Form 16 is an official document issued by employers to their employees. The form provides important information, such as how much income was received as well as the taxes that were deducted in the previous year.

It is a proof of income and is required for tax filing. Verification of the Form 16 documents is essential to confirm the accuracy of data, including the income, deductions, as well as TDS are accurate. If there are differences, it may result in the tax return being filed with legality and also the receipt of notifications from the tax department

What is Form 16?

It refers to the documents issued by the employer to its employees. It contains details of the salary paid and the Tax Deduction from the salary during the financial year. It is proof of income.

It has two main parts:

- Part A: This part contains details like the employer’s name, address, PAN, TAN, the employee’s PAN, and a summary of tax deducted and deposited.

- Part B: It provides information about exemptions, deductions (like under Section 80c), and the final tax payable.

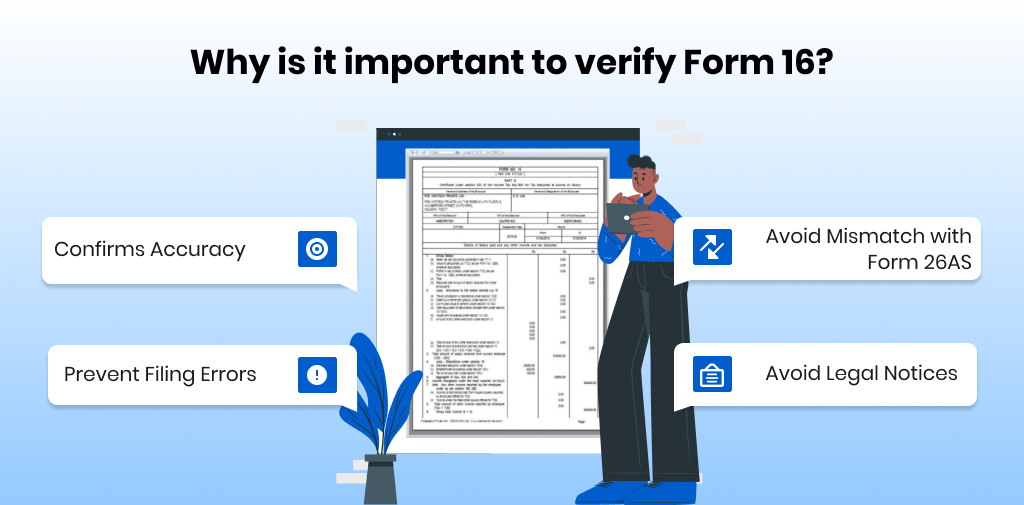

Why is it important to verify Form 16?

- Confirms Accuracy: The Verification confirms that the salaries TDS, salary, and other specifics are true.

- Avoid Mismatch with Form 26AS: A mistake in the matching between Form 16 as well as Form 26AS may cause issues when filing tax returns.

- Prevent Filing Errors: Any error on the Form could result in incorrect Income Tax Return (ITR) filings.

- Avoid Legal Notices: Incorrect details about tax can result in receiving notices or even penalties from Tax Departments like the Income Tax Department.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How to verify Form 16?

You can verify through the e-Filing Portal and Surepass Verification API.

Through e-Filing Portal

- Visit e-filing Portal

- Login with user ID or Password

- Go to e file tab

- Click on view 26AS in Income Tax Return Section.

- You will be redirected to TRACES website.

- Click on the View Tax Credit Tab.

- Click on verify TDS Certificate.

- Enter all the required detail.

- Click on validate.

- Details will be shown on the screen.

Through Surepass Form 16 Verification API (For Business)

Surepass Verification API helps businesses instantly verify. It cross-verifies the details from the official database and confirms legitimacy in the verification process.

How to verify Form 16 Online Using Surepass API?

- Input: Upload the image to the API.

- API Processing: API extracts and verifies PAN, TDS details, employer information, and salary components.

- Output: Receive instant verification results.

