Introduction

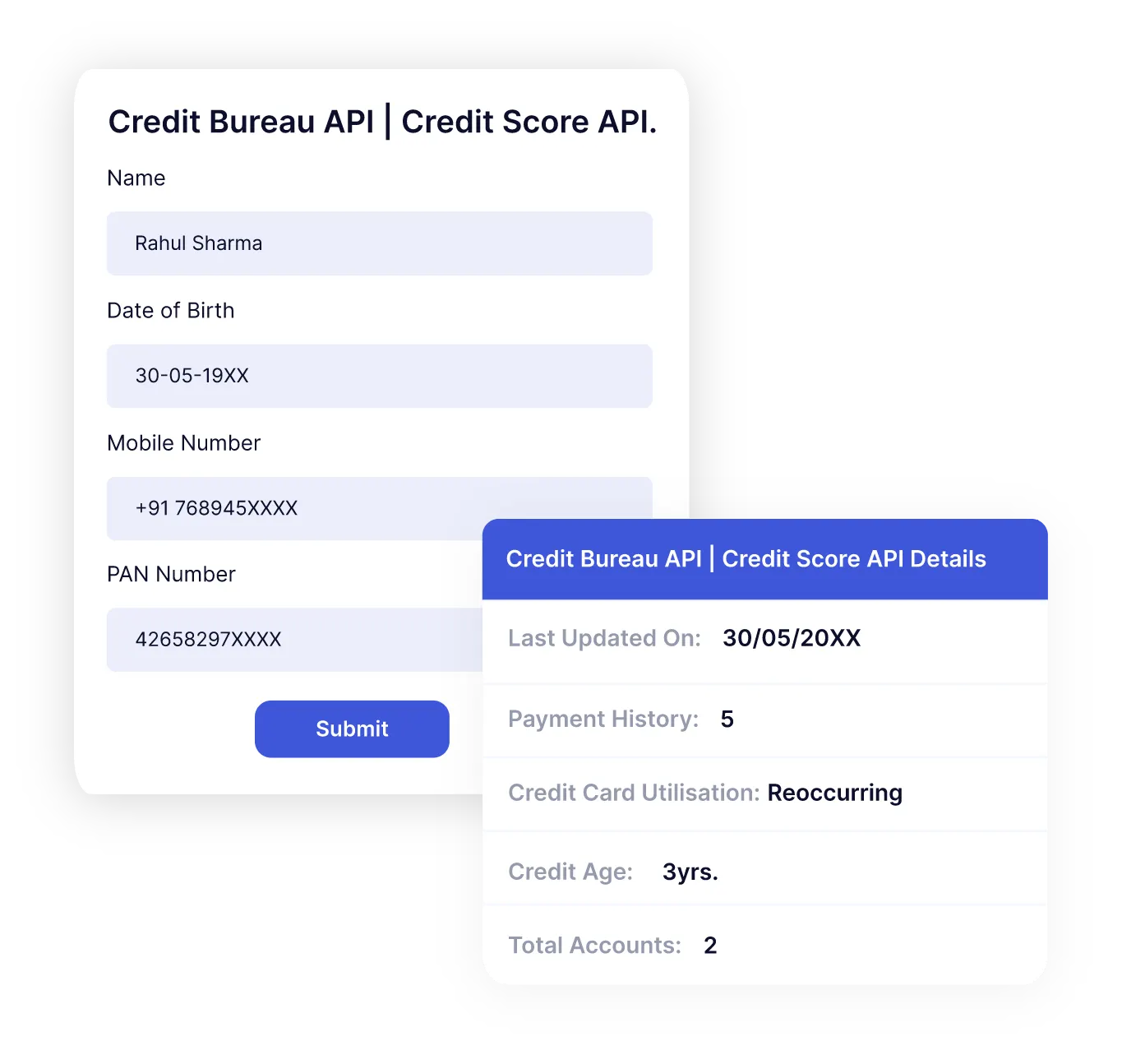

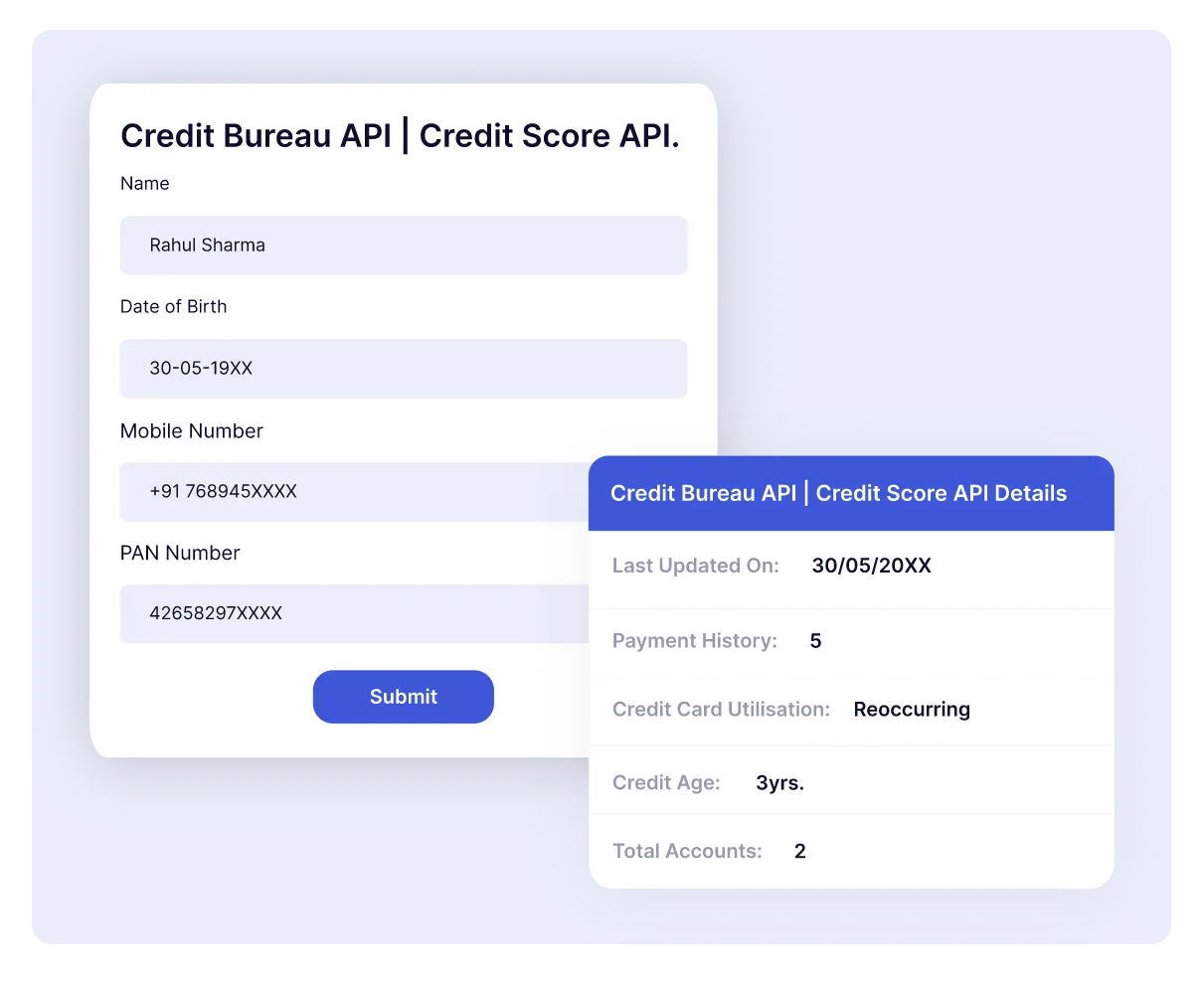

Surepass Credit Bureau API or Credit Score API is a tool that fetches the complete credit report of a person with one click only in real time. It provides accurate data as it fetches details of authentic credit bureaus like Equifax and others.

Use Cases Of Credit Bureau API

- Loan Approval Process

Banks and financial institutions use credit score API to quickly check the creditworthiness of a person. It will add efficiency to the loan approval process and reduce the risk of defaulters.

- Peer to Peer Lending Platforms

P2P lending platforms use this API to check the creditworthiness of a borrower to provide better lending.

- Fraud Detection

The API will help to detect fraudulent financial activities by verifying the authenticity of customer information against credit bureau databases.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Stop fraud and check financial stability with Surepass Credit Bureau API by accurately verifying credit scores and customer info.

Accurate and Reliable

Our system checks the information from the department. Therefore, the results are always correct and legitimate.

Blog

What Is Aadhaar Verification API, Why Use It?

What is Credit Bureau API?

How does Credit Bureau API?

Is there any Credit Score API in India?

How do I know my credit Score?

How accurate is credit bureau API?

Can I Integrate Credit Bureau API in the existing system?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More