GST, or Goods and Services Tax, is an important part of business in India. It helps ensure that companies pay the right taxes and can legally operate. Businesses that are registered under GST to get a GST number. This number helps track taxes, claim benefits, and build trust with customers and partners. This blog will help you learn various GST number check methods.

What Is GST Number?

GST Number or GSTIN is a 15-digit identification number issued to every entity and person under GST. This number is based on the PAN and is necessary for tracking tax payments and filing GST returns.

Benefits of GST Number Check

Verifying GST numbers offers multiple benefits and is a crucial step in maintaining compliance with tax laws.

- Confirms that Business is Legitimate: GST no verification helps confirm that the business you are dealing with is registered and compliant with tax regulations. This reduces the risk of working with fraudulent companies and the associated risks.

- Prevents Fraud: GST Verification helps in detecting fake GST numbers that protect your business from scams and financial losses.

- Simplifies Financial Process: Regular GST Verification helps simplify the financial processes by ensuring that transactions are documented correctly making account and tax filing easy and efficient.

Methods For GST Number Check

There are many methods of checking GST numbers which are listed below. You can follow the steps and choose any of the convenient methods for GSTIN verification.

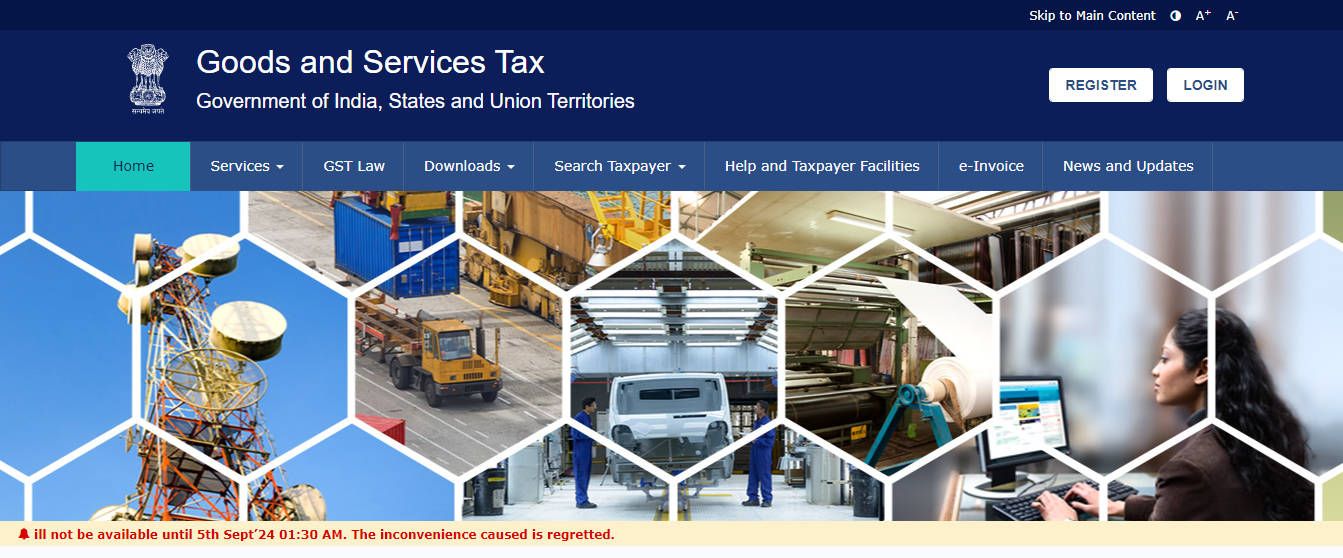

GST Online Verification Via Official GST Website

Verifying GST numbers by an official GST portal is a quick and efficient if you want to verify individual GST number.

