Introduction

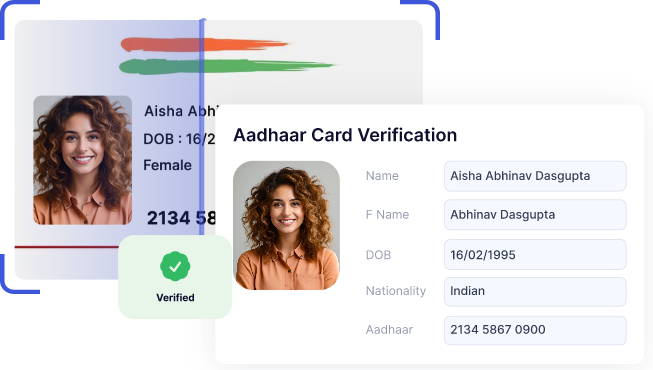

As identity fraud is rising, verifying Aadhaar details is essential for banks, NBFCs, Fintech, Telecom Providers, and other organizations. The API detects tamper-proof demographic data.

Key Features

- Instant Verification: It helps in quick verification of Aadhaar within seconds.

- Prevent Fraud: Detect tampered and fake Aadhaar with advanced AI technology.

- Paperless and Convenient: No need to upload or store documents for verification.

Use Cases

Banks and NBFCs: Banks and financial institutions can use this API for quick verification during customer onboarding. It reduces paperwork and helps prevent fraudulent account opening.

Telecom Operators: Telecom companies can integrate this API to verify Aadhaar details before activating a new SIM card.

Insurance Providers: Insurance companies can use the Aadhaar verification to simplify customer onboarding and policy issuance.

Benefits of Verifying with our API

Prevent Fraud

QR based APIs saves any institution that has been and can be a victim of identity frauds.

Prevent human errors

Errors brought on by manual methods are eliminated by automated filling in forms.

Onboard faster

Real-time data extraction leads to instant onboarding and service.

case-study

How SurePass helped in verifying customers for a used two wheeler seller of India

How to verify an Aadhaar card using a QR code?

Can the Aadhaar QR Code be used for KYC?

Who can use this API?

Can this API detect fake and tampered Aadhaar cards?

What are the benefits of QR-based verification over manual checks?

Do I need technical knowledge to use this API?

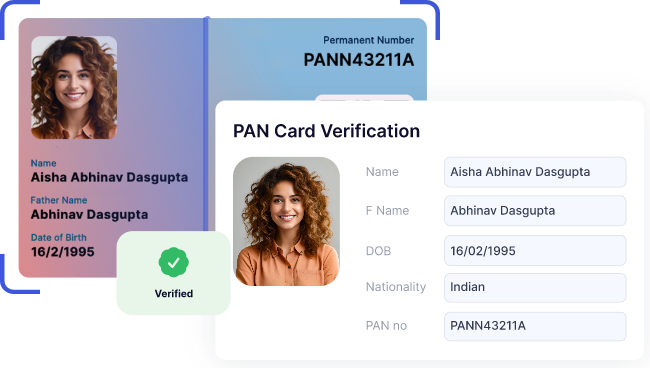

Pan Verification API

PAN verification API is imperative to have, From Banks, NBFC’s to other financial institutions. A Permanent Account Number also known as PAN is a must have document for any taxpayer.

Read More

Photo ID OCR API

Photo ID OCR (Optical Character Recognition) API is the most efficient OCR out there.field’s like full name, address, mobile number, gender, date of issue mentioned on the photo ID.

Read More