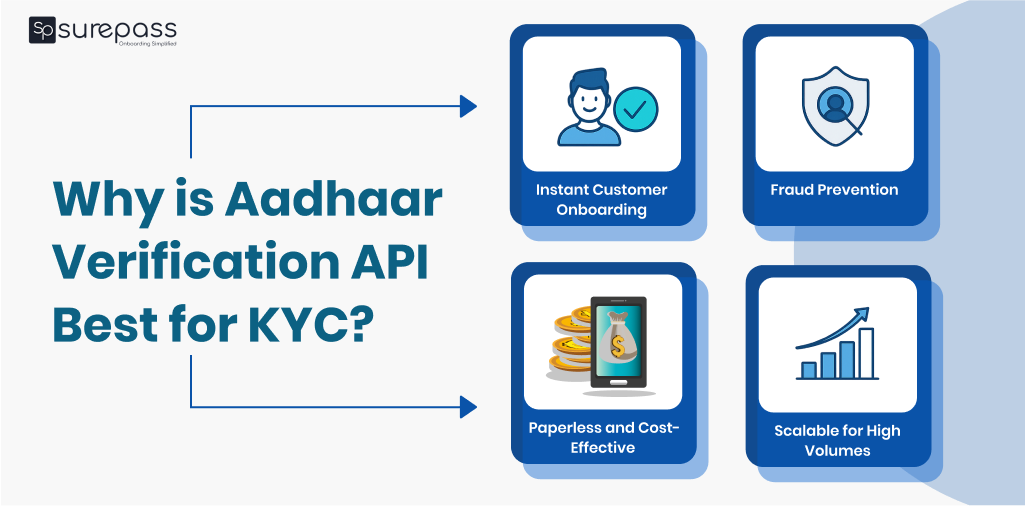

Why is Aadhaar Verification API Best for KYC?

These are reasons why the Aadhaar Verification API is important for business:

- Instant Customer Onboarding: Manual verification takes several days to complete the KYC process. On the other hand, businesses can perform this process in real-time.

- Fraud Prevention: APIs are made up of AI and advanced technology. It can detect fake identity that reduces identity theft and money laundering.

- Paperless and Cost-Effective: It eliminates the labour-intensive and time-consuming manual documentation. It saves operational costs and reduces errors.

- Scalable for High Volumes: Business who has to verify multiple identities can use the batch processing feature, which makes it Ideal for:

- Banks and NBFCs

- Fintech Companies

- Telecom Service Providers

- eCommerce Platforms

- Gig Economy App

So, stop wasting time and resources on manual verification. Our Aadhaar Verification API for business confirms instant, secure, and compliant – get started with a free demo.

Conclusion

Aadhaar Verification API makes the identity verification process fast, secure, and simple. It replaces slow, manual processes with a quick online solution. It saves time, reduces costs, and prevents fraud. With automated and real-time verification, businesses can onboard customers efficiently. It enhances the customer experience and reduces the customer drop-off rates. Whether you are a bank, fintech company, or e-commerce platform, the Aadhaar verification API is the smart way to manage large-scale verification.

FAQs

Ques: What is the Aadhaar Verification API?

Ans: It is an application programming interface that helps in the quick verification of Aadhaar.

Ques: Who offers the best Aadhaar Verification API for business?

Ans: Surepass offers the best Aadhaar Verification API for business.

Ques: What are the benefits of using the Aadhar Verification API?

Ans: It helps in quick onboarding, reduces fraud, and is cost-effective.

Ques: Which industries can use the Aadhaar Verification API?

Ans: Banks, NBFCs, Fintech Companies, Telecom Service Providers, and eCommerce Platforms can use this API.

Ques: Can the Aadhaar Verification API be used for bulk verification?

Ans: Yes, it offers a bulk verification feature.