Introduction

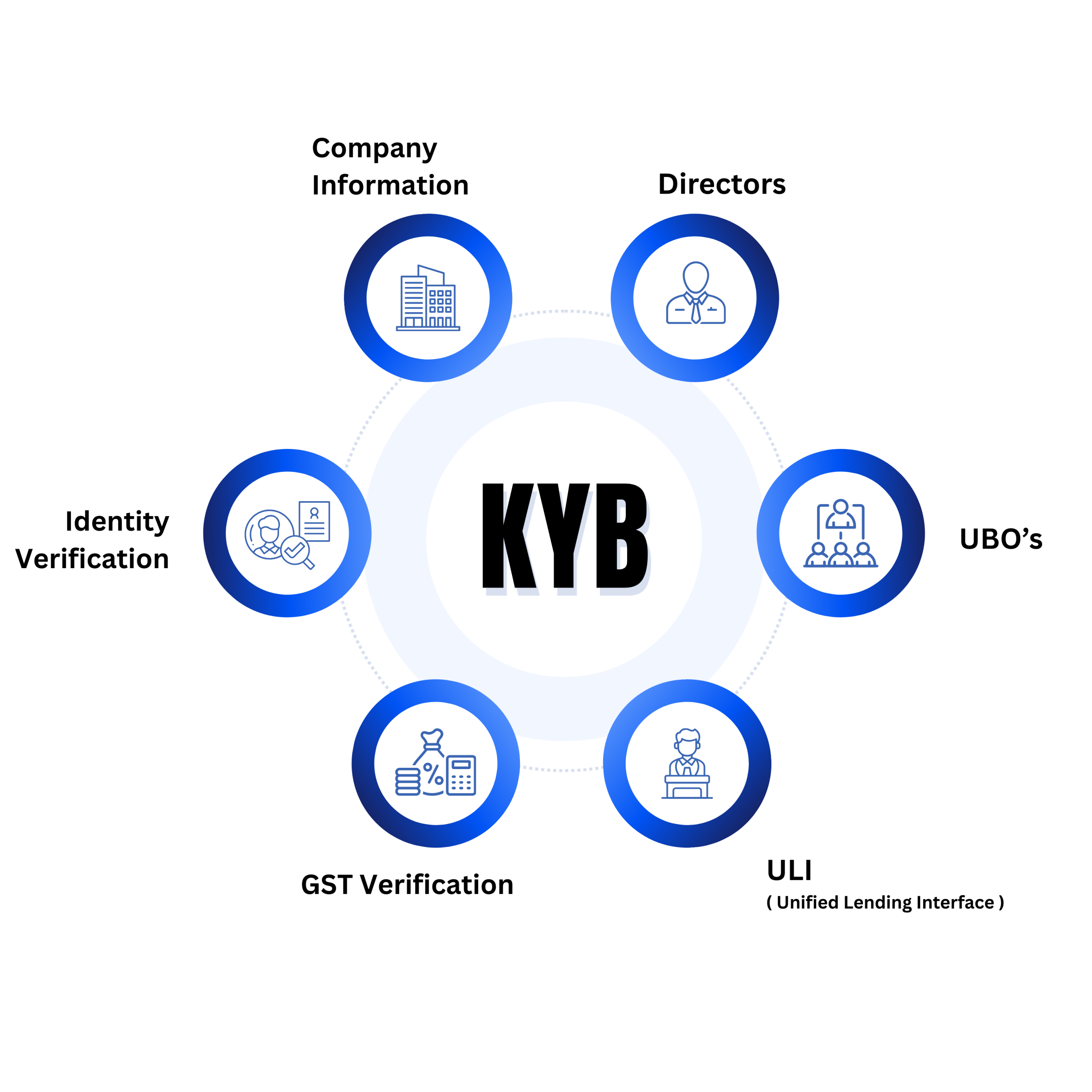

Surepass KYB Solution helps businesses verify the legitimacy of the business with information, including registration, ownership, executives, operational details, UBO, and Anti-Money Laundering checks. The accurate verification reduces the risk of fraud, penalities reputational damage, identifies shell companies, and complies with regulations.

It provides information in real time that increases operational efficiency and reduces the dependency on manual checks. It is a comprehensive solution that provides all the necessary checks in a unified place, so businesses don’t need to use multiple dashboards and APIs. Whether you want to verify a single entity or dozens, this scalable solution supports bulk verification. It smoothly integrates with the existing workflows of the business without technical hassles.

Use Cases of KYB Verification:

- Corporate Onboarding and KYC:

Banks and financial institutions can use the Surepass KYB verification solution to verify the legitimacy of a company during the account opening process. - Marketplace & Vendor Verification:

An e-commerce platform can integrate this solution to validate sellers, suppliers, and service providers before allowing them to operate on your platform. - B2B Partnerships & Due Diligence:

Conduct background checks on businesses to assess legitimacy and reduce operational risk. - Fraud Prevention & Risk Management:

Identify businesses that seem suspicious early in the onboarding process with AML checks.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

The KYB verification prevents fraud by cross-referencing business data with the help of Surepass’s Business Verification API.

Accurate and Reliable

Our system checks the information. Therefore, the results are always correct and legitimate.

case-study

How Surepass Enabled Seamless RC and Identity Verification for a Leading Insurance Company?

What is KYB Verification?

Why is KYB Verification important?

What details are verified in KYB Verification?

Who needs KYB Verification?

How does KYB Verification help prevent fraud?

Is KYB Verification mandatory?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More