The Goods and Services Tax (GST) is among the most significant tax reforms that have occurred in India. It was introduced in July 2017. It is replacing a complicated structure of indirect taxes, including the service tax, VAT, and excise duty, with one, unifying tax structure. It simplifies taxation to be understandable, transparent, and more efficient for businesses and customers.

Although it has numerous benefits, GST has also faced criticism for some drawbacks, particularly in its early phases. Smaller businesses find difficulties in completing the process as frequent revisions to the rules cause confusion. In this blog, we will learn about the advantages and disadvantages of GST in India.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

What is GST?

GST (Good and Services Tax) is a single tax that the government charges on the sales of goods and services. It replaces old taxes like VAT, service tax, and excise duty. GST is the same across the states in India, which makes buying and selling easier as it removes different tax rates in each state.

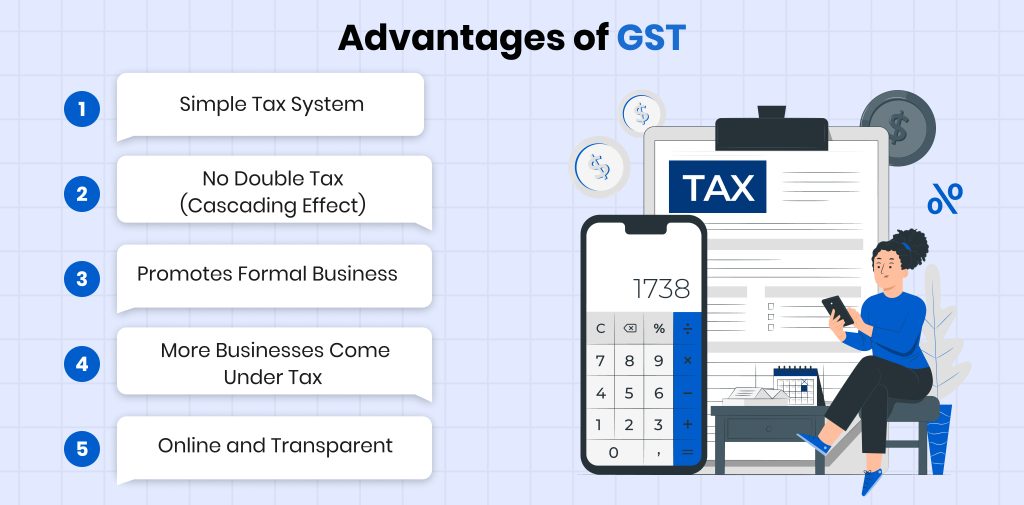

Top 10 Advantages of GST

Here are the top 10 advantages of GST that business and consumers must know:

1. Simple Tax System

GST has replaced many indirect taxes with one single tax. Businesses now follow one rule instead of many, which makes things easier.

2. No Double Tax (Cascading Effect)

Earlier, tax was added on every step. GST gives input credit, so people don’t pay tax on tax anymore.

3. Promotes Formal Business

To claim GST benefits, businesses must keep proper bills and records. This makes more businesses work officially and legally during the GST verification process.

4. More Businesses Come Under Tax

GST has lower limits for registration and uses online systems. This brings more small and medium businesses into the tax network.

5. Better for Exporters

Exports are not taxed under GST. Exporters can also get refunds for taxes they paid on inputs, which helps them compete globally.

6. Online and Transparent

All GST work is done online through a single portal. Businesses can easily do GST registration online. It reduces paperwork and brings more clarity to tax payments.

7. More Government Income

GST helps track taxes better and stops tax cheating. This increases the money collected by the government.

8. Faster and Cheaper Transport

GST removed old road taxes and check posts. Now goods move faster across states, and transport costs are lower.

9. Same Tax Rules in All States

Before GST, each state had different tax rates and rules. GST has brought the same rules across India.

10. Less Human Error

With invoice matching and online filing, GST reduces mistakes. It also helps businesses stay up-to-date with their tax work.

