Verify Once, Onboard Everywhere

- One-time KYC, used many times.

- Less paperwork for customers and teams.

- Works with PAN, Aadhaar, Passport, Voter ID, DL, and other valid documents.

Efficiency

Simplifies KYC processes by enabling single-time KYC registration and faster customer onboarding across financial institutions.

No Repeated Documentation

Customers need to submit KYC documents only once, eliminating repeated paperwork with banks, NBFCs, and financial entities.

Standardization & Accuracy

Ensures uniform KYC standards, centralized records, and reduced errors through a centralized CKYC repository.

CKYC APIs At a Glance

Surepass gives you a simple set of CKYC APIs fully connected to the Central KYC Registry so you don’t have to handle files or SFTP yourself.

Key Features of CKYC

Seamless Processing

Fast, automated bulk CKYC flows

Smart Deduplication

Prevent duplicate customer records

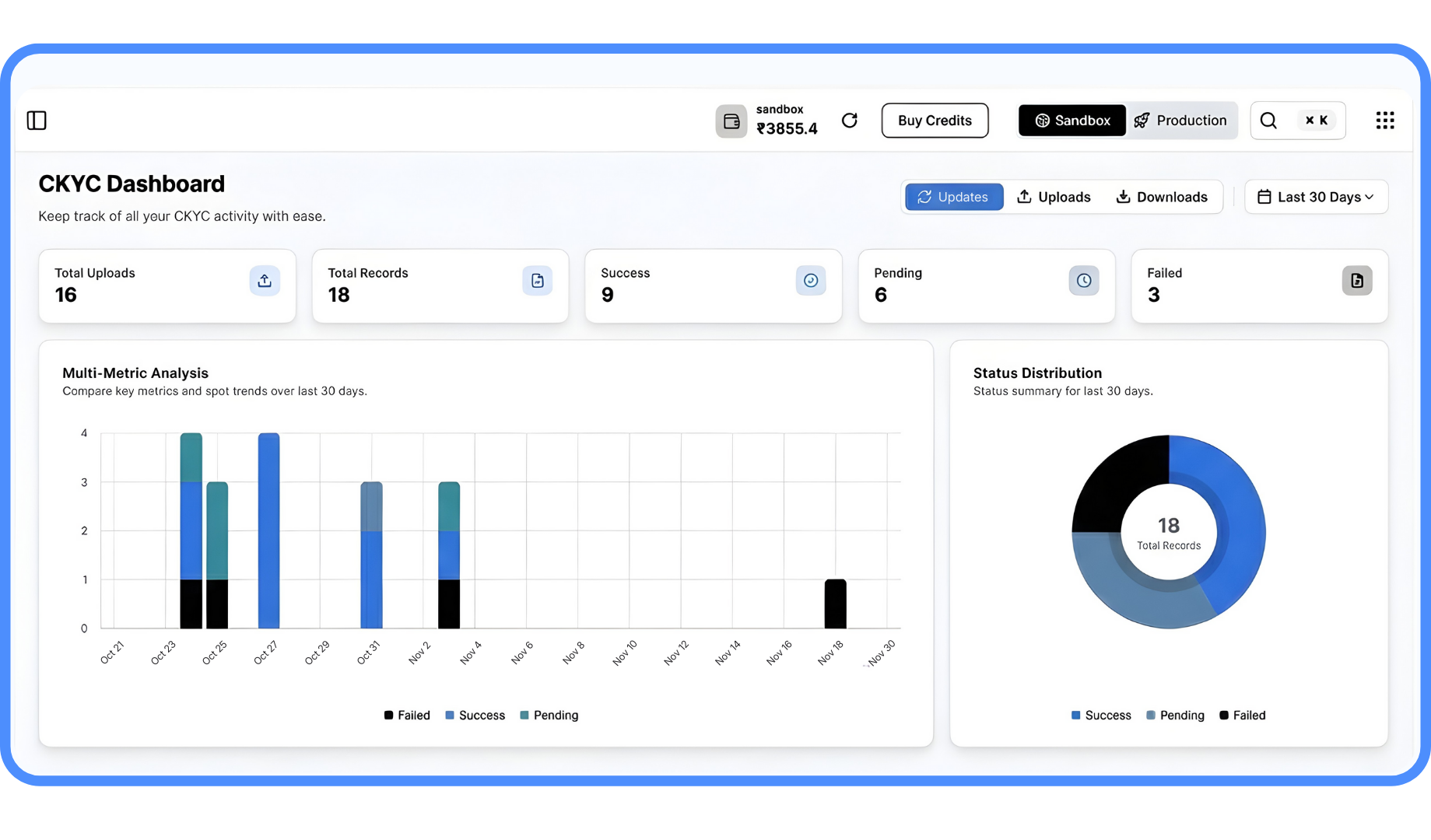

Clean MIS Dashboards

Real-time CKYC status visibility

Secure Architecture

Encryption, audit logs & IP control

