In the financial world, according to March 2024, around 2,664 borrowers in India have been wilful defaulters. According to the RBI (Reserve Bank of India), they owe a total of ₹1.94 lakh crore. A wilful defaulter is someone who can repay a loan but chooses not to, or diverts the funds for other purposes. It is an act of dishonesty. Taking the right action against these defaulters is crucial to protect the financial system. Here in this blog, you will learn about the Wilful Default in detail.

What is a Wilful Defaulter?

A wilful defaulter is a borrower who fails to repay loans even when they can pay the loan. It involves diverting funds, disposing of assets used as loan security without permission, or failing to infuse equity as agreed upon with the lender. It is a deliberate act of non-payment, not a situation of genuine inability to repay.

How are Wilful Defaulters Identified?

A wilful defaulter is thoroughly identified through a structured process, including the Identification Committee (IC) and the Review Committee (RC). The RBI wilful defaulter list is created following a formal process:

- Identification Committee (IC): The IC, constituted by the lender, evaluates to determine if a wilful default has occurred.

- Review Committee (RC): If the IC believes the default is wilful after considering the response. It refers the case to the RC.

- Communication of Decision: The RC decision includes the reason and is communicated properly to the borrower.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Real Cases

Infrastructure Company Heads Declared Wilful Defaulter

A major public sector bank has declared the chairman of a well-known infrastructure group and his son as wilful defaulters. As they have failed to repay a loan amount of rupees 164 crore. Even though they are financially capable of paying, there were signs of fund diversion also seen.

Jewellery Firms Top Wilful Defaulter

A leading jewellery company was identified as the largest wilful defaulter in India with an unpaid loan of ₹8,516. This company has the capability to pay the loan, but diverted the funds.

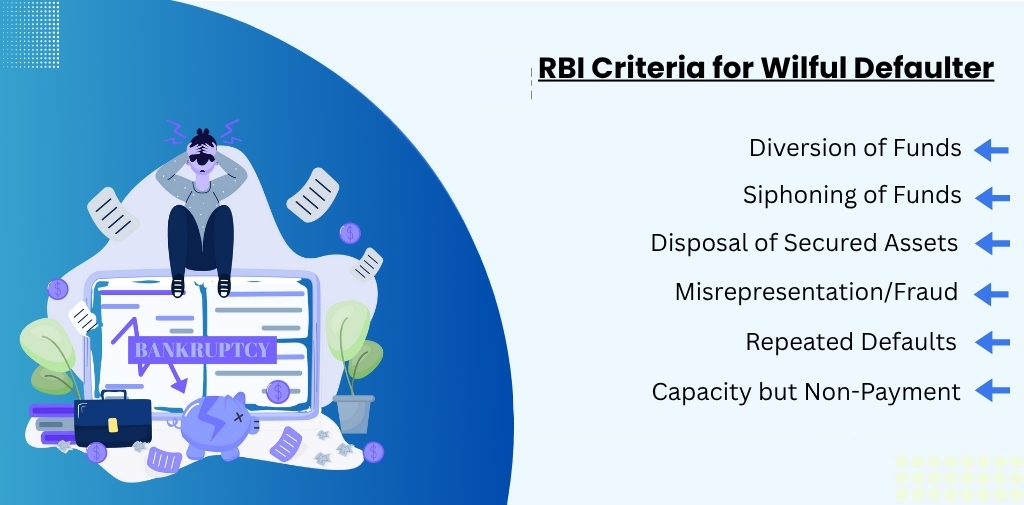

RBI Criteria for Declaring Someone a Wilful Defaulter

Deliberate Non-Payment

The borrower can repay loan obligations, but intentionally defaults on payments. It involves a borrower who has sufficient cash flow and net worth but still fails to meet their repayment obligations.

Diversion or Siphoning of Funds

Funds obtained for a specific purpose are used for other activities without the lender’s knowledge or approval. It includes utilizing short-term working capital for long-term purposes.

Misrepresentations and Falsification of Records

The borrower provides misleading or false information to lenders to obtain the loan or during the loan repayment process. It includes falsifying financial statements or other relevant documents.