- Visit the official GST portal at this Address www.gst.gov.in

- On the home page find search taxpayer under the tab section

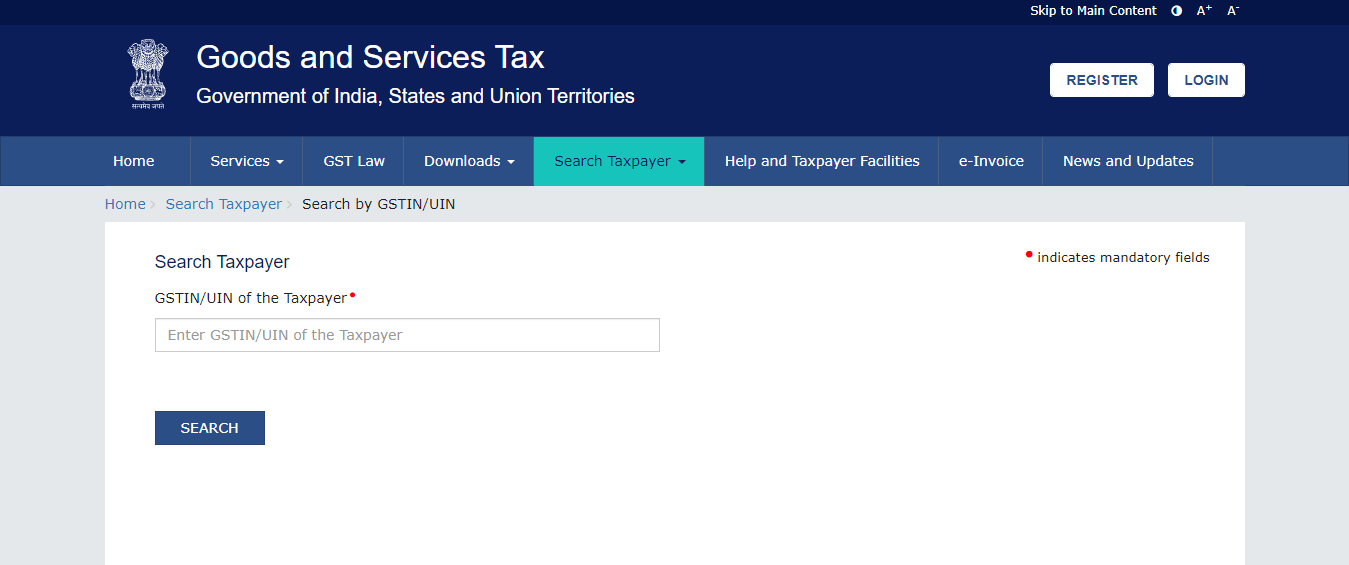

- Click on Search taxpayer

- Now click on the search by GSTIN

- Enter the GST Number and click on the search option

The portal will display the business details related to the GSTIN you have entered. These details will provide the legal name of the business, registration status, type of taxpayer, and the date of registration. After getting the details review and compare the information whether it matches with the business you are dealing with or not. If you find any error or misleading information clear your doubts.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Why is It Important to Check GST Number?

There are several reasons why businesses and individuals need to verify GST numbers, but the main one is to confirm that a company is registered before entering into any transactions. Verifying a GST number confirms that the company follows tax regulations. Checking a GST number online is helpful for this purpose. Another key reason is to maintain tax compliance. If a business wants to claim returns, it needs to verify the GST number of its suppliers to ensure they are legitimate. This makes tax filing easier.

Conclusion

GST Number Check is important for making sure that businesses are following tax rules and are legitimate. It helps you detect and avoid dealing with fake companies. It also eliminates the chances of financial losses, which can happen while working with an illegitimate company. You can verify GST Numbers via the official GST check portal and APIs. Regularly checking GST numbers makes your financial tasks easier and helps create a trustworthy business environment.

FAQs

Ques: Can We Verify the GST Number Online?

Ans: You can verify the GST Number Online via the official GST portal at www.gst.gov.in

- Go to this website

- Find the Search Taxpayer tab

- Click on the Search by GSTIN

- Enter the GST Number

- Click on the search button and receive details related to GSTIN.

Ques: Can We Find Details With the GST Number?

Ans: You can use GST Verification API to find details with GST number only.

Ques: How Do I Check A GST Number?

Ans: You have various methods of GST number checking, you can check GST numbers on the official GST check portal and using a GST Verification tool. Enter the GST number receive details related to GST and verify the details.