Due Diligence audit is a mandatory step before investing, buying, or merging into a business. This audit simplifies the evaluation process. It provides a clear view of a business’s financial health, legal standing, and market reputation. It helps in identifying risks, evaluating the value, and making informed decisions. In simple words, business verification helps avoid financial fraud and costly investments.

What is a Due Diligence Audit?

Due Diligence Audit is a process of thorough examination of an organization. It includes checking financial operations, legal, tax, and other aspects, before checking mergers, acquisitions, or investments.

Importance of Due Diligence Audit

This audit is essential for risk management:

- It reduces the risk of fraud and other compliance issues that can lead to legal and financial losses.

- Audit provides accurate data to stakeholders, investors, and lenders. It helps investors make the right decisions.

- This process helps in the right valuation of the business and avoids overpayment or undervaluation.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Purpose of Due Diligence

Diligence helps solve potential problems early, so they don’t turn into bigger issues.

- Prevent Risk: It assists in identifying early warning signs, which can be turned into more serious concerns sooner. The key is to be proactive and not merely identify mistakes in the event of an incident.

- Validity of Valuation: Audit confirms that the company is legitimate and the presented financial value is accurate.

- Regulatory Protection: Due Diligence Audit helps in avoiding fines or legal trouble in the future.

Types of Due Diligence Audits

These are the types of Audits that you must know:

- Financial Due Diligence

Auditors check the company’s balance sheets, income statements, liabilities, and revenue streams. It confirms that there are no hidden risks that could cut the transaction or cause financial damage.

- Legal Due Diligence

The auditor checks contracts, ownership of ideas or products, and any ongoing or past legal cases. Whether the company is following all laws and needs approvals. Its main aim is to make sure there are no hidden liabilities that can harm the business later.

- Operational Due Diligence

It is essential for mergers, acquisitions, and private equity investments. It involves an evaluation of target companies’ operational aspects to check the suitability of the buyer and investor.

- Cybersecurity Due Diligence

Checking IT infrastructure, data privacy protocols, and vulnerability to cyber threats is essential. This helps identify potential data breaches, compliance with data protection laws (DPDP Act), and overall IT risk management.

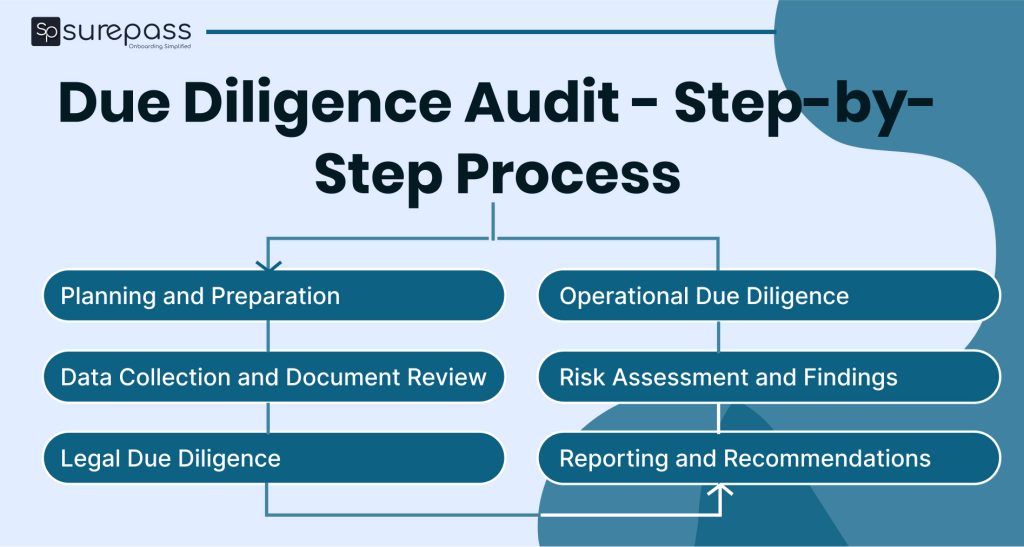

Due Diligence Audit – Step-by-Step Process

The Due Diligence Audit process involves several steps:

- Planning and Preparation

Define the scope and objectives of the audit (financial, legal, operational, tax, IT, etc.). Identify the key stakeholders such as buyers, sellers, investors, legal advisors, and auditors. Assembles a due diligence team. Sign a Non-Disclosure Agreement (NDA) to protect confidential data. Prepare a Due Diligence Checklist of required documents.

- Data Collection and Document Review

Request and collect relevant documents from the target company. It includes: Financial Records, Legal Documents, Operational Records, Regulatory and Compliance, IT, and Cybersecurity.

Review revenue streams, profit margins, and cash flow trends. It assesses working capital requirements and debt obligations. It checks tax compliance and potential exposures.

- Legal Due Diligence

Review contracts and check for pending or past litigation. It confirms intellectual property ownership.

- Operational Due Diligence

Check business process and efficiency. Evaluate supply chain risks and vendor dependencies. Review key customer relationships and concentration risks. Analyze workforce (employee contracts, benefits, and labor disputes). Examine IT systems and cybersecurity measures.

- Risk Assessment and Findings

This involves finding key risks and highlighting the potential deal breakers or negotiation points. Compare findings with industry benchmarks.

- Reporting and Recommendations

Prepare a due diligence report that summarizes findings. Talk about or negotiate a term based on audit results. Plan integration strategy and solve issues before closing any deal. Share the report with investors, buyers, or company leaders to guide final decisions.

Benefits of Audit

Benefits of conducting due diligence:

- Knowing the Competition Better: A due diligence audit can reveal how your business compares to others in the market. It helps you find strengths and weaknesses.

- Better bargaining power: In M&A transactions, detailed factual findings help in negotiating better.

- Spotting future problems early: It helps in identifying challenges early that can come after closing the deal.

Conclusion

A Due Diligence Audit is not just a compliance exercise. It is a strategic safeguard that confirms every major business’s decision is based on verified facts, not assumptions. Checking hidden risks, evaluation, and operational realities. This helps stakeholders bargain for better deals and to avoid errors. It is a must for investments and acquisitions due diligence converts doubt into clarity and provides assurance to investors, buyers, as well as lenders.

FAQs

Ques: What is due diligence in auditing?

Ans: Due diligence audit is an internal audit of a company that seeks to confirm that the company is ready for sale.

Ques: What are the 4 P’s of due diligence?

Ans: The 4 P’s of due diligence include People, Process, Philosophy, and Process.

Ques: What is a due diligence process?

Ans: It is a process of checking all aspects of business thoroughly before investing or merging.

Ques: Why is a Due Diligence Audit Important?

Ans: It reduces risks and helps in the right business valuation.

Ques: What is the main purpose of a Due Diligence Audit?

Ans: Its main purpose is to verify essential information about a business before a major transaction.