Introduction

This API furnishes an array of essential credit metrics, including credit age, credit mix, FICO score, on-time payments, inquiry count, FICO report, and full name. Such detailed insights offer users a holistic view of their creditworthiness, enabling them to make informed financial decisions.

Whether individuals are seeking to apply for loans, mortgages, or credit cards, having instant access to their credit reports through this API empowers them to navigate the financial landscape with confidence and clarity.

Furthermore, the accessibility and convenience provided by the FICO Credit Score API streamline processes for individuals and businesses alike. By eliminating the need for cumbersome paperwork and lengthy waiting periods typically associated with traditional credit reporting methods, this API revolutionizes how credit information is accessed and utilized.

Overall, the FICO Credit Score API by Surepass represents a significant advancement in financial technology, offering unparalleled efficiency and transparency in assessing creditworthiness.

Benefits of Verifying with our API

Plug and Play

The FICO Report API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

FICO Score Report API prevents fraud through identity verification, multi-factor authentication, secure communication, and user consent mechanisms.

Accurate and Reliable

It achieves accuracy and reliability by accessing current FICO credit data, employing rigorous data verification, and following secure industry standards.

Blog

What Is Aadhaar Verification API, Why Use It?

What is the FICO Credit Score API?

How does the API work?

Is the FICO Credit Score API secure?

Can businesses use the API for customer verification?

What are the benefits of using the FICO Credit Score API?

Are there any limitations or restrictions to using the API?

Cibil Credit Report API

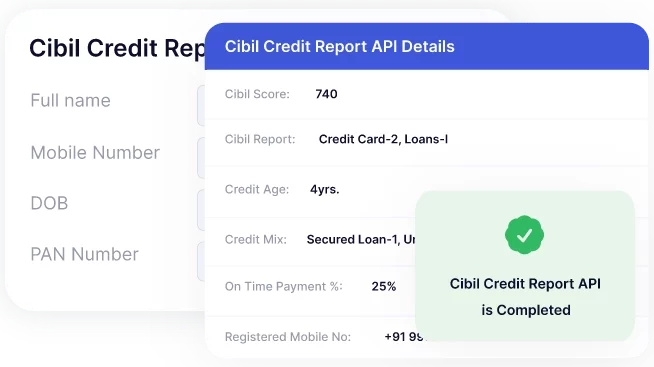

The CIBIL Credit report API provided by Surepass is a tool that allows individuals to access their credit-related information from the Credit Information Bureau (CIBIL) in a convenient and automated manner.

Read More

Equifax Credit Report API

The Equifax Credit Report API enables individuals to easily retrieve their credit report, providing lenders with essential information for assessing creditworthiness in financial applications.

Read More