Before Aadhaar Offline KYC, entities conducted Aadhaar Authentication that required a direct call to the CIDR database. This process requires OTP authentication, and full Aadhaar details were shared with the verifying organization. With OKYC 2.O organization can verify Aadhaar without OTP and biometric authentication. The Aadhaar offline KYC secures the verification process with selective data sharing, Aadhaar Masking, and QR Scanning. It is beneficial for both individuals and entities as it solves many verification issues and streamlines the verification process. It is a paperless way of verifying identity accurately.

Why OKYC 2.O Matters?

The OKYC 2.O offers several advantages over the traditional OKYC process:

- Privacy and Data Minimization: The Aadhaar number is not shared. Instead reference ID is used.

- No Biometric/ OTP Required (in many cases): It aims to remove the need for biometric verification or one-time passwords (OTPs) for many use cases.

- Easier Onboarding: With QR-based verification, OKYC 2.O makes the onboarding process easier.

- Reduce Aadhaar Copy Misuse: For traditional verification, Aadhaar photocopies are used to verify identity. This is prone to errors and identity misuse.

- Security: In the traditional verification process, Aadhaar PDFs, tampered images, or fake Aadhaar cards were used. However, with OKYC, ensure only verified information is used.

Benefits of OKYC 2.0 Verification

These are the benefits of using OKYC 2.O verification:

- Reduced Onboarding Time: It eliminates the need for manual document collection and verification. It reduces the verification time and adds efficiency to the onboarding process.

- Increased User Privacy: The OKYC 2.O offers the selective data sharing and masked Aadhaar feature that protects sensitive information such as the full Aadhaar number.

- Fraud Prevention: The Aadhaar offline KYC improves the Aadhaar Authentication process. It helps detect forged, tampered, and altered Aadhaar documents and prevents fraud.

- Instant Verification: The QR scanning features make verification quick. As you no longer need to collect and verify documents manually.

Automate your KYC Process & Reduce Fraud!

We have helped 3000+ companies in reducing Fraud by 95%

Aadhaar OKYC 2.0 vs Aadhaar eKYC

Both Aadhaar eKYC and OKYC 2.0 are verification processes. However, they have several differences:

Aadhaar e-KYC

- In this process, the full demographic details of the Aadhaar holder are shared with the verifying authority.

- It can also include biometric information. It is a real-time verification process conducted by the UIDAI.

- The agency receives the Aadhaar data. The data may be stored or used for verification.

OKYC 2.0

With the Aadhaar OKYC 2.0, only the selected information is shared including Masked Aadhaar Number, Name, Photo, Date of Birth, Gender, Address, and other details.

Verification can be done through the QR code sharing. No OTP or biometric authentication is required. This simplifies the verification process and limits the sharing of sensitive personal data of individuals.

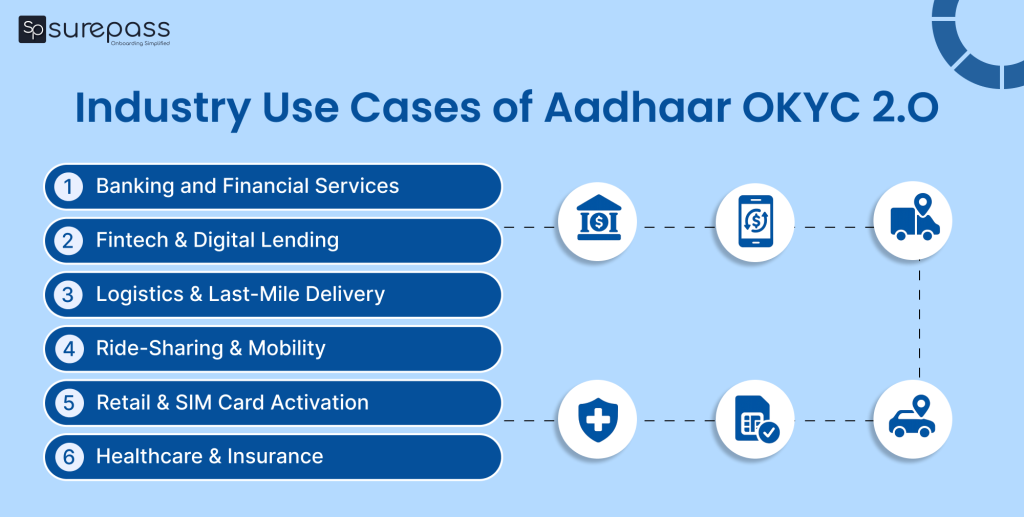

Industry Use Cases

- Banking and Financial Services: The Aadhaar OKYC 2. O streamlines the verification process. Now these entities can verify customer identity easily without OTP verification. It eliminates the need for physical collection and verification of documents. It makes the onboarding process efficient.

- Fintech and Digital Lending Platform: It simplifies the verification process with simple QR scanning and selective data sharing. These platforms can verify identities quickly during loan applications, credit assessments, payday loans, and online micro lending business. It minimizes the risk of fraud, such as forged Aadhaar cards and manipulated KYC documents.

- Insurance Sector: OKYC 2.O helps insurers verify the policyholders easily during policy issuance, claim processing, and agent onboarding. The OKYC 2.0 reduces the onboard delays and improves the verification process.

- Gig Economy and Workforce Hiring Platforms: Companies that hire delivery partners, drivers, warehouse staff, and gig workers can rely on the OKYC 2.0. It helps in quick and paperless verification and ensures that only legitimate individuals become part of the organization.

- Hotel Check-in: The OKYC 2.O helps in the instant verification of the identity through the QR scan. It eliminates the risk of storing Aadhaar card photocopies. It reduces the risk of misuse and exposure to sensitive information.

Conclusion

Aadhaar OKYC 2.O is a reliable solution for the Aadhaar-based identity verification process. It adds privacy, security, convenience, and compliance to the verification process. With QR-based scanning, face authentication, selective data sharing, and biometric lock/unlock, it limits the sharing of sensitive data. It is helpful for individuals and gives them control over how their information is being used. On the other hand, it is beneficial for verifying entities as they don’t need to store and manage the sensitive documents. It reduces the manual workload and reduces the overexposure of data.

FAQs

Ques: What is OKYC Aadhaar?

Ans: It is a paperless way of verifying Aadhaar through QR or XML file.

Ques: Is Aadhaar Offline KYC legal?

Ans: Yes, Aadhaar Offline KYC is legal in India.

Ques: Is OTP required for Aadhaar OKYC?

Ans: No, OTP is not required for Aadhaar OKYC.

Ques: How is OKYC 2.O different from the traditional Aadhaar-based verification?

Ans: The traditional Aadhaar-based verification process relies on manual document collection and verification, where OKYC 2.O is a quick and paperless way of verification.

Ques: Can OKYC 2.O prevent identity fraud?

Ans: Yes, OKYC 2.O prevent identity fraud with accurate verification.