Aadhaae OKYC has transformed the identity verification process in India. It is a secure and quick alternative that enables paperless verification through QR scanning, eliminating the need for OTP authentication.

It reduces paperwork and ensures fraud-proof verification. The traditional offline Know Your Customer was a paper-based, time-consuming, and prone to document fraud. Aadhaar OKYC 2.O is one of the most reliable solutions that solves all the offline verification issues. Here in this blog, you will learn about the top 10 use cases of Aadhaar OKYC 2.O that streamline the verification process for various industries.

Why is Aadhaar OKYC better for verification?

These are the reasons that make Aadhaar OKYC better for verification:

- Quick Paperless Verification: The OKYC 2.O makes the verification process quick and efficient. It eliminates the physical collection and verification of documents and saves time.

- Privacy and Data Minimization: Only demographic information, such as Name, DOB, and address, is shared with the selective sharing feature. It reduces the exposure or sharing of personal information that can be misused.

- Reduced Operational Overheads: The Aadhaar OKYC-based verification replaces the need to store physical documents. It reduces data leaks and enables faster processing.

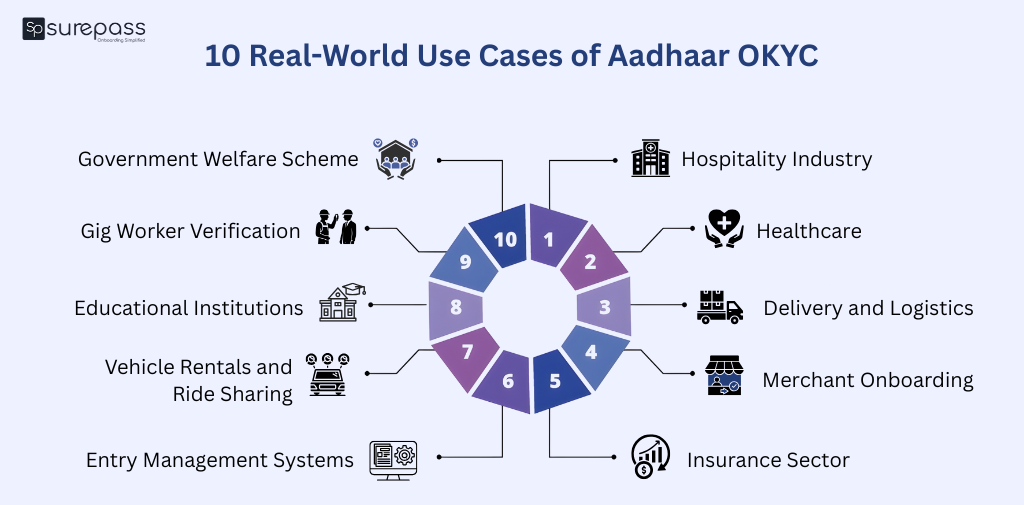

Top 10 Use Cases for OKYC 2.O

These are the top 10 use cases for OKYC 2.O:

Aadhaar OKYC for Hotel

The OKYC 2.O is beneficial for both hotels and guests. It helps verify the guests’ legitimacy with simple QR scanning, and guests can share the required data with selective sharing. It replaces the paper-based verification and reduces the exposure of sensitive information.

Automate your KYC Process & Reduce Fraud!

We have helped 3000+ companies in reducing Fraud by 95%

Aadhaar OKYC for Hospital Patient Verification

Hospitals often struggle with patient identities during emergencies, insurance claims, or government healthcare schemes. The integration of OKYC 2.O streamlines the patient verification process and adds efficiency to the onboarding process. This reduces document fraud.

Aadhaar KYC for Delivery and Logistics

Delivery platforms such as food apps, courier companies, and logistics services can rely on OKYC 2.O. It prevents fraudulent activities and helps verify the delivery partner during onboarding. It can be used to verify the recipients for high-value deliveries.

Merchant Onboarding

OKYC 2.O is beneficial for the e-commerce platform for verifying the legitimacy of the sellers during onboarding. It eliminates the listing of fraudulent sellers on the platforms and ensures compliance with the KYC regulations.

Access Control for Offices, Events, and Gated Communities

OKYC 2.O is the right solution to be a part of an access management system for secure authentication. It prevents unauthorized entry and confirms that only authorized individuals can enter the office or events. It also eliminates the need for manual ID collection at the gate.

Insurance Sector

Many insurance companies face fake documents and identity misuse cases. The OKYC 2.O simplifies the identity verification for health insurance, motor insurance, and life insurance companies. The quick and accurate verification reduces the risk of fraud.

Aadhaar OKYC for Vehicle Rentals and Ride Sharing

For Car rental services, bike rentals, and ride-sharing platforms, OKYC 2.O is a quick alternative for identity verification. It helps prevent identity theft, misuse, impersonation, and unauthorized rentals.

Educational Institutions

Schools, colleges, and universities can verify students or staff during admissions, examinations, hostel entry, or scholarship distribution. OKYC 2.O helps the institution maintain accurate records and prevent identity misuse. It confirms that only the authorized students can take entry into the campus zone.

Gig Worker Verification

Gig economy platforms such as ride-hailing, food delivery apps can verify gig workers. OKYC 2.O simplifies the verification process with advanced and secure features. It reduces identity theft and makes onboarding efficient.

Government Welfare Scheme

OKYC 2.O helps in beneficiary verification for subsidies, pensions, scholarships, or welfare schemes. It confirms that only the right person gets the benefits. It also prevents the risk of fraudulent and duplicate claims. It reduces paperwork for citizens and administrators.

Conclusion

The Aadhaar OKYC 2.O is a secure and ideal solution for paperless verification. With this solution, businesses can easily verify the identities without direct calling to the UIDAI database. It is beneficial for the entity as it enables quick and secure verification. With selective sharing and QR-based authentication, entities can verify the Aadhaar. Aadhaar OKYC is an ideal solution for E-commerce platforms, Hospitals, Hotels, Educational Institutions, Insurance companies, Vehicle Rental, and Ride-sharing vehicles.

FAQs

Ques: What is OKYC in banking?

Ans: OKYC is the know your customer verification process.

Ques: How is Aadhaar OKYC 2.O different from the traditional Aadhaar eKYC?

Ans: No biometric authentication is required for OKYC 2.O. However, biometric authentication is in eKYC process.

Ques: What industries get benefits from the Aadhaar OKYC 2.O?

Ans: These industries get most of the benefits of Aadhaar OKYC:

- Hotels and Travel Services

- Delivery and Logistics

- Insurance Companies

- Hospitals (Patient Verification)

- Government Welfare Departments

- Gig Worker Platforms

- E-commerce and Merchant Onboarding

- Educational Institutions

Ques: Is OKYC legal?

Ans: Yes, OKYC is legal.

Ans: Only the demographic information of an individual’s Aadhaar is shared.