Managing money can be challenging, especially when you have multiple accounts across different banks for various purposes. Checking balances, switching between apps, and logging into multiple websites is a struggle. Here, the account aggregator plays an important role by unifying all the financial accounts into a secure dashboard. It simplifies money management by providing a full view of finances in one place.

What is Account Aggregation?

It is a process that unifies the multiple account information, such as bank accounts, credit cards, loans, and investments, on one platform. It provides users a complete view of their finances. This aggregator fetches the details like balances, transactions, and statements. It helps people and businesses track spending, manage budgets, monitor investments, and financial details without logging into multiple accounts.

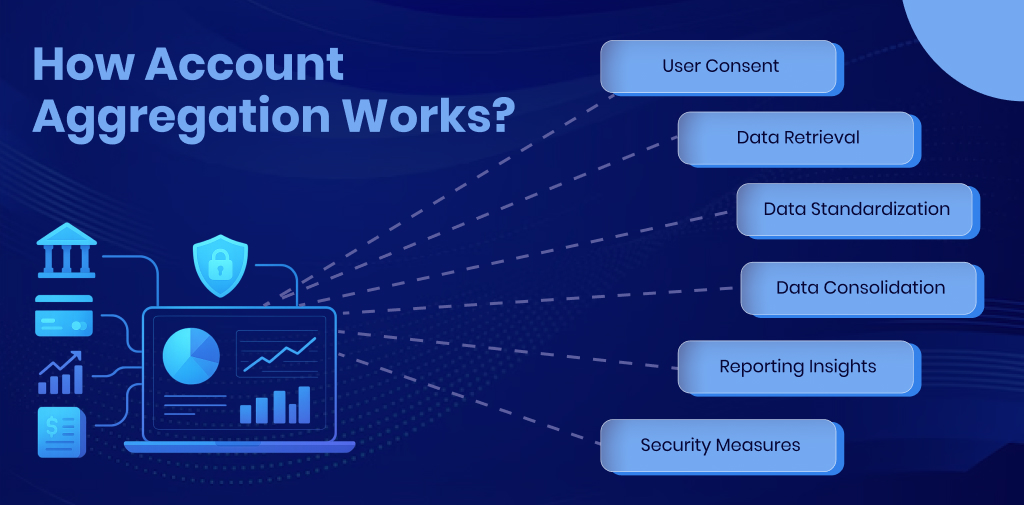

How Account Aggregation Works?

Here is how account aggregation works:

- User Consent

In this step, the user allows the aggregator to access their accounts. This consent is mandatory, usually through login credentials or secure APIs (like Open Banking APIs).

- Data Retrieval

The aggregator connects to multiple banks or financial institutions. APIs or secure data sharing protocols, it fetches account balances, transactions, loan details, and other financial data.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

- Data Standardization

Every financial institution may provide data in a different format. The aggregator converts all this data into a uniform format. It makes it easy to compare and analyze.

- Data Consolidation

The platform merges the information into a single dashboard. Users can see a complete summary of total balances, recent transactions, spending patterns, and investment details.

- Reporting Insights

- Some aggregators provide additional information such as:

- Spending analysis.

- Budget recommendations.

- Investment tracking.

- Alerts for unusual transactions.

- Security Measures

It uses encrypted connections (HTTPS, TLS). It uses token-based authentication instead of sharing passwords wherever possible. Compliance with regulations like DPDP, GDPR (Europe) or NDPR/Local Financial Data Guidelines (India).

Benefits of Account Aggregation

- Time Saving

Account Aggregation helps you check all your bank accounts, credit cards, and investments in one place. There is no need to log in to multiple apps or websites. It is like having a single key that unlocks your entire financial world.

- Financial Decisions

Getting all your finances in one dashboard gives full information. You can track where your money is going. Understand your net worth instantly, and make smarter spending, saving, and investing choices.

- Budgeting and Tracking

Account aggregation tools often include expense categorization. This makes it easy to see exactly how much you are spending on groceries, entertainment, or travel. It helps you stick to a budget without manually tracking every rupee.

- Fraud Detection

Monitor all your accounts from a single platform, and you can quickly find suspicious transactions or unexpected charges. It reduces the risk of fraud going unnoticed.

- Goal Setting

Whether you are saving for a house, vacation, or retirement, connecting all your accounts helps track progress towards your goal in real time.

Use Cases.

- Loan and Mortgage Applications

Traditional loan approvals rely on credit scores and manual bank statements. It can be slow and incomplete. The aggregator helps in instant income verification, cash flow underwriting, and risk reduction.

- Family Finance

Parents find it difficult to oversee their kids’ spending; on the other hand, children managing aging parents’ finances face transparency issues. It helps monitor children’s debit card spending, detects unusual withdrawals, and shares financial dashboards.

Security Risks and How to Stay Safe

Account aggregation offers convenience, but it introduces security and privacy risks. Many users don’t even know how their financial data is stored, shared, or potentially exposed.

- Data Privacy Concerns

When you link accounts to an aggregator, you need to give access to a third party to your banking data. Many apps use screen scraping (storing login credentials) instead of secure APIs, raising privacy concerns. Many apps use screen scraping (storing login credentials) instead of secure APIs and raising privacy concerns.

- Fraud Risks

If an aggregator stores your login credentials, in case a data breach occurs. It can expositive financial credentials. Hackers can intercept data during transmission. Spam apps mimic legitimate services to steal logins. If hackers access your aggregation dashboard, they see all linked accounts. Settled over claims that it collected more financial data than needed.

To prevent this issue, enable two-factor authentication (2FA), monitor to detect unusual account activity, and never use banking credentials.

Surepass Account Aggregation API

Surepass offers the Account Aggregation API that helps manage finances easily. It handles consent, adds strong authentication, and returns verified transactions without storing. It is useful for underwriting, PFM, and reconciliation workflow.

Conclusion

Account Aggregation simplifies financial management by combining all your accounts—banking, credit, loans, and investments — into secure platforms. It helps users and businesses save time, track spending, make informed financial decisions, and monitor investments. While it offers convenience, it’s important to choose a trusted aggregator. It confirms the implementation of strong security measures and protects your data.

FAQs

Ques: Is account aggregator safe?

Ans: Yes, accounts are aggregators are safe to use.

Ques: What kind of accounts can I link with an aggregator?

Ans: You can link bank accounts, credit cards, insurance, and investment accounts.

Ques: Does account aggregator help in fraud detection?

Ans: Yes, it helps in unusual transactions and activities with unified account information.

Ques: Who regulates account aggregators in India?

Ans: RBI regulates account aggregators in India.

Ques: What does an account aggregator do?

Ans: It collects and consolidates financial data of multiple accounts into one dashboard.