Introduction

Surepass has launched a KYB verification solution backed by certified legal expertise for verifying companies and beneficiaries. Forget about endless manual checks, high compliance costs, and unnecessary onboarding delays—now, through an intuitive interface, a company (plus its beneficial owners and representatives) can be verified by a single authorized representative.

What is a KYB check?

KYB stands for “know your business,” It is a set of practices that verifies businesses by screening companies and their beneficial owners. This is done to reduce the risk of money laundering and fraud.

The procedure is required for financial institutions and other AML-regulated entities (online payment services, online banking, crypto marketplaces and services, and so on).

Why is KYB important?

KYB checks are required for two main reasons:

It prevents fraud. KYB assists businesses in detecting and eliminating fraudsters among their counterparties. This contributes to lowering the financial and reputational risks associated with money laundering, terrorist financing, and fraud.

Regulatory adherence. KYB assists AML-regulated businesses in determining whether their partners, customers, or suppliers are: subject to sanctions or other adverse regulatory action, involved in financial crime, or pose money laundering risks.

National anti-money laundering laws mandate KYB, regional regulations (such as the EU Money Laundering Directives), and non-binding standards and guidelines.

How does the Surepass KYB solution benefit businesses?

One of the most apparent advantages of incorporating API software into your fulfillment process is how it can speed up and smooth out the process. While this is a huge benefit, there are several other ways for our clients to expand their logistics capabilities through API integration. When it comes to verification, Surepass API provides a one-stop shop. It offers a straightforward plug-and-play API solution.

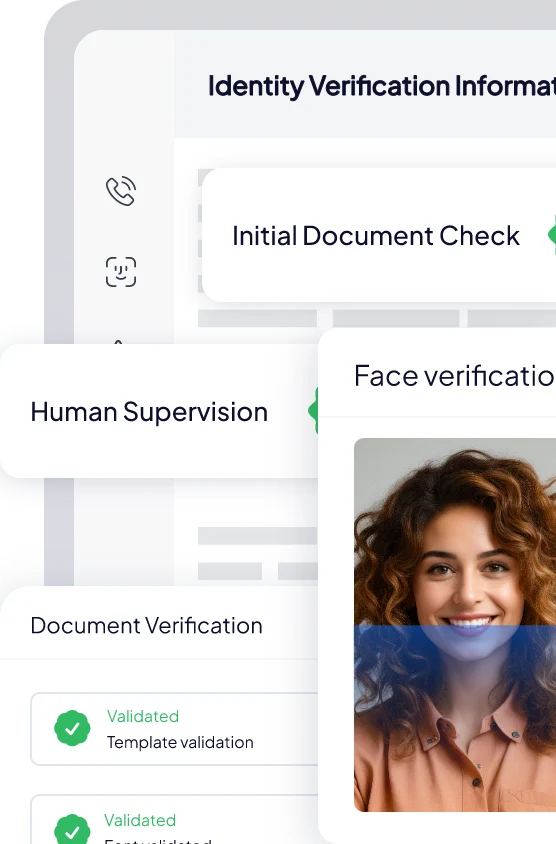

Surepass’s all-in-one KYB solution includes KYC checks, which enable verification of UBOs, representatives, and other individuals. All this is made possible within a single dashboard where users can:

- set up automated check levels;

- perform in-depth investigations;

- provide the applicant with feedback (e.g., requesting additional docs);

- generate reports, etc.

Automate your KYC Process & reduce Frauds!

We have helped 200+ companies in reducing their user onboarding TAT by 95%

The average processing time for business verification is 3 hours but may take longer depending on the complexity of the entity’s structure.

Other benefits include:

1. Fast customer onboarding

Users are quickly onboarded with a customizable widget that collects all necessary information from businesses and individuals via the Web SDK.

2. Easy integration

The solution is integrated using Web SDK and has more than 99.996 percent uptime.

3. Savings on verification costs

Surepass automates the entire business verification process, reducing costs and manual labor.

Our legal experts will assist you in developing the flow based on the risks identified and tailoring the solution to the specifics of your business. Furthermore, Surepass offers 24/7 customer support, and our customer success team is always available to answer any questions and show you how to utilize the solution thoroughly.