Regulatory Compliance Ready

Aligned with RBI & SEBI norms

Bulk Processing

Process 10K+ records effortlessly

Multi-Document Mapping

PAN, Aadhaar & ID linking

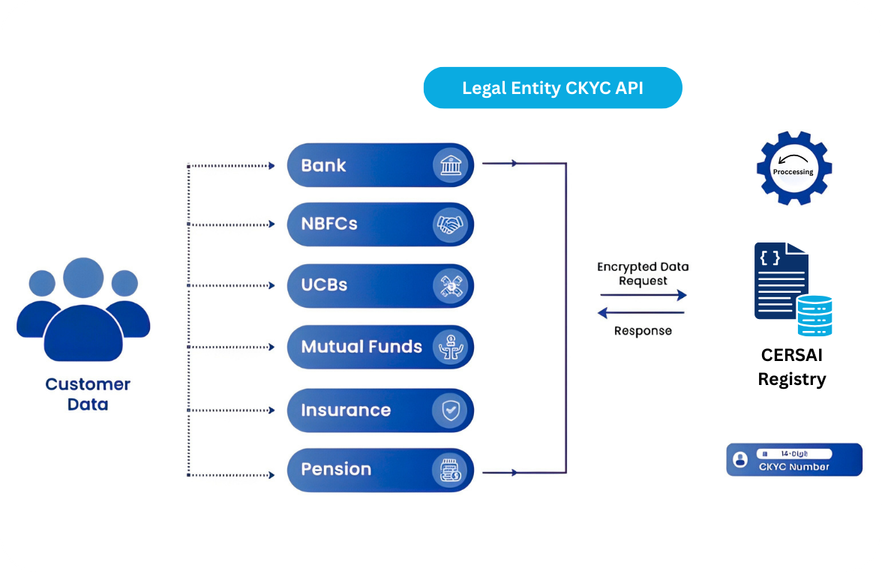

Key Industries We Serve

Built for industries where speed and compliance matter

Banks and neobanks, faster onboarding.

NBFCs & lenders, instant KYC checks.

Insurers needing quick verified proposers.

Brokers & MF platforms, KRA onboarding.

Fintechs embedding CKYC across channels.

Telecoms needing fast subscriber KYC

Banks and neobanks, faster onboarding.

NBFCs & lenders, instant KYC checks.

Insurers needing quick verified proposers.

Brokers & MF platforms, KRA onboarding.

Fintechs embedding CKYC across channels.

Telecoms needing fast subscriber KYC

Get started with CKYC

The Future Of Your Business Is Just A Click Away – Let CKYC Lead The Way!

What is a CKYC number?

How can I check CKYC status?

Is CKYC mandatory?

Which documents do I need for CKYC?

Can it handle companies as well as individuals?

Who is required to complete CKYC?

