Introduction

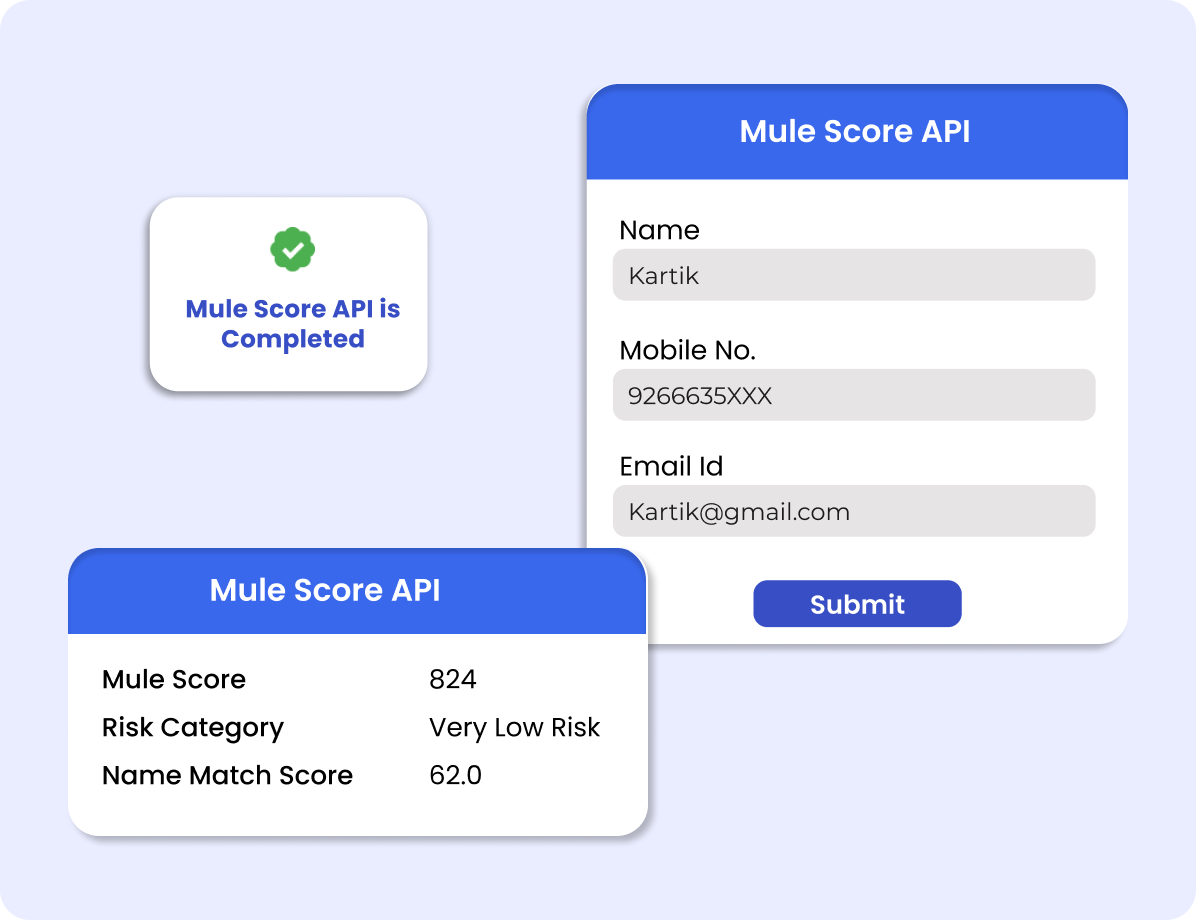

Currently, fraudsters use fake identities to open accounts, conduct transactions, and access other services. Our Mule Score API is the right solution to avoid such fraud:

- A fraud risk score to evaluate trustworthiness.

- Verification of digital activity and history linked to an individual.

- Confidence in employment and UPI verification.

- Analytics-driven insights based on email, phone, and name history.

Benefits for Businesses

- Reduce Fraud Losses: It detects suspicious profiles before onboarding.

- Faster Decisions: The automatic verification gives a score in real time.

- Build Trust: It confirms that only genuine customers can access the service.

Use Cases

- Banks and Financial Institutions: The API automates the scoring and verification process and helps detect mule accounts, fraudulent transactions, and identity theft.

- Lending Platform: This API helps in checking the borrower’s credibility and reduces the risk of default. It helps verify employment history, UPI activity, and digital footprint.

- E-commerce Platform: E-commerce platforms can use this API to protect platforms from fake sellers or fraudulent buyers. It verifies their identity and analyzes risk scores in real time.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Prevent fraud by identifying mule accounts, detecting risk profiles, and ensuring only verified customers access your services.

Accurate and Reliable

Our system checks the information. Therefore, the results are always correct and legitimate.

Blog

The Dark Side of Easy Money: Understanding Money Mule

How do you identify money mules?

What is the money mule score?

How can I integrate the Mule Score API into my system?

How does the Mule Score API detect fraud?

Which industries can benefit from the Mule Score API?

How does the Mule Score API help banks and lenders?

Driving License API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More