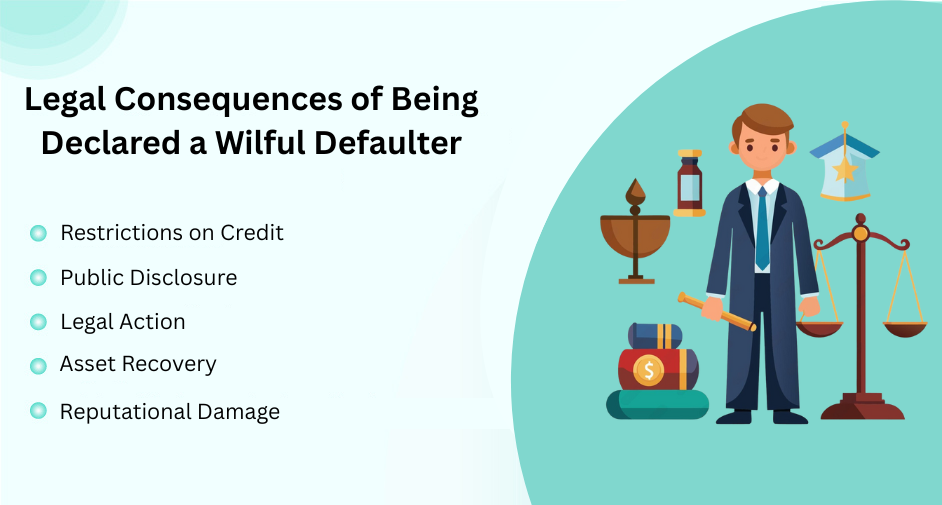

Legal Consequences and Suits Filed

- Restrictions on Credit: Lenders are prohibited from providing additional loans or credit facilities to wilful defaulters. Includes a ban on new ventures for a specified period after removal.

- Public Disclosure: Names of wilful defaulters are published on the CIBIL wilful defaulter list and the RBI. It alerts other lenders and the public to their status.

- Legal Action: Banks may initiate legal proceedings, including civil and criminal action, to recover outstanding dues.

- Asset Recovery: The Bank can take possession of assets pledged as collateral for the loan.

- Reputational Damage: The wilful defaulter tag severely tarnishes the reputation of the individual, company, and directors.

Process of Declaration

The process of declaration generally includes making a formal announcement or statement about something.

Here is a brief of the process:

- Preliminary Assessment: In a preliminary assessment, lenders conduct internal screening to identify potential wilful defaults. It involves examining whether the borrower can repay but intentionally defaults or misuses funds.

- Identification Committee: An identification committee that consists of senior officials is formed to examine. This committee reviews evidence, borrower representations, and financial health to find wilful default. It issues a notice to the borrower of the wilful defaulter.

- Borrower’s Repay and Hearing: The borrower gets a chance to respond in writing. If required, they can also attend a personal meeting to present their side.

- Final Decision by Committee: If the explanation is not convincing, the committee gives a written decision saying why the borrower is being labeled a wilful defaulter.

- Review Committee Check: The order of the identification committee is reviewed by the review committee, involving higher-level officials.

- Final Order: If the review committee agrees, then the borrower is officially declared a Wilful defaulter.

- Reporting to Authorities: The borrower’s name is shared with CRILIC (Central Repository of Information on Large Credits) and Credit Bureaus.

How to remove a wilful defaulter?

To get rid of the wilful defaulter tag, a borrower can take several steps, including paying the outstanding dues:

- Pay the Dues: Your first step would be to clear outstanding debt, including any interest and penalties.

- Negotiates with Lenders: If you are unable to pay the full amount, try to negotiate a settlement with the lender. It leads to a reduced amount or a payment plan.

- Dispute Inaccuracies: If the wilful defaulter tag is based on inaccurate information, try to solve it with the respective authorities.

- Legal Counsel: You can consult a professional lawyer specializing to learn the steps and legal rights.

- Financial Advisors: Get guidance from a lawyer specializing in financial matters to understand the rights and options.

Conclusion

Wilful defaulters are a serious issue for the financial ecosystem. They avoid loan repayment even if they can pay on time. Its cases include high-profile names like Mehul Choksi and Manoj Jaiswal, making it extremely important for stricter regulations and faster legal action. RBI guidelines help identify and penalize such defaulters. It is essential to protect lenders, ensure credit discipline, and maintain public trust in the financial system.

FAQs

Ques: What do you mean by wilful defaulter?

Ans: A wilful defaulter refers to the borrower who intentionally fail to repay a loan or intentionally diverts loan funds.

Ques: What is the punishment for a wilful defaulter?

Ans: According to the Companies Act 2013, Section 447 punishes wilful defaulters with up to 10 years imprisonment and a fine of up to three times the fraud amount.

Ques: What is the difference between NPA and Default?

Ans: An NPA (Non-Performing Asset) is a loan or advance where the borrower has failed to repay interest or principal for a period of more than 90 days.

A Wilful Defaulter is someone who fails to repay a loan on time willingly.

Ques: Can wilful defaulters participate in tenders or public contracts?

Ans: Government Agencies and PSUs do not allow wilful defaulters to participate in tenders or public contracts.