Introduction

Loan Defaulter check API is a verification solution that allows businesses to check the borrower’s loan repayment history in real time. It reduces the dependency on manual data collection and review with automated checks. It helps find loan defaulters and reduces the losses. This solution streamlines the onboarding process and reduces customer drop-offs that occur due to delays.

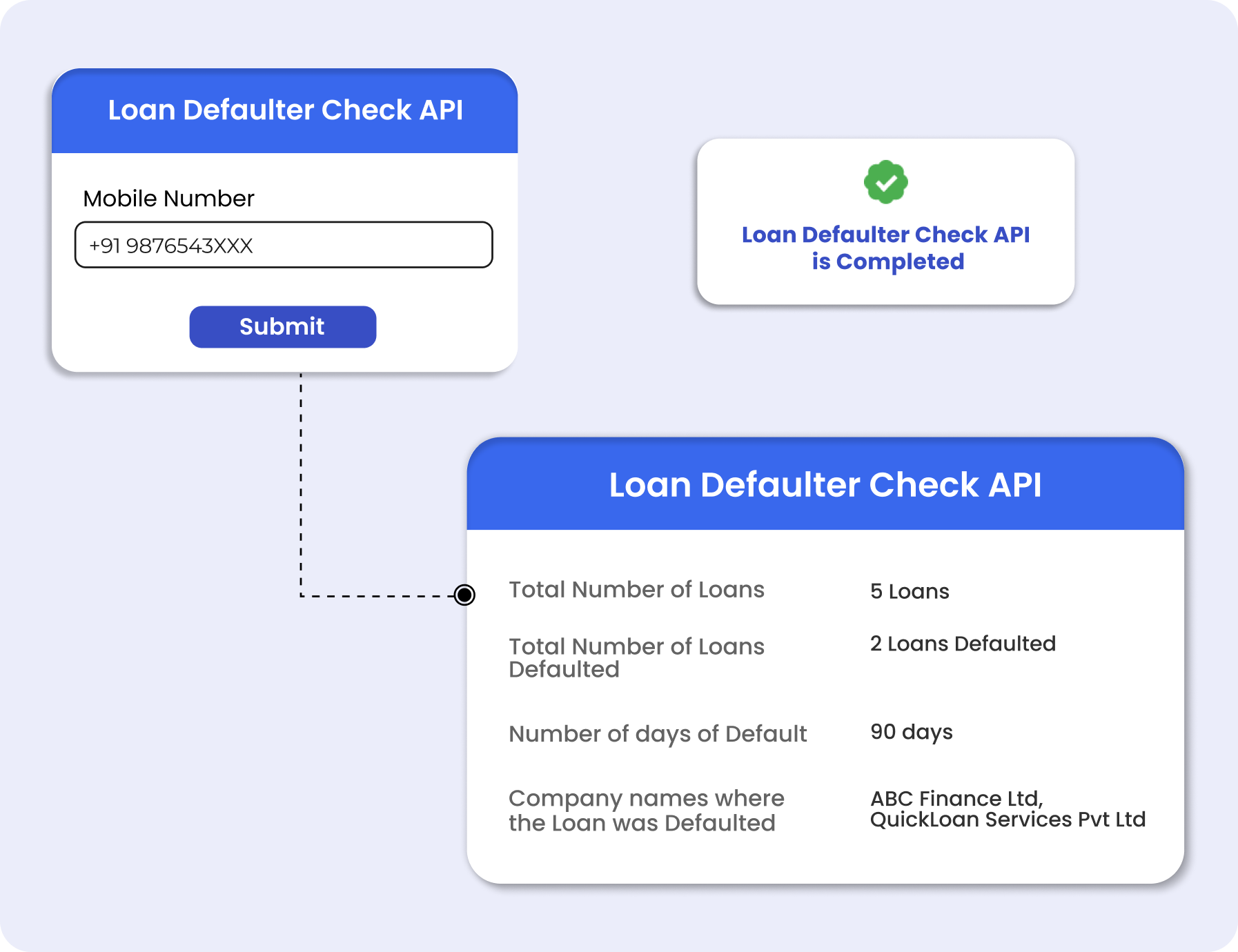

How does it work:

Input: Enter the Mobile number.

Output: Get the following details:

- Total No. of loans.

- Total No. of loan defaults.

- Number of Days Defaulted.

- Company Name of Defaulted Loans.

Key Benefits

- Faster Credit Decisions: The API enables instant borrower creditworthiness checks. It allows lenders to approve or reject applications quickly without manual intervention.

- Reduce Loan Defaults: With accurate and up-to-date information, businesses can easily identify the loan defaulter, which reduces the chances of defaults.

- Seamless Integration: It is designed to integrate into existing loan origination and KYC workflows.

- Cost-Effective: The API adds automation and bulk support, which reduces the dependency on manual resources and reduces the overall cost.

Use Cases

Digital Lending Platforms

Digital Lending Platforms can use the Loan Defaulter Check API to instantly evaluate the borrower risk during online loan applications. It enhances the efficiency of the loan disbursal process and reduces the chances of loan default.

NBFCs and Banks

NBFCs and banks can integrate the API into their workflow to check the history of defaults. The API provides visibility into the number of loans, default counts, and overdue delays. It helps financial institutions to reduce NPAs.

Merchant Landing Platforms

These platforms can use this API to evaluate small business owners and merchants before offering working capital. It helps identify existing loan defaults and reduce the credit risk.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Prevent loan defaults and NPAs by checking the loan default history of the borrower with the Loan Defaulter Check API.

Accurate and Reliable

Our system checks the information. Therefore, the results are always correct and legitimate.

Blog

How Does the Unified Lending Interface (ULI) Transform Lending in India?

What is the Loan Default Check API?

Why is the Loan Default Check API important for businesses?

What data is required to use the Loan Defaulter Check API?

What details does the Loan Defaulter Check API provide?

How fast is the Loan Defaulter Check API?

Does it provide accurate information?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More