Do you want to find a company or a taxpayer through the GST Number? Then you are on the right platform. GST verification is essential to check the legitimacy of the business. It prevents fraudulent transactions and maintains compliance. By identifying a fake GST number, you can avoid doing any business with a fraudulent entity. In this guide, you will learn search Taxpayer by GSTIN.

How to Search a Taxpayer by GSTIN?

You can search the business information from the GSTIN from:

Through the GST Portal

You can find the business information of the Taxpayer from the GST Service Portal.

- Go to services.gst.gov.in.

- Enter the GST Number and Captcha.

- Click on Search.

The following information will be displayed on the screen.

- Legal Name.

- Trade Name (if any).

- Registration Date.

- State Jurisdiction.

- Taxpayer Type (Regular, Composition, etc.).

- GSTIN Status (Active, Inactive, Cancelled).

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How do the APIs Help in Taxpayer Search?

APIs make the verification and searching process easy and effective. Here’s how they enhance taxpayer searches:

Bulk Verification for Large-Scale Operations: The API can process thousands of GST Numbers simultaneously if you upload the GST Number list. It provides instant and accurate details, which is ideal for vendor onboarding, periodic compliance, and year-end reconciliations.

Helps in Fraud Detection: The API helps in identifying inactive/cancelled GSTINs and business name mismatches. It helps in the detection of multiple GSTINs under a single address. With the integration of the API, businesses can enhance their operational efficiency.

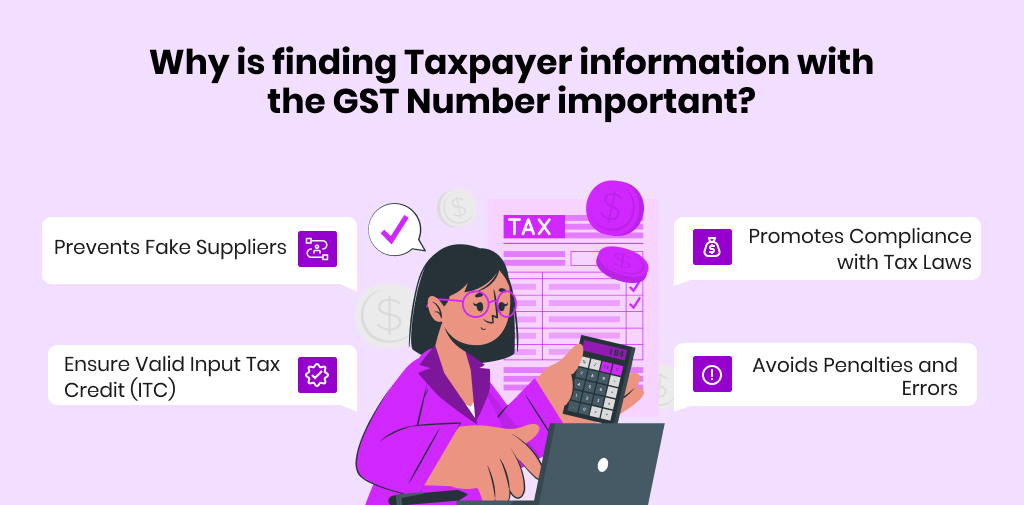

Why is finding Taxpayer information with the GST Number important?

Prevents Fake Suppliers: GST Verification helps businesses confirm that they are dealing with legitimate companies and suppliers, reducing the risk of legal troubles.

Ensure Valid Input Tax Credit (ITC): Input Tax Credits can be claimed only when transactions involve GST-registered entities. GSTIN verification helps business save their ITC claims and maintain financial accuracy.

Promotes Compliance with Tax Laws: GST verification helps ensure compliance with GST regulations. It also minimises the risk of legal disputes and audits.

Avoid Penalties and Errors: Creating an invoice for an invalid or fake GSTIN can lead to fines and compliance issues. That’s why, when you verify the Taxpayer through GSTIN. You get confirmation that the business is legitimate and does not cause any issues.

Fake ITC Claims Cases that Businesses Must Know

In the financial year 2024-25, officers from the central and state governments found more than 25,000 fake firms that claimed ITC (input tax credits) of 61,545 crore. Of this, Rupees 1,924 crore was recovered, and 168 people were arrested.

A total of 42,140 fake firms were caught. These firms were involved in fake ITC claims of more than 1 lakh crore rupees. Around 3,107 crore rupees have been recovered, and 316 arrests have been made. The government has taken several strict steps to overcome this kind of fraud.

According to the GST rule, businesses can claim ITC on the tax paid when they buy goods or services. But some fake firms have been misusing this by creating false invoices just to claim ITC and cheat the government.

To stop this, the GST registration process has become stricter. Now, it has become mandatory for risky businesses to get under Aadhaar and physical inspection before getting registered. Genuine business still get their GST registration within 7 days.

If any company is found to use an ITC case, their GST will be cancelled or suspended. They may be blocked from claiming ITC. You can prevent yourself from being a part or working with frauds by verifying GST and Taxpayer information.

Conclusion

Search taxpayer by GSTIN is an essential process for all the entities involved in tax processes. It helps in the verification of business and detects fake GSTINS. You can easily find the details of the business from the GST Services portal and the Verification API. As our Government has become stricter due to the rise in the ITC and GST-related fraud. You need to be alert while dealing with fake business and legal troubles.

FAQs

How to Search Taxpayer by GSTIN?

You can Search Taxpayer by GSTIN through the GST service portal and the APIs.

How to Search GST Number by Name?

You can search for GST Number by Company Name through the GST Portal.