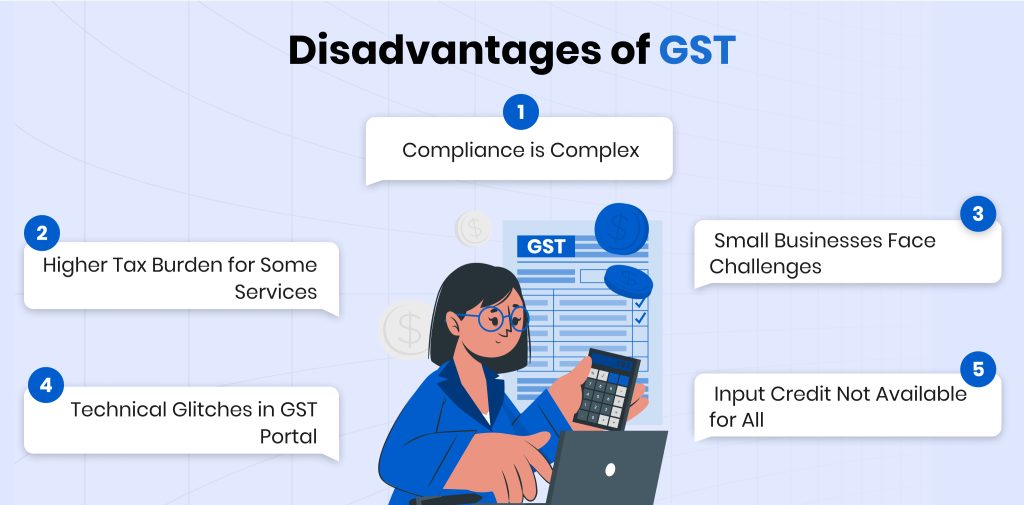

Disadvantages of GST

These are the disadvantages of using GST:

1. Higher Tax Burden for Some Services

Under GST, some services like telecom, insurance, and banking became costlier as the tax rate increased from 15% to 18%.

2. Compliance is Complex

Businesses have to file multiple returns and follow strict timelines, which can be difficult, especially for small businesses.

3. Technical Glitches in GST Portal

The online GST portal often faces technical issues, making return filing and invoice uploads frustrating at times.

4. Small Businesses Face Challenges

Many small traders and businesses struggle with digital processes and need help to manage GST filings and rules.

5. Input Credit Not Available for All

Input tax credit is not allowed on several expenses like motor vehicles, employee food, or health insurance, which limits benefits.

6. Frequent Changes in Rules

GST rules and rates keep changing, which creates confusion and makes it hard for businesses to stay updated.

7. Initial Cost of Transition

When GST started, businesses had to upgrade software, train staff, and change billing systems, which cost time and money.

8. Working Capital Blocked in Refunds

Exporters and businesses often face delays in getting GST refunds, which affects their cash flow and daily operations.

9. Increased Cost for Unregistered Dealers

If a business buys goods from an unregistered supplier, it has to pay GST under reverse charge, which increases the cost.

10. Not Yet Fully Unified

Petroleum products and alcohol are still taxed separately by states, so it’s not a completely unified tax system yet.

Conclusion

The Advantages and Disadvantages of GST show that GST has made taxes easier and more transparent in India. It replaced many taxes with one and made taxation simple. It encourages more businesses to work legally and reduces extra taxes on taxes. But there are some problems too. Small businesses find it hard to follow all the rules, and technical issues make things difficult. Some services have become more expensive, and delays in refunds affect cash flow.

FAQs

Ques: What Are The Advantages and Disadvantages of GST?

Ans: GST simplifies the tax system, reduces tax evasion, eliminates tax cascading, and brings more revenue. It has several disadvantages, like a higher tax burden on small businesses, high tax rates for small goods, etc.

Ques: What are the advantages of GST on GDP?

Ans: GST helps increase GDP by simplifying taxation and reducing tax evasion.

Ques: What are the advantages of supply in GST?

Ans: GST makes supply easier as it removes extra tax and allows the same rules across all states.

Ques: Is GST the same across all states in India?

Ans: Yes, the GST is the same across all the states in India.

Ques: What are the main advantages of GST for consumers?

Ans: GST reduces the overall tax that benefits the end consumer.