Every year, thousands of companies are struck off from the government registry. These companies are removed by the Registrar of Companies (ROC). They get this status due to reasons, like inactive operations, missed filings, and a strategic exit plan. Here in this blog, you will learn about Struck Off Company Meaning, reasons, how to find a list of Struck Off Companies, etc.

What is Struck Off Company Meaning in Legal Terms?

Under the Companies Act, 2013 in India, a struck-off company means a company that has been officially removed from the Registrar of Companies (ROC) records. It happens when the company has not been active or has failed to follow legal rules, like filing annual returns or financial statements.

When a company is struck off, it loses its legal existence. After being struck off, a business can not do business, sign contracts, buy or own property, or sue someone.

Why are Companies Struck Off?

There can be many reasons:

- Non-Compliance with ROC Filing Requirements: If the company fails to file Annual returns, financial statements, and income tax returns for 2 consecutive financial years.

- Inactivity or Dormancy: Companies that are not operational for a long period and have not applied for dormant status may be considered inactive. The ROC may strike off such companies to keep the registry clean and updated.

- Failure to Commence Business: If a company, especially a newly incorporated one, fails to commence business within a prescribed period (usually 6 months to 1 year), it may be considered for strike off by ROC.

- Voluntary Strike Off by the Company: Sometimes, the directors or shareholders of a company may apply for a voluntary strike-off of it. The company has no liabilities, the company is not operational, and is no longer needed. This is done using Form STK-2 with the ROC, provided all compliance requirements are met.

- Government Crackdown on Shell Companies Regulatory authorities often strike off companies suspected of being shell entities, involved in Money laundering, transactions, and tax evasion.

- Financial Crisis: Companies that are facing economic losses or an inability to preserve operational expenses can choose a strike off.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How to find a List of Struck Off Companies?

If you want to check a struck-off company, follow these steps to find the List of Struck-Off Companies:

- Go to the MCA Portal.

- Under MCA Services, click on Master Data.

- Enter the company name or CIN Number.

- Enter the captcha and click on submit.

- Details will be displayed. Click on the links and fill in the captcha.

- Get master data details along with Struck Off status.

What happens to Assets when a Company is Struck Off?

When a company is struck off the register, it loses its legal existence.

- Assets will get frozen: The company can not manage, sell, or transfer its assets because it no longer exists legally.

- Government May Take Custody (Bona Vacantia): According to this rule, the government can claim the unclaimed assets under the doctrine of bona vacantia (ownerless goods). These assets may go to the central government or the state treasury.

- Restoration can reclaim the Assets: If the company is restored legally, it regains control of its assets. All transactions that should have taken place during the struck off period may then the processed.

Can a Struck-Off Company Be Restored?

Yes, you can restore under certain conditions. In India, the restoration of a company that has been struck off from the Registrar of Companies is governed by the Companies Act, 2013.

Legal Provision for Restoration

A company or any of its directors, shareholders, or creditors can apply to the National Company Law Tribunal (NCLT) to restore the company’s name in the register. This request must usually be made within 3 years of the date of the strike-off.

Who can apply for Restoration?

- Directors of the company

- Shareholders or members

- Creditors

Conditions for Restoration

You can restore the company, but you need to meet the eligibility criteria:

- The company is carrying on business or in operations at the time of being struck off.

- Show that the companies’ strike-off was not justified, or there was non-compliance due to valid reasons.

- Submit pending financial statements, annual returns, and compliance documents.

- Pay penalties and file overdue ROC forms.

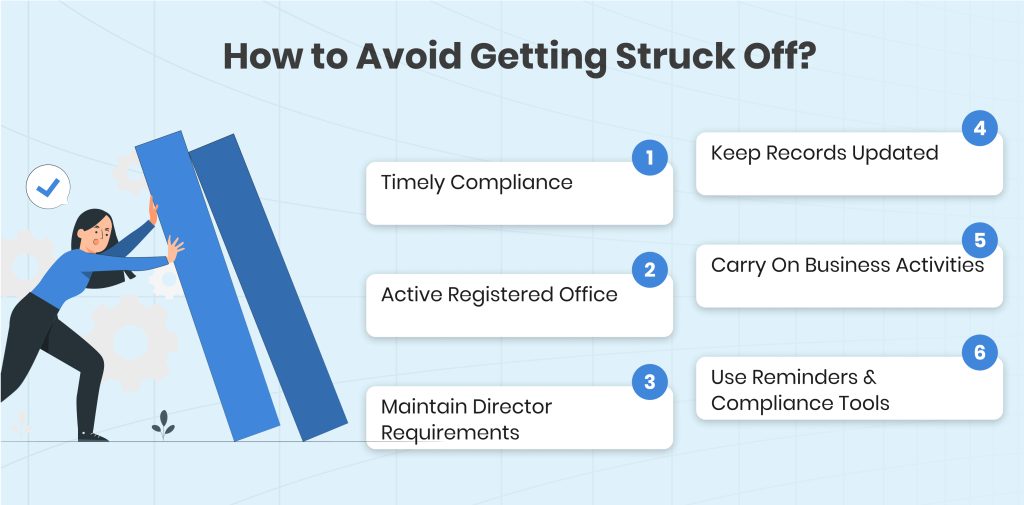

How to Avoid Getting Struck Off?

If you want to avoid being struck off by the Registrar of Companies (ROC then keep these points in mind.

- File Annual Returns and Financial Statements on Time

Every company should file Form AOC-4 (financials) and MGT-7 (annual return) annually with the MCA. Avoiding or missing filing is one of the most common reasons for strike-offs. You can set up automated reminders to do timely submissions.

- Maintain Business Activity

Companies that are inactive for two consecutive financial years and have not applied for dormant status can be struck off. Even if your business is minimal, maintain bank transactions, invoicing, or filings that show it is operational.

- Update Company Details with ROC

Keep the registered office address, director’s details, and contact information updated with the MCA. If somehow communication fails, the company may be removed without your knowledge.

- Respond to Notices

If the ROC issues a notice under Section 248, you should respond within the time limit. Ignoring notices may result in a strike off, even if your company is active.

- Don’t Leave an Inactive Company Unattended

If your company is no longer in use, you can apply for voluntary strike off under Form STK-2. It will protect the director from disqualification or penalties.

Conclusion

A struck-off company is an entity that has been legally removed from the records of the ROC (Registrar of Companies) due to its inactivity, non-compliance, or voluntary closure. While the company loses its legal status and cannot operate or manage its assets. These provisions are to restore it through NCLT. Business owners must regularly file returns, maintain operations, and respond to ROC notices to avoid this status. If you check the struck of companies from the MCA portal before partnering with a business.

FAQs

Ques: What are Struck Off Companies?

Ans: Companies whose name is removed from the register of companies by the Registrar of Companies (RoC).

Ques: What does it mean if a company is struck?

Ans: It means the company has lost its legal status

Ques: Where can I find a list of struck companies?

Ans: You can find the list of companies in the master data from the MCA Portal.

Ques: Can a struck-off company be restored?

Ans: Yes, you can restore a struck-off company through NCLT.

Ques: Who can apply to restore a struck-off company?

Ans: Restoration can be requested by: Company directors, Shareholders, Creditors.