The company is a well-known private-sector life insurance company. It is a joint venture between two massive giants. It is the first company in India to be listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). The company began operations in FY 2001. It is a leading international financial services group from the UK.

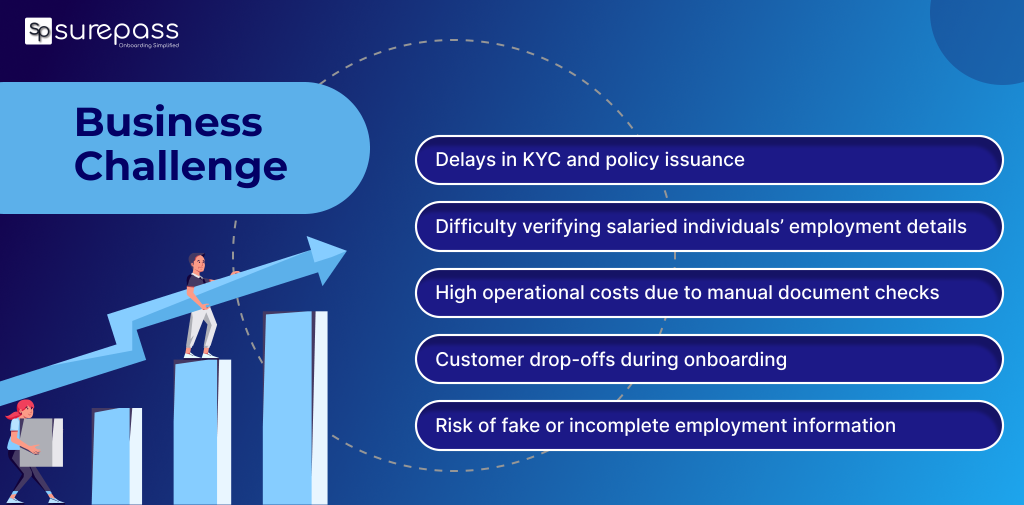

Business Challenge

As a life insurance provider with a large customer base, the Top Private Life Insurers face challenges in simplifying KYC and employment verification during the policy issuance process, such as:

- Delays in policy issuance and claims processing.

- Difficulty in verifying salaried individuals’ employment details.

- High operational cost due to physical document verification and customer drop-offs.

- Risk of fraudulent or incomplete employment information.

Offered Solutions

We integrated three Key APIs into the Top Private Life Insurers’ digital onboarding workflow:

- Employment Verification API

The Employment Verification API helps in instant employment verification with automation. It helps confirm job status, employer name, and salary information.

- EPFO Passbook API

The EPFO Passbook API helps in verifying the employees’ contribution details and history. It helps in evaluating financial stability and easing the policy issuance and claim management.

- EPFO API

The EPFO API helps in verifying individual EPFO details. It enabled the company to verify salaried employees and reduce the risk of fraud.

Outcomes

After the integration of the right solutions, the company has seen several changes:

- Efficiency: The employment verification solution adds automation to the verification process and makes it quick. The process that took 2 to 3 days can be completed in under 30 seconds.

- Reduced Manual Effort: Automation replaces the need for manual input and reduces the chances of human errors.

- Fraud Prevention: Accurate verification of employment and EPF details reduces the risk of fraud.

- Reduce Customer Drop-Offs: Quick verification makes the customer onboarding faster. Minimal documentation and smooth onboarding enhanced customer retention.

Why Choose Surepass?

These are reasons why you should choose Surepass:

- Instant and Accurate Verification: The Surepass APIs offer real-time verification for identity, employment, and EPF details instantly. It reduces the turnaround time from many days to seconds.

- 100% Secure and Compliant: Surepass follows the RBI guidelines and security norms.

- Plug and Play Integration: These API smoothly integrates with the existing business system.

- Fraud Prevention: APIs are equipped with advanced AI technology that easily identifies fake and forged documents and identity theft.

- Dedicated Customer Support Team: Surepass’s team is highly responsive and always available to resolve customer issues.

- Comprehensive Set of APIs: Surepass offers a comprehensive set of APIs and Products for Banking, Finance, Insurance, Hospitality, and more.

Conclusion

The Top Life Insurer was facing challenges in the accurate verification of EPF and employment verification. After integration of the right solutions, the verification time reduced from several days to seconds. The automation eliminates manual intervention and reduces human errors. It reduces the customer drop-off and enhances the customer experience. Apart from the EPF APIs, Surepass offers several other solutions that help insurance companies check credit scores and financial health.