Introduction

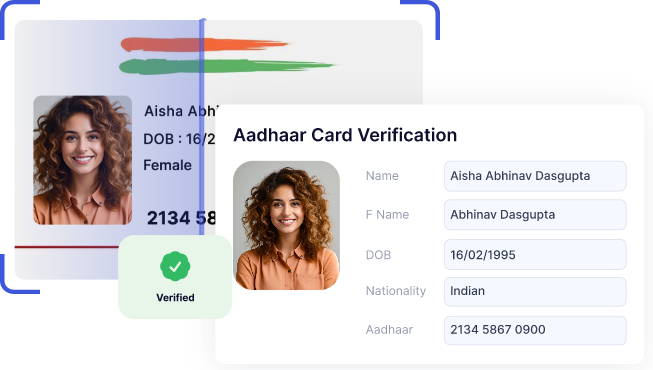

With the help of udyam aadhaar, the company owner can acquire different benefits from the government such as government tenders, bank borrowings at lower interest rates, tax rebates, and so forth through MSME using relevant client’s aadhaar card number. Udyam aadhaar is needed for all kinds of businesses, regardless of whether small or middle-class, in order to reap the advantages of the Indian government.