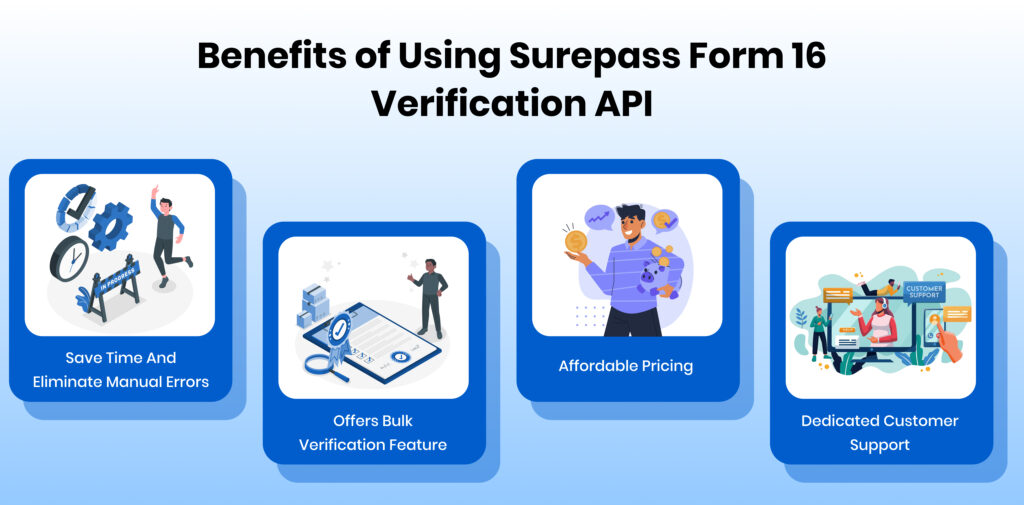

Benefits of Using Surepass Form 16 Verification API

These are the following benefits you will get the using the API:

- Save Time And Eliminate Manual Errors: Surepass Form 16 Verification API automates the verification process, minimising the need for manual checks. It enhances the process’s efficiency and reduces the chance of human error.

- Offers Bulk Verification Feature: With the bulk verification feature, businesses can verify a large number of documents in one instant instead of manually verifying each document.

- Affordable Pricing: Surepass offers affordable plans and pricing based on the credits. Whether you are a small business or a large enterprise, you can buy an API plan according to your needs.

- Dedicated Customer Support: Surepass offers a dedicated customer support team that assists clients whenever they encounter any issues.

Common Mistakes to check while verifying Form 16

Verifying Form 16 is important for accurate tax filing and compliance.

- Incorrect or Mismatched PAN: Suppose any mismatch is seen in the PAN details and the original PAN of the employee. It will lead to issues in ITR Filing.

- Mismatch in TDS Amount: The TDS deducted as shown in Form 16 should match the figures in Form 26AS. A mismatch can result in tax notices or rejection of a tax credit claim.

- Errors in Personal or Employer Details: Spelling mistakes or entries in the employee name, employer name, PAN, or TAN can affect the validity of the form and lead to compliance issues.

- Missing Digital Signature or Authentication: It should have the digital signature of the employee. A missing signature may make the document unacceptable for verification.

Conclusion

Verifying the authenticity of Form 16 is important to confirm that the details are accurate. If you are a business, It helps you protect yourself from errors and associated issues. You can verify through the e-Filing Portal as an individual. If you are a business handling multiple Form, using the API for verification is better. It offers a bulk search feature that allows you to verify multiple simultaneously.

FAQs

Can Form 16 be verified online?

Yes, you can verify.

Can I view my Form 16 online?

Yes, you can view online through the Traces Portal.

What is the salary limit for Form 16?

2,5 lakh is the salary limit.

Can I use Form 16 as income proof?

Yes, you can use it as a valid proof of income.

Is there any tool to verify Form 16 Online?

You can use the Surepass Verification API to verify Online.