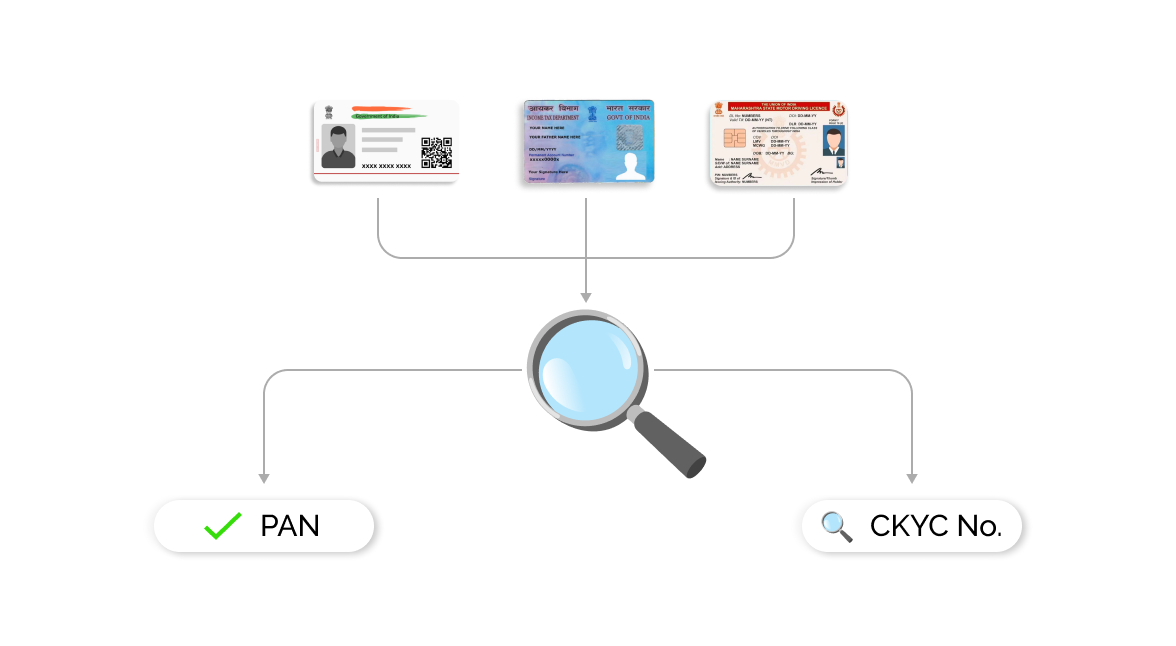

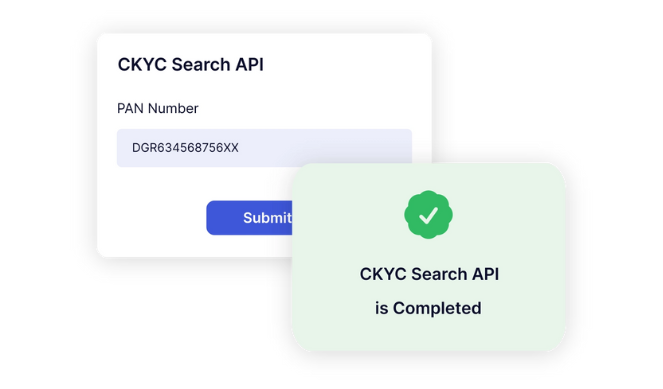

CKYC Search API

Check whether a CKYC record already exists using PAN, Aadhaar, Driving Licence, or CKYC number. Instantly get the current CKYC status along with key details to help you decide the next steps, making it ideal for quick pre-KYC checks and avoiding duplicate records.

Get API Key

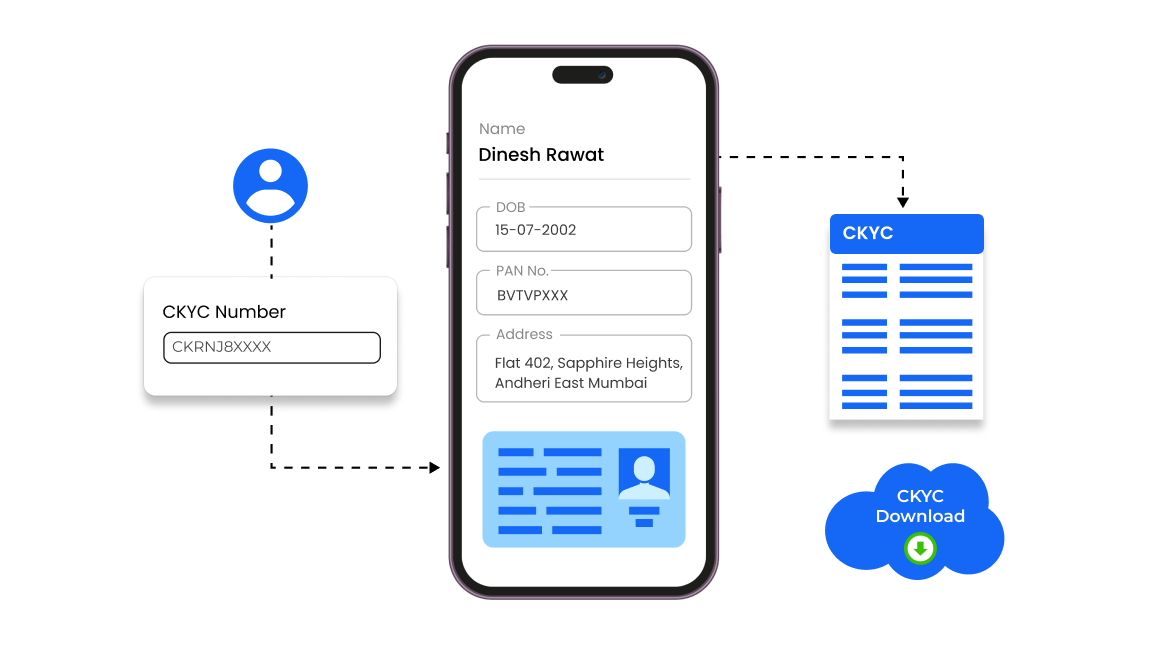

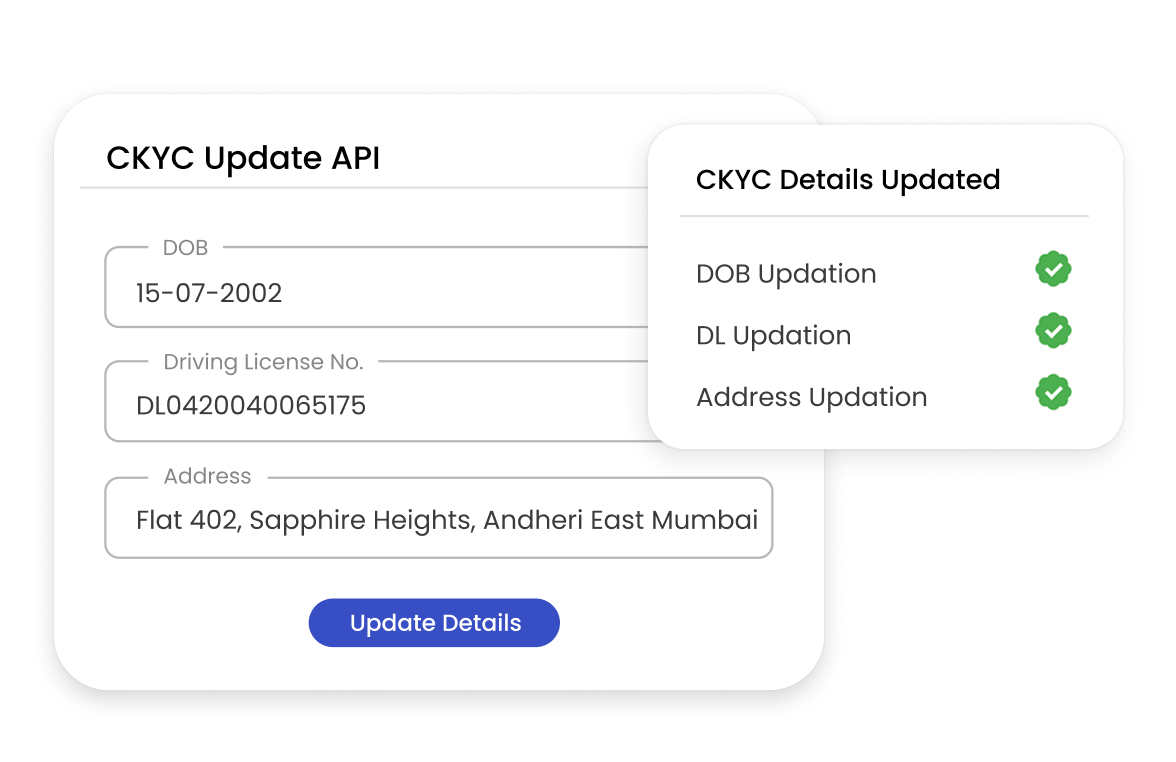

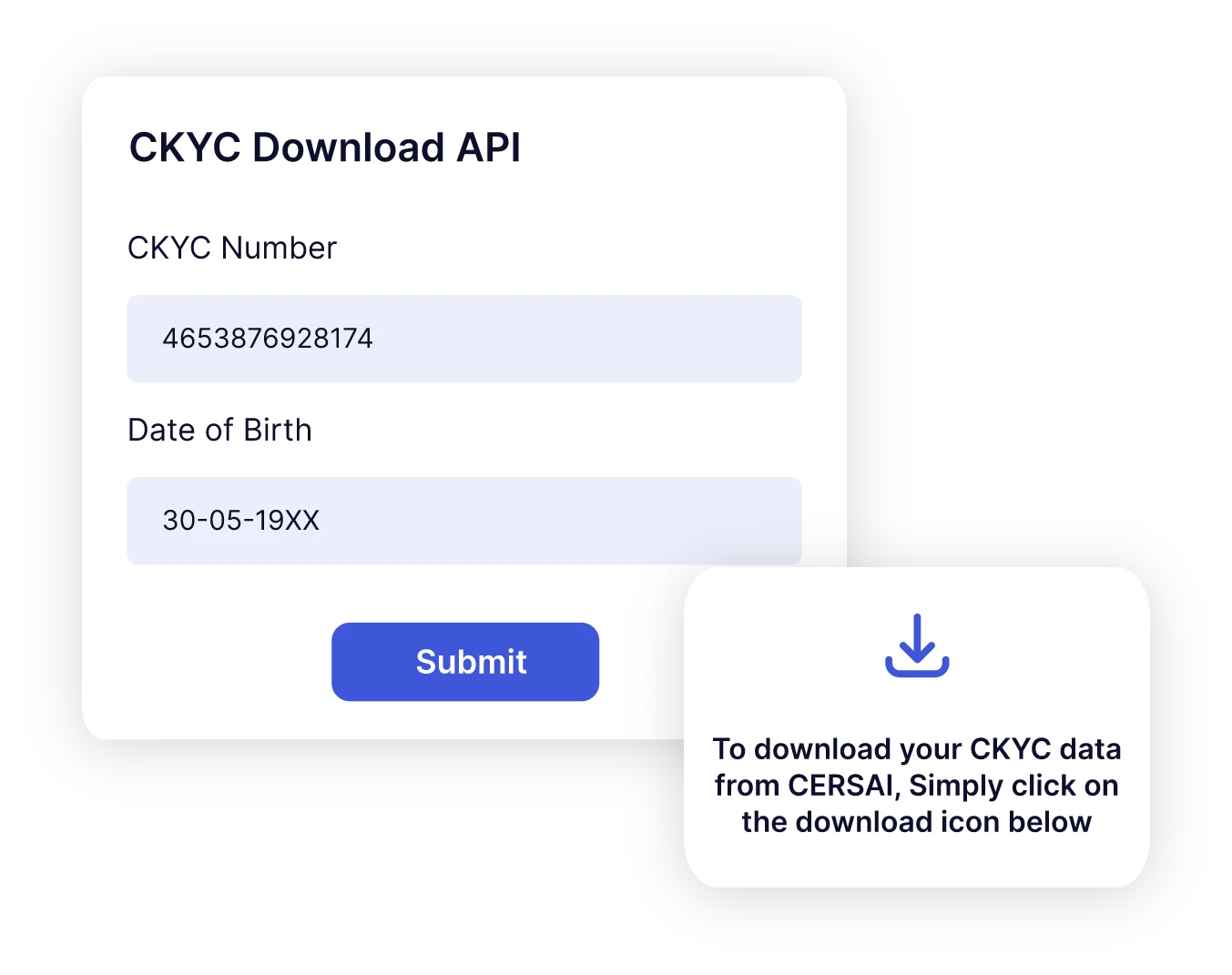

CKYC Download API

Pull the verified CKYC record using the CKYC number and date of birth. Get identity, address, and document details in clean JSON, ready for seamless integration—ideal for fast account opening, loans, and policy issuance.

Get API Key

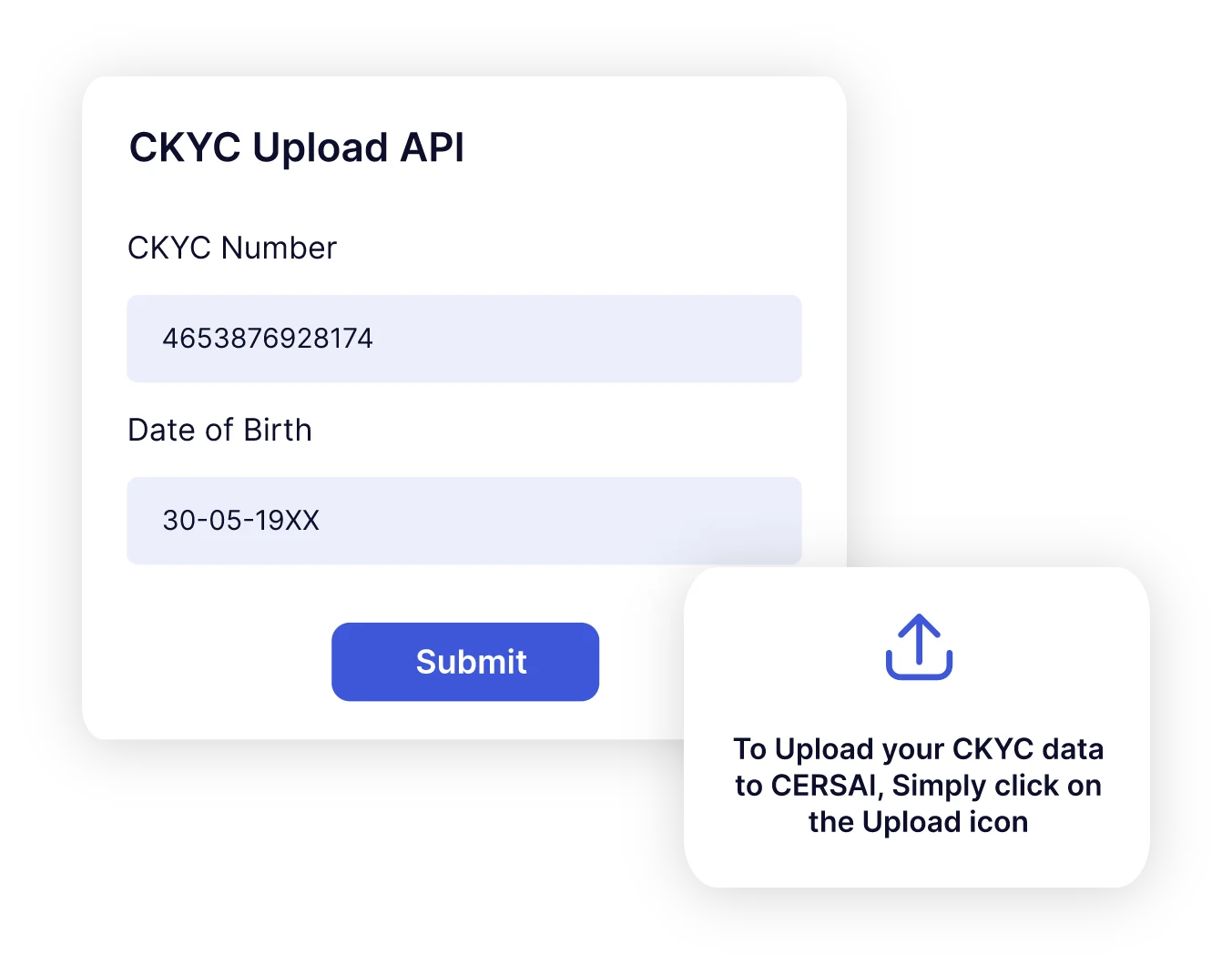

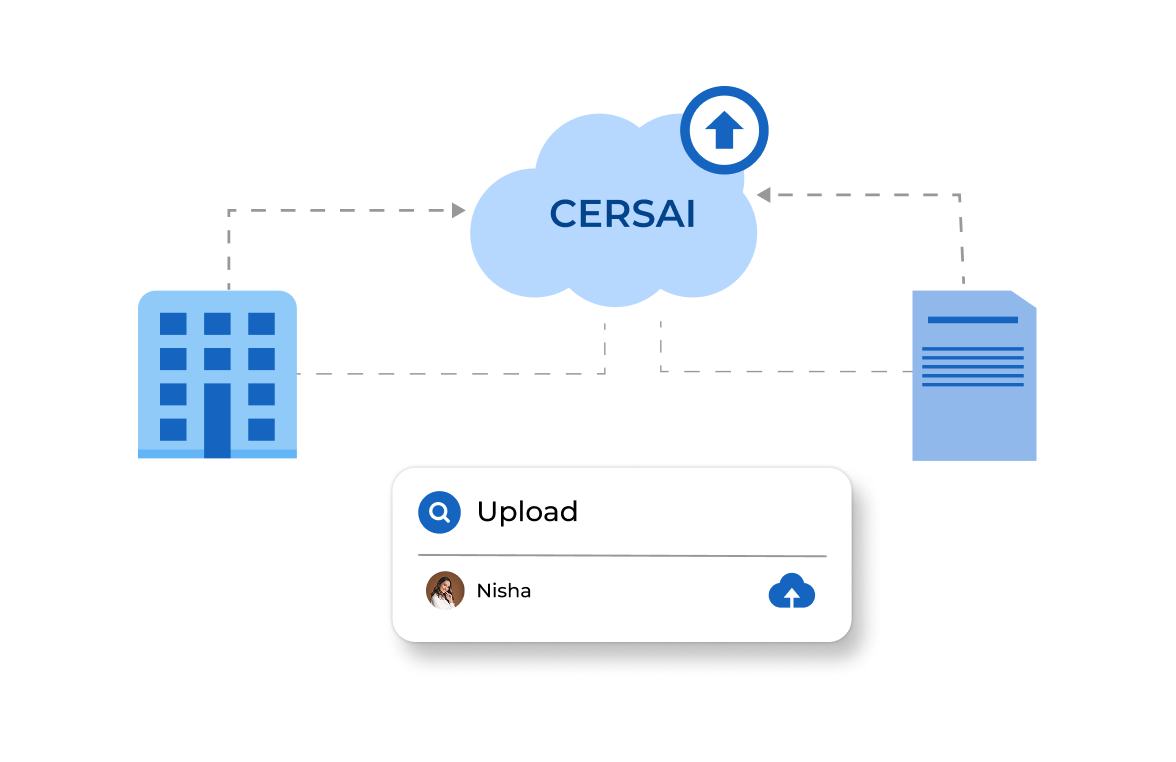

CKYC Upload API

Upload new or updated customer KYC directly to CERSAI in the required format. We handle data conversion, retries, and status tracking, making onboarding and updates simple

